Yesterday’s press release from the Fed, along with its decision to keep rates unchanged, not only gives us some insights into how policymakers are thinking, but by comparing it with the prior press release, we can get a feel of how their view on the economy is changing.

So let’s dive in.

April 28, 2010:

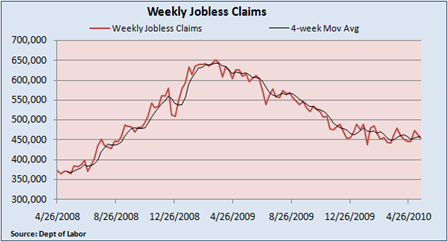

Information received since the Federal Open Market Committee met in March suggests that economic activity has continued to strengthen and that the labor market is beginning to improve.

vs.

June 23, 2010:

Information received since the Federal Open Market Committee met in April suggests that the economic recovery is proceeding and that the labor market is improving gradually.

The modest shift in the language shows that Fed officials did not see the economic recovery accelerate in the weeks leading up to the current meeting as they detected prior to the April gathering.

Moving along.

While bank lending continues to contract, financial market conditions remain supportive of economic growth (removed). Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.

vs.

Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time (order reversed).

Plenty going on here. The FOMC removed the bolded statement, underscoring their concern over what’s happening in the credit markets. And it inserted the sentence above that is underlined. Without mentioning Europe by name - “largely reflecting developments abroad,” the new language is an indication that policymakers are concerned and are monitoring events.

Additionally, the reversal in the clauses of the final sentence – placing “the pace of the economic recovery is likely to moderate for a time” at the end versus the beginning – is a subtle way of telegraphing that the Fed is slightly more worried about the strength of the recovery.

Let’s keep going.

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

vs.

Prices of energy and other commodities have declined somewhat in recent months, and underlying inflation has trended lower. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

At least publicly (and probably privately), the Fed is even less concerned about inflation, at least in the short term. Some of the big drop in energy prices, however, has reversed itself over the past three to four weeks.

What does it all mean?

The Fed became slightly more pessimistic on the outlook between the April and June meetings, but it gave no indication that it expects the recovery to stall, let alone enter a double dip recession.

Moreover, it is showing even less concern, at least temporarily, about inflation (lowering odds of a near-term rate hike).

And given the slow recovery in the labor market, the still-fragile and uneven recovery, and new problems that have cropped up in credit markets in Europe, any possible rate hike that might have been contemplated earlier in the year is likely to be delayed. In my view, we may not see any change through the end of the year.