Monday, November 30, 2009

RBA puts interest rates on upward path

The downturn in Australia was relatively mild, and Australia's central bank was the first major central bank to begin reversing the monetary stimulus put in place.

Since the risk of a "serious contraction" has passed, per the RBA, monetary authorities have been gradually boosting rates.

Bank of Japan calls emergency meeting

The rising yen is adding to deflationary pressure and undermining the competitiveness of its export-driven economy. And gains in industrial production seen earlier in the year have been diminishing, according to Bloomberg.

With its key interest rate at 0.1%, there is little the BoJ can do at this point, though it could resume its policy of quantitative easing - pumping additional reserves into the banking system beyond what is needed to keep rates at near zero.

Saturday, November 28, 2009

Natural gas surplus

Wednesday’s report that natural gas supplies increased by 2 billion cubic feet (bcf) to 3,835 bcf probably marks the peak in supplies heading into the winter heating season.

Stocks are now 404 bcf higher than last year at this time and 442 bcf above the 5-year average of 3,393 bcf. The recession, which has hurt industrial demand, heavy injections earlier in the year, and the mild summer in much of the country account for the surplus in the commodity used to heat just over half the homes in the US.

And that surplus goes a long way in explaining why natural gas prices remain at low levels.

Wednesday, November 25, 2009

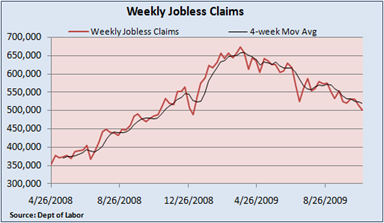

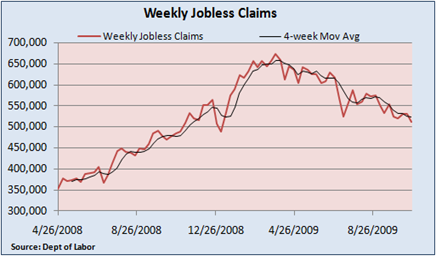

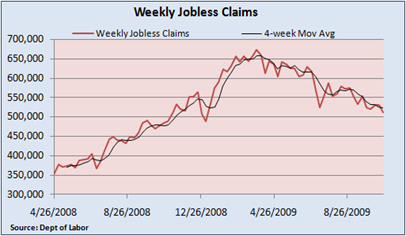

Sharp drop in jobless claims argues against double-dip recession

Recent reports on the economy, including falling housing starts, sluggish industrial production, and the latest downward revision in 3Q GDP have given proponents of the double-dip recession argument (or a W-shaped recovery) added ammunition in recent weeks.

But today’s report from the Labor Department of a steep decline in weekly jobless claims is probably the most solid argument that the slow and fragile economic recovery may be on a firmer foundation than many believed possible.

Weekly initial jobless claims fell 35,000 in the week ending November 21 to 466,000, the lowest level in 14 months and well below the consensus forecast offered by Bloomberg of 495,000.

The 4-week moving average continues to cooperate, dropping 16,500 to 496,500, the first dip below 500,000 in over a year. And continuing claims slid 190,000 to 5.42 million. However, the expiration of standard benefits and not job creation is probably the main reason for the downward trend.

Weekly jobless claims can be volatile and seasonal adjustments do not always accurately capture recurring changes in the job market. But in searching through the data, I did not find any comments that Wednesday’s early report (weekly claims are typically reported every Thursday) influenced the latest drop.

The timeliness of jobless claims makes this one of my favorite barometers of economic activity, and the downward trend in layoffs implies that companies are slowly detecting an improvement in the economic outlook.

In addition, today’s steep decline provides hope that we may soon see diminishing job losses and eventual gains in employment.

Too soon to give the all clear sign

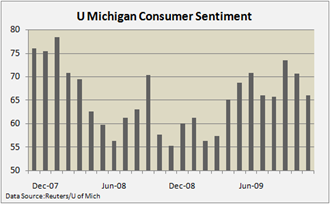

Still, any enthusiasm should be tempered with the second-straight monthly decline in consumer sentiment, as measured by the University of Michigan’s survey on confidence. This doesn’t bode well heading into the all-important Christmas shopping season.

And an unexpected drop in orders for durable goods, which was also released this morning, suggests a modest recovery at best.

Tuesday, November 24, 2009

Fed minutes and worries about inflation, bubbles

Members are mindful that very low short-term rates could lead to "excessive risk-taking in financial markets or an unanchoring of inflation expectations."

Officials in both China and Japan have recently expressed concern that low interest rates in the U.S. could be fueling the carry trade - borrowing where rates are cheap and investing the proceeds in parts of the world that fetch higher returns - and speculative bubbles in Asia.

Although some members saw inflation risks leaning to the downside in the near term, others felt that risks were tilted to the upside over a longer horizon, because of the possibility that inflation expectations could rise as a result of the public’s concerns about extraordinary monetary policy stimulus and large federal budget deficits.

Moreover, these participants noted that banks might seek to appreciably reduce their excess reserves as the economy improves by purchasing securities or by easing credit standards and expanding their lending substantially. Either way, the money supply would surge.

Such a development, if not offset by Federal Reserve actions, could give additional impetus to spending and, potentially, to actual and expected inflation, the minutes said.

To keep inflation expectations anchored, all agreed it was important for policy to be responsive to changes in the economic outlook and for the Fed to continue to clearly communicate its ability and intent to begin "withdrawing monetary policy accommodation at the appropriate time and

pace."

In my view, a small rate hike would send a strong signal to the financial markets that the U.S. is serious about its commitment to a strong dollar and stable inflation, and it could help dampen the speculation in gold as well as curtail some of the commodity inflation we are seeing (see Rate hike: sooner rather than later?). However, a minor boost should have little negative impact on the fragile economic recovery.

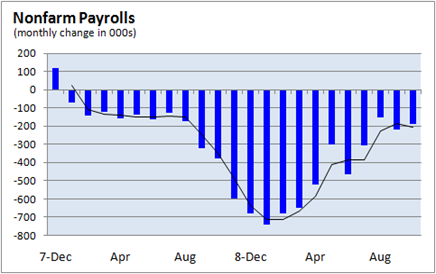

With the unemployment rate now above 10% and poised to head higher, there is little likelihood that Fed will take that kind of bold action. Nonfarm payrolls, which showed no signs of stabilizing over the past three months (see Thoughts on unemployment), will need to begin evening out before the Fed signals it is in the twilight of its current policy.

Monday, November 23, 2009

Baltic Dry Index signaling further gains in global economy

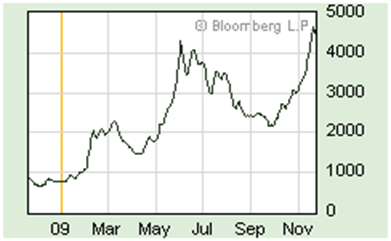

Back in early September, I published an article entitled, “Baltic Dry Index flashing yellow.”

At that time, the important measure of shipping rates had fallen approximately 40% from its early June peak, suggesting a possible pause in the global economic recovery. Or a spate of new ships coming online.

But what a difference a couple of months can make. More specifically, what a difference just three weeks can make!

The chart provided by Bloomberg shows that shipping rates have surged since the beginning of the month, suggesting that economic activity has picked up considerably, even if technical factors may be boosting rates.

Much of the improvement is likely coming out of China amid strong demand for raw materials , but the economy in the U.S. and Europe has also shown signs of life recently.

Thursday, November 19, 2009

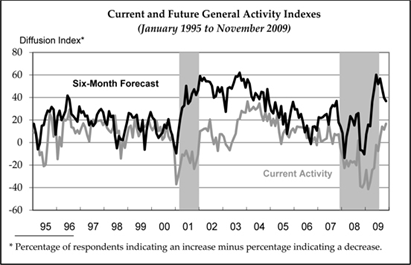

Manufacturing expands per Philly Fed

The Philadelphia Fed’s Business Outlook Survey indicates that output in the mid-Atlantic regions accelerated in the latest month.

The Philly Fed index increased from 11.5 in October to 16.7 in November, topping the forecast by Bloomberg of 12.0 A reading of zero is a sign that production is neither increasing nor decreasing.

New orders and shipments improved, but there was little in the way of new employment. On the inflation front, prices received increased slightly to –1.5 as the lack of demand at the retail level makes it very difficult for companies to raise prices.

Companies are still optimistic going six months out as the future general activity index remained positive for the 11th consecutive month, but the index did decline from 39.8 in October to 36.8. Still, the level is near where we saw it over 5 years ago, which is an encouraging sign that manufacturing will continue to recover as companies re-stock.

However, the strength and length of the manufacturing recovery will depend heavily upon how strong demand comes back in the U.S.

Weekly jobless claims hold steady

Weekly initial jobless claims held steady at 505,000 versus one week ago, but the slow downward trend remains intact, suggesting the economic recovery that probably began during July is still in place.

The 4-week moving average, which removes some of the volatility in the weekly number, fell 6,500 to 514,000, while continuing claims, which have dropped dramatically in recent months, fell another 39,000 to 5.6 million.

Before we get too excited about the drop in continuing claims that totals over1 million from its peak, it is important to note that much of the decline is probably the result of standard benefits expiring after six months rather than job creation, especially given that the economy is still shedding jobs at a heady pace (see Thoughts on unemployment).

Nonetheless, the drop in weekly claims is modestly encouraging and signals the economy is slowly recovering from a very deep hole, but the slow pace and still-high level is a clear sign that we are not experiencing a robust recovery.

For a detailed explanation of weekly claims, please see Economy 101: What are weekly jobless claims?

Wednesday, November 18, 2009

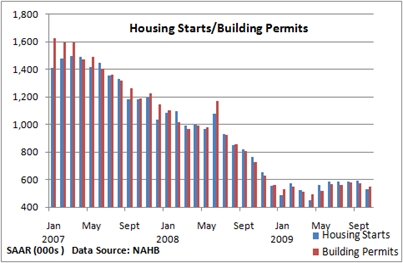

A pause in the new home market

New home sales make up less than 10% of overall housing sales, but a plunge in housing starts last month suggests the originally-scheduled end of the new home buyers tax credit had an adverse impact on the market in October.

Housing starts fell a steep 10.6% last month to a seasonally adjusted annual rate of 529,000. Building permits, which are used for forecast future starts, fell 4.0% to 552,000. Single-family authorization, which is considered a more important indicator, was down just 0.2% to 451,000.

The declines exceeded forecasts but are likely the result of the expected expiration of the $8,000 tax credit for first time home buyers, which had not yet been extended by Congress.

Rising real estate construction spending aided GDP in 3Q and further gains are a crucial ingredient if the economic recovery is to become self-sustaining.

Elsewhere, yesterday’s release of the Housing Market Index, which was unchanged from October’s downwardly revised reading of 17, also signaled the tentative situation builders were in as they awaited Congressional approval of an extension of the tax credit.

A reading of 50 indicates builders are neither optimistic nor pessimistic about the new home market.

The extension and expansion of the credit, coupled with historically low mortgage rates and improving affordability, are expected to lend support to the housing market going forward. But high unemployment and a still high level of layoffs will probably remain headwinds to a housing recovery.

Tuesday, November 17, 2009

Outside energy and food, wholesale prices fall

Led by steep 1.6% gains in both energy and food, the Producer Price Index increased a modest 0.3% in October, the third increase in five months. Food and energy have been fairly volatile in recent months and have had a major impact on the headline figure.

The core rate, which removes the two categories, fell a steep 0.6% last month amid lower prices for light motor trucks and passenger cars, which fell 5.2% and 0.5%, respectively.

Inflation at the wholesale level remains benign, though the best news is behind us.

Sluggish industrial production

The small rise in the headline figure produced a 0.2% rise in capacity utilization to 70.7%, but with plenty of slack in the economy, the threat of inflation remains distant at this time, which the Fed made very clear in its last statement.

The economy is still moving ahead, but the recovery is fragile and the pace remains choppy as evidenced by the latest numbers.

Monday, November 16, 2009

Empire gives back some of recent gains

The Empire Manufacturing Index is the first look at goods producers each month, though it is a narrow measure and only reflects conditions in New York.

In November, the survey fell 11 points to 23.5, but remains well above zero, which marks the line between expansion and contraction. Shipments, new orders, and prices eased; however, the drop is not worrisome, in my view, as the index has been on an almost uninterrupted, upward pace since early in the year.

A look at business conditions going out six months did improve to its best level in about 5 years, rising just over one point to 57.0.

Saturday, November 14, 2009

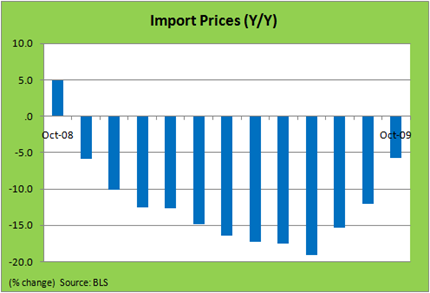

Inflation pressure slowly growing from overseas

Prices from overseas increased 0.7% in October, the seventh increase in eight months as fuel prices jumped a steep 1.8%. Excluding fuel, prices increased a modest 0.4%, which follows similar gains over the prior two months.

Strong increases in industrial supplies over the last three months have boosted import inflation at the core level, which is not much of a surprise given gains in commodity prices.

The weakening dollar may be playing a role, but at this point it is probably minor since depressed demand in the U.S. makes it very difficult to raise prices. Moreover, currency fluctuations do not immediately translate into price changes due to hedging techniques.

Gains from oil disappear

Prices remain below levels seen one year ago, but the steep decline that was fueled primarily by falling oil prices has mostly dissipated.

Friday, November 13, 2009

Trade deficit widens on higher oil bill

The US trade deficit widened from $30.8 billion in August to $36.5 billion in September amid a surge in imports, while the continued rise in exports suggests the global economy remains on the mend.

In the month of September, imports jumped $9.3 billion to $159.1 billion, while exports increased $3.7 billion to $128.3 billion.

Much of the deterioration in the trade gap can be blamed on a $4.1 billion increase in the nation’s bill for oil. Higher prices played a role, thanks mostly to the weaker dollar, but oil imports also jumped.

If the dollar remains on a downward path, speculators and institutional investors may continue to put money into commodities, including crude, which could further exacerbate the trade deficit and negate the favorable impact from rising exports.

The worsening trade gap is likely to hamper GDP when the advance figures are updated later in the month.

Consumer sentiment stuck in a range

Economic activity is no longer contracting, as evidenced by 3Q’s rise in GDP, but the inability of the economy to produce jobs is weighing heavily on consumer sentiment.

Details available via Examiner.com.

Thursday, November 12, 2009

Fewer jobless claims suggest recovery intact

Weekly initial jobless claims now stand at 502,000, down 12,000 in the latest week.

Still too high but the trend is encouraging. Details available at Examiner.com.

Wednesday, November 11, 2009

Production strong in Germany, but sentiment sours some

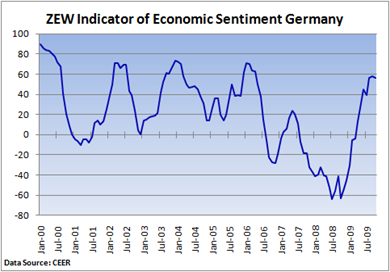

ZEW sends a mixed signal

A couple of key reports from Germany this week are sending out mixed signals. Industrial production in September surged by 2.7% following an impressive 1.8% rise in the prior month. Foreign demand provided much of the boost as the global economy continues to power ahead, bolstering Germany’s export-dependent economy.

However, institutional sentiment, though still has high levels, pulled back some in the latest month. The respected ZEW survey fell 4.9 points in November t0 51.9 points but remains well above the historical average of 26.9.

The Center for European Economic Research pointed out that analysts remain cautious as to how private consumption will evolve, especially due to the uncertainties that abound in the labor market.

Sentiment among analysts started in an uptrend late last year and continued to surge through much of the first part of 2009. The initial optimism was a bit premature, in my view, but Europe’s largest economy has started on the road to recovery.

Tuesday, November 10, 2009

Fedspeak - Why rates are expected to remain low

Comments from Federal Reserve presidents in between meetings give us additional insight into FOMC decisions as well as provide us clues that might signal an impending change in policy.

First, Atlanta Fed chief Dennis Lockhart said in his prepared remarks today that he believes an economic recovery probably got underway this summer. In particular, he pointed out that housing prices appear to have bottomed and risk spreads have normalized. Both are key to self-sustaining recovery.

But he cautioned that his "baseline forecast is for a relatively subdued pace of growth beyond the current quarter and through the medium term. The potential sluggishness of the recovery partly reflects certain unique characteristics of this recession.

It was led by a crisis in banking and capital markets that was triggered by a sharp and persistent reduction in valuations of residential real estate assets."

Lockhart also said problems in commercial real estate are "very worrisome for parts of the banking industry."

San Francisco President Janet Yellin made similar comments today in a speech about the economy and real estate. Yellin reminded her audience that the economy has started to move ahead, but "the strength and durability of the expansion is in question.

Some of the rebound is due to temporary government programs and a swing in inventory investment that will not provide an ongoing source of growth."

Though we are hearing cautious optimism for the Fed, fears that a subdued recovery will not produce the jobs needed to bring down the unemployment rate implies that the fed funds rate will hover near zero for the foreseeable future.

Friday, November 6, 2009

Thoughts on unemployment

October’s rise in the unemployment rate past 10% had been eventually expected but is still sobering and a reminder that the high rate of unemployment is a daunting task for both policymakers and those who have find themselves downsized out of a job.

A broader measure of unemployment, known as U-6 which includes discouraged workers not counted under the standard definition as well as part-timers who want full time work, rose from 17.0% to 17.5%.

Because it appears that the economic recovery will be gradual (see L, W, U, V – the alphabet soup of economic recoveries) and job growth is a lagging indicator, unemployment above 10% is likely to persist for some time, while an eventual rate hike by the Federal Reserve will be pushed further into the future.

I covered most of the details of today’s release at Examiner.com. Although the chart below indicates that the pace of job losses is slowing, the last three months show there has been very little progress.

Yes, we are seeing modest declines in weekly jobless claims as companies gradually turn more optimistic on the economy, but improvement has been far too slow and claims north of 500,000 each week suggests the jobless rate may be headed higher.

Companies continue to work off inventories

Much today’s attention is on the unemployment rate, which jumped past 10% in October, the release this morning of wholesale inventories indicates that the rapid destocking cycle that began last year is slowly but not significantly abating.

The U.S. Census Bureau reported that wholesale inventories fell 0.9% in September, while sales grew 0.7%. Although sales continue to rise and have gained ground for six-straight months, manufacturers have been reluctant to quickly ramp up production, hampering gains in economic activity.

As viewed by the chart above, companies continue to work off goods on hand, rather than significantly boost production. Note that the inventories-to-sales ratio, or how many months companies need to completely liquidate inventories, fell from 1.20 to 1.18 and remains in a sharp, downward trend.

The economy is improving and demand overseas, especially from Asia, has accelerated. But the domestic recovery is still fragile, and consumer demand, which is starting to show signs of expanding, is being held back by high unemployment, damaged balance sheets, and sluggish growth in incomes.

Rapidly falling inventories should eventually add to economic activity as companies restart idle production lines in order to meet expected demand. But these same firms are in no hurry to significantly raise output.

Thursday, November 5, 2009

Natural gas supplies near peak

Natural gas supplies rose another 29 billion cubic feet (bcf) in the latest week and now stand at 3,788 bcf as the country heads into winter. We may see another increase next week or the following week, but as temperatures continue to cool down, supplies are topping out.

According to the Energy Information Administration, stocks are 379 bcf higher than last year at this time and 414 bcf above the 5-year average of 3,374 bcf.

A relatively mild summer in much of the country, which reduced electricity needs, and the decline in industrial demand that was tied to the recession are key reasons for the ample supplies heading into the colder months.

The country has also seen big increases in natural gas production recently, though falling prices earlier in the year stunted production.

Productivity soars

Forecasts provided by Bloomberg News called for a 6.3% increase in productivity and a 3.9% decline in unit labor costs.

Notably, unit labor costs declined 3.6% over the last four quarters—the largest decrease since the series began in 1948, according to the government. With labor costs, which are the largest piece of the expense equation for most businesses, well under control, the risk of an unwanted rise in inflation is highly unlikely.

No real surprises despite the big miss by forecasters

Huge gains in productivity and corresponding declines in unit labor costs are to be expected in the early stages of an economic recovery because firms are reluctant to add new workers even as production pick up. And in this case, the continuation in job losses added to the out-sized increases in productivity.

As layoffs wind down and hiring picks up (as many analysts anticipate will eventually occur), productivity gains will eventually begin to slow.

Jobless claims resume downward trend

It’s been a slow and painful drop but the economic recovery is gradually reducing the number of weekly initial jobless claims. In the latest week, weekly claims fell 20,000 to 512,000, the lowest since the beginning of the year.

Details are available at Examiner.com.

Wednesday, November 4, 2009

Rate hike: sooner rather than later?

Note that even the language that conditions "warrant exceptionally low levels of the federal funds rate for an extended period" remained in the statement despite talk from analysts that the FOMC would tweak the language as it eventually prepares to raise interest rates.

If we are going to see changes at the December meeting, we are more likely to hear talk from Fed officials in speeches in the upcoming weeks, rather than get blind-sided at a Fed meeting.

That said, it might have been beneficial for a change in the language referring to rates and an eventual hike at the December meeting to 25 bp followed by another small increase to 50 bp in January.

Yes, the economy remains in a fragile state, and the unemployment rate is probably headed higher. Moreover, political pressure from lawmakers for the Fed to continue doing much of the heavy lifting remains intense. Plus, the protests from the executive and legislative branches would probably be deafening.

However, a symbolic increase would not harm the economy, in my my view, as rates would still be near rock-bottom levels. And the emergency situation and free-fall in the economy late last year that brought about near zero interest rates has abated.

A small increase would help attract the capital needed to fund large deficits and would send a strong message to international investors that the Fed is serious about the Treasury's strong dollar policy. Furthermore, it may slow some of the asset inflation we've been seeing in the commodity markets.

Do I anticipate this will occur? Highly doubtful. Bernanke & Co. will most likely hold the fed funds rate at its current target of 0-0.25% until job creation is on a self-sustaining, upward path.

Service sector begins to slowly dig out of deep hole

Manufacturing may be rebounding at a solid pace, but today’s report on the service sector suggests non-manufacturing industries have only begun to stabilize.

The ISM Non-Manufacturing Index fell from 50.6 in September to 50.3 in October, shy of the consensus estimate of 51.6 provided by Bloomberg. A reading of 50 is neither expansionary nor shows the sector is contracting. And at 50.6, the service sector, for all practical proposes, has just stopped shrinking.

On the positive side, the trend over the past 12 months has been slowly to the upside. Unfortunately, the improvement has not made a dent in the jobless rate, and the employment component of the index remains weak, falling 3.2 points to 41.1.

ADP’s employment report, which came out this morning, showed that the private sector shed another 203,000 jobs last month. Friday’s nonfarm payroll report will provide greater clarity on how the labor market performed last month.

Monday, November 2, 2009

Pending home sales on strong upward trajectory

The Pending Home Sales Index, which is a forward-looking indicator of existing home sales based on contracts signed, surged ahead for a record eight-consecutive months, providing the latest evidence that the housing market is on the road to recovery.

Pending home sales increased by 6.1% to 110.1 in September, which puts the index 21.2% above a year ago – the largest annual gain since the index began in 2001, according to the National Association of Realtors.

“We’re witnessing a rush of first-time buyers trying to beat the expiration of the (first-time home buyer) tax credit at the end of this month,” the chief economist for the NAR said.

But he cautioned,“We’re clearly not out of the woods because an excess of homes remains on the market despite recent improvement. Although current inventory is getting closer to price equilibrium, foreclosures will continue to enter the pipeline.”

Not missing an opportunity to lobby Congress to extend the subsidy, he added that “an extended and expanded tax credit would help absorb this incoming inventory.”

Foreclosures are likely to rise next year, according to analysts, and an extension of the credit may be warranted. But pent-up home demand, coupled with historically low interest rates and the big rise in affordability over the past couple of years, may go a long way in absorbing additional inventories.

A strong foundation for a more permanent economic recovery must include rising home sales and rising home prices.

Factories shift into higher hear

ISM at 30-month high

A key gauge of manufacturing expanded at its fastest pace since April 2006, suggesting the economic recovery that likely began late in the summer is gathering momentum.

The ISM Manufacturing Index improved from 52.6 in September to 55.7 in October, topping forecasts by about two percentage points and rising in nine of the past ten months. A reading above 50 is expansionary.

New orders pulled back slightly but continued to expand, falling 2.3 points to 58.5. But production surged 7.6 points to 63.3 as companies continue to replenish depleted stockpiles in the wake a the dearth in activity late last year and early this year.

Notably, employment moved above 50 for the first time in 15 months, indicating that workers are needed to meet expanding output. More importantly, it is a signal that firms are slowly growing more optimistic that the recovery in place is more than just a temporary burst of economic activity.