But level still too high

Weekly initial jobless claims fell 24,000 to 456,000 in the latest week, suggesting that increases over the past two reporting periods may have come from difficulties adjusting for the Easter holiday.

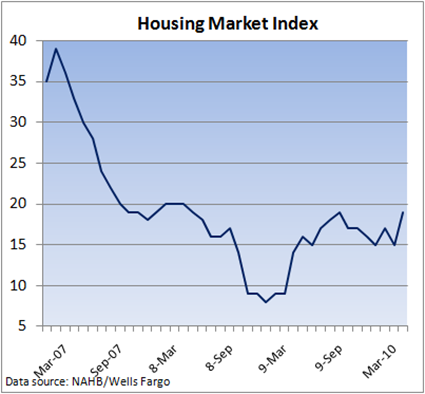

Still, the weekly claims are 14,000 above the reading of 442,000 heading into Easter, and as evidenced from the chart below, the downward trend that started early last year has nearly come to a halt over the past four months or so.

It’s difficult to say why, especially given the relatively upbeat data that have been streaming from a number of different sources. Manufacturing is experiencing a V-shaped recovery, consumer spending has started to pick up, and the service sector, which makes up most of the economy, is accelerating.

I suspect that the uneven and shallow recovery, that likely started sometime last summer, is mostly responsible for the still-elevated level of claims.

Companies are still cautious, lending is tight and many firms are not yet seeing the economic recovery reflected in higher sales. Consequently, they appear to be quick to pull the trigger on layoffs.

As the recovery broadens, and that appears to be happening, layoffs should diminish. In the meantime, April’s employment numbers will probably reflect the still high number of job cuts.