The

bi-partisan debt commission appointed by President Barack Obama officially unveiled its plan to tackled the nation’s fiscal woes and return some form of sanity to the federal budget.

Tasked with coming up with recommendations to bring the deficit under control, the commission spared virtually no one in an effort to lop off nearly $4 trillion from the budget deficit by 2020.

And its across-the-board approach, which will cause consternation in many quarters, may be its greatest strength because compromise must involve some give and take.

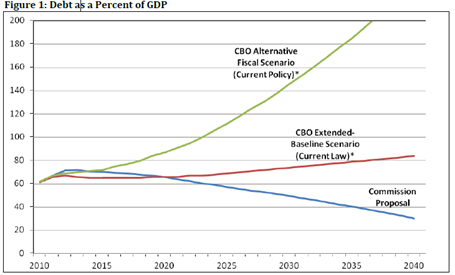

The Extended-Baseline Scenario generally assumes continuation of current law. The Alternative Fiscal Scenario incorporates several changes to current law considered likely to happen, including the renewal of the 2001/2003 tax cuts on income below $250,000 per year, continued Alternative Minimum Tax (AMT) patches, the continuation of the estate tax at 2009 levels, and continued Medicare “Doc Fixes.” The Alternative Fiscal Scenario also assumes discretionary spending grows with Gross Domestic Product (GDP) rather than to inflation over the next decade, that revenue does not increase as a percent of GDP after 2020, and that certain cost-reducing measures in the health reform legislation are unsuccessful in slowing cost growth after 2020.

The Extended-Baseline Scenario generally assumes continuation of current law. The Alternative Fiscal Scenario incorporates several changes to current law considered likely to happen, including the renewal of the 2001/2003 tax cuts on income below $250,000 per year, continued Alternative Minimum Tax (AMT) patches, the continuation of the estate tax at 2009 levels, and continued Medicare “Doc Fixes.” The Alternative Fiscal Scenario also assumes discretionary spending grows with Gross Domestic Product (GDP) rather than to inflation over the next decade, that revenue does not increase as a percent of GDP after 2020, and that certain cost-reducing measures in the health reform legislation are unsuccessful in slowing cost growth after 2020.

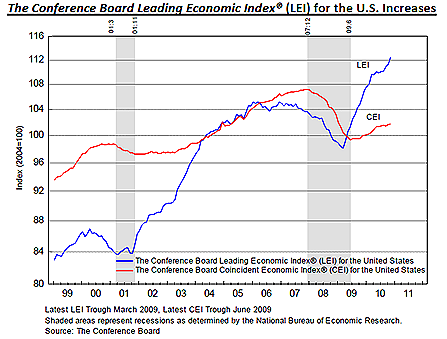

The chart above provides a stark look at the looming fiscal disaster that awaits if nothing is done, assuming of course (see green line) that foreigners won't willingly buy an ever-growing supply of U.S debt that currently yields less than 3% (or near zero if one buys T-bills that mature in less than 90 days).

The commission’s proposal, which at first glance seems difficult to swallow, actually encompasses modest changes in entitlement and discretionary spending that most Americans should be able to adjust to. On a side note, the changes are much less onerous than the nasty recession that we have all been forced, to some degree, to deal with.

Just the facts

An overview of the plan:

• Achieve nearly $4 trillion in deficit reduction through 2020, more than any effort in the nation’s history.

• Reduce the deficit to 2.3% of GDP by 2015 (2.4% excluding Social Security reform), exceeding President’s goal of primary balance (about 3% of GDP).2

• Sharply reduce tax rates, abolish the AMT, and cut backdoor spending in the tax code.

• Cap revenue at 21% of GDP and get spending below 22% and eventually to 21%.

• Ensure lasting Social Security solvency, prevent the projected 22% cuts to come in 2037, reduce elderly poverty, and distribute the burden fairly.

• Stabilize debt by 2014 and reduce debt to 60% of GDP by 2023 and 40% by 2035.

Note: Plausible baseline resembles CBO’s Alternative Fiscal Scenario, assuming the continuation of the 2001/2003 tax cuts protected by Statutory PAYGO, estate tax and AMT policies at 2009 levels, and a Medicare physicians' pay freeze. The baseline also assumes discretionary spending as requested in the President’s Budget and a gradual phase down of the conflicts in Iraq and Afghanistan.

Note: Plausible baseline resembles CBO’s Alternative Fiscal Scenario, assuming the continuation of the 2001/2003 tax cuts protected by Statutory PAYGO, estate tax and AMT policies at 2009 levels, and a Medicare physicians' pay freeze. The baseline also assumes discretionary spending as requested in the President’s Budget and a gradual phase down of the conflicts in Iraq and Afghanistan.

2 Note that increases in this deficit level as compared to the Co-Chairs’ November 10, 2010, draft do not reflect major policy changes, but rather baseline changes to more honestly (and conservatively) account for the costs of the conflicts in Iraq and Afghanistan

Digging down into some of the components of the plan, the full retirement age for social security, which is already scheduled to rise to 67 in nearly 20 years, would rise to 68 by about 2050 and 69 by about 2075. The earliest one could receive benefits would increase lock step to 63 and 64, respectively.

Cost of living adjustments would be modified slightly, taxes on eligible income would increase gradually and the system would become more progressive.

Discretionary spending also comes under the microscope.

If the plan passes, discretionary spending in 2012 would be equal to or lower than spending in 2011, and would then return spending to pre-crisis 2008 levels in real terms in 2013. Future spending growth would be limited to half the projected inflation rate through 2020.

The federal workforce, which has been exempt from the havoc caused by the recession, would drop by 10%, or 200,000, by 2020 primarily through attrition.

Medicare spending, which threatens to explode over the next 20 years, would also be impacted.

Don’t tax me, tax the fellow behind the tree

Those hoping the commission would focus entirely on spending are in for a disappointment but compromise dictates that taxes be a part of the equation.

In return for a simpler tax code that reduces tax brackets to as low as 8%, 14% and 23%, the cap of mortgage interest would be modified, deductions for charitable giving would change and gasoline taxes would rise by 15 cents per gallon – dedicated to transportation projects rather than the current practice of relying on deficit spending.

Additionally, the dreaded alternative minimum tax would finally die the death it so desperately deserves.

But can it pass?

The atmosphere on Capitol Hill is nothing short of poisonous.

The plan has been called “unacceptable” by at least one politician, while others view it as a starting point. Translation: how can its most '”onerous” provisions be eliminated while still passing something that shows Congress can get by with the minimum.

Of course, the recovery might just accelerate dramatically, reducing outlays while bringing in unexpected tax revenues.

But for a more likely scenario, one only has to look as far as Europe. Greece barely avoided a financial meltdown thanks to an E.U. bailout, and Ireland quickly followed. And now there are whispers that Portugal and Spain are next.

If the U.S. ever faces a crisis of confidence in its ability to rollover and expand its debt, the reaction in financial markets will be swift and violent, with the dollar and the stock market likely entering a free-fall. Interest rates would soar.

Spending and tax changes needed to deal with such a crisis would be draconian and unacceptable to most, as the only other alternative, monetizing the debt by the Fed, would quickly create hyperinflation.

The current plan is a bi-partisan solution that gives everyone something to cheer about and everyone something to gnash their teeth. But it provides lawmakers the cover to put this mess behind us and show the world the U.S. can and will get its fiscal house in order.

If passed, and that’s extremely questionable, it would provide a huge boost in confidence to foreign and U.S. investors alike and likely remove any chatter about whether the U.S. can sustain its triple-A credit rating.

It would also lay the groundwork for future growth that provides meaningful employment and the accumulation of wealth for this generation and generations to come.