The Federal Open Market Committee (FOMC) released the minutes from its August 10 meeting this afternoon, and comments from the report indicate that policymakers have grown increasingly concerned about the economy.

“The incoming data on the labor market were weaker than meeting participants had anticipated. Private-sector payrolls grew sluggishly in recent months,” according to comments that were reflected in the minutes.

Reasons stated: “Policymakers discussed a variety of factors that appeared to be contributing to the slow pace of job growth.

“A number of participants reported that business contacts again indicated that uncertainty about future taxes, regulations, and health-care costs made them reluctant to expand their workforces (see Did Bernanke take a swipe at Washington). Instead, businesses had continued to meet growth in demand for their products largely through productivity gains and by increasing existing employees' hours.”

Committee members also noted that “the economic outlook had softened somewhat more than they had anticipated, particularly for the near term, and some saw increased downside risks to the outlook for both growth and inflation.”

Although the FOMC voted to begin buying longer-term Treasuries with proceeds from maturing mortgage-backed debt, there was some concern that such purchases would leave financial markets to the conclusion that large-scale purchases would be in the offing.

Ben Bernanke did focus on policy options that are still available in the Fed’s arsenal in his speech last week, which does suggest that further quantitative easing is around the corner.

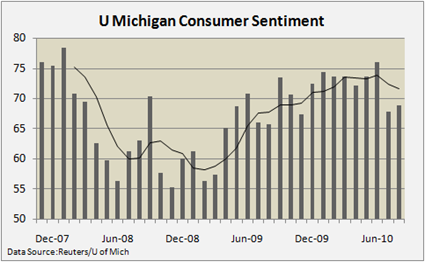

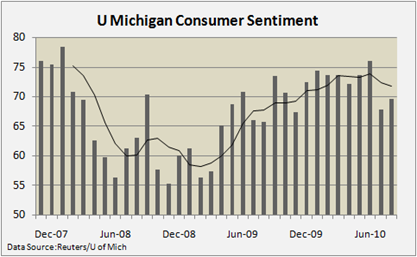

Still, though data have been sluggish recently, a contraction does not appear to be imminent (see consumer spending and consumer confidence reports out this week).