But prices are beginning to drift higher

Federal Reserve Bank of Philadelphia President Charles Plosser warned Friday of the risks of keeping monetary policy too easy in the face of an energy price shock, the Wall Street Journal reported.

“What creates inflation is monetary policy at the end of the day,” Plosser said.

Citing the jump in energy prices, Plosser said, “The reason oil prices worry me is that there will be more pressure to keep monetary policy easier for longer,” as some fear such price hikes will cut into discretionary spending and dull the recovery.

“That response is a response that will in my view” create inflation, and “we need to lean against that,” he added.

Conversely,

Atlanta Fed President Dennis Lockhart was less concerned about the latest burst in headline inflation, saying on the same day, “While short-term measures of inflation have moved up rather strongly in the last few months, I hold to the view that this trajectory will not persist.”

He noted, “Inflation pressures associated with rising commodity prices will dissipate if, as currently expected, the rate of growth in these prices slows.”

Unlike the official Fed focus on core inflation – inflation minus food and energy – Lockhart added that the Fed should be looking at headline inflation, which includes changes in food and energy.

Headline inflation has jumped over the past three months in response to higher food and gasoline prices, with the year-over-year headline inflation nearly doubling in three months to 2.1%.

Core inflation, however, has remained fairly stable, though prices have edged up a faster-than-expected 0.2% in both January and February, the first such increases in over a year.

Still, it’s worth noting that core prices tend to rise faster early in the year, suggesting the BLS’ method for adjusting for seasonality may not be capturing all the nuances of price changes.

Nonetheless, even if we’re beginning to see the first pick up in core inflation (and I believe we are), it’s not something to be worried about, at least not yet.

(

Addendum: The Fed-favored core PCE Index released today rose 0.2% in February, the second such increase in a row following virtually no change over the prior five months, providing the latest evidence that prices are slowly creeping higher.)

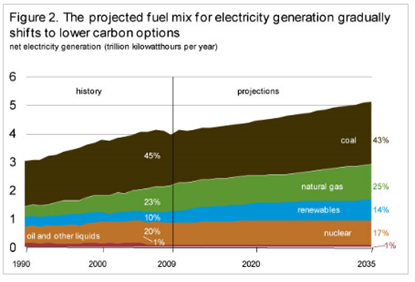

But the surge in commodity prices since the end of the summer has been squeezing manufacturers and may eventually threaten price stability, especially as the Fed continues to hold rates at near zero and buy hundreds of billions of dollars in bonds.

Indexes that measure metal and raw material prices have marched to new highs, while broader measures of raw material prices remain below the 2008 peak thanks in large part to crude, which remains well below its 2008 high.

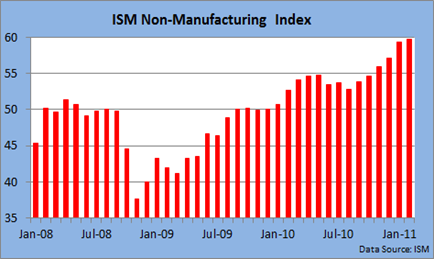

Manufacturers are feeling the sting from increased prices at the early stages of production (see chart below), as evidenced by the national ISM surveys for both manufacturing and non-manufacturing industries.

The ISM surveys do not look at prices manufacturers receive for their goods, only the cost of raw materials. However, regional surveys by the Fed do take that into account.

For much of the shallow recovery, manufacturers have had little ability to pass along higher commodity costs, and either had to squeeze out additional efficiencies or take a modest hit to margins.

But as the chart above reveals (see prices received), that is beginning to change.

And according to the

Fed’s latest Beige Book – a summary of economic conditions in each of the Fed’s twelve districts – manufacturers said “...they were passing through higher input costs to customers or planned to do so in the near future.”

It seems unlikely the Fed might act on anecdotal evidence alone (and that’s what the Beige Book is about), but the remarks have merit in my view since they are apparently being corroborated by the Fed’s regional surveys.

QE2 – higher stock prices and higher commodity prices

Inflation expectations were cratering last summer amid the slowdown in economic activity associated with the sovereign debt crisis in southern Europe that caused a modest amount of instability in the credit markets. And the resulting slowdown in U.S. economic activity gave many a temporary respite from higher raw material prices.

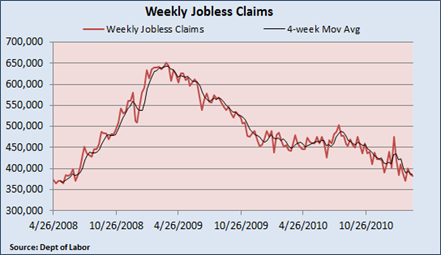

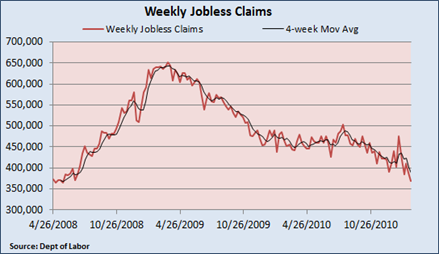

Fed fears of deflation, increased odds the economy might enter a double-dip recession (both unwarranted in my opinion) and a stagnant labor market led the Fed to discuss and eventually embark on a plan to buy $600 billion in longer-term Treasury bonds.

Its goal: stimulate demand, revive the sagging labor market and modestly bolster inflation expectations.

Economic activity has accelerated since the fall and stock prices have surged well above summer lows. Of course, the Fed is comfortable with the assertion that it helped to engineer the rise in stock prices.

But it doesn’t believe the extra cash it has pumped into the economy has found its way into raw material prices.

Most of the newly injected liquidity has ended up back at the Fed, as banks have taken the extra deposits from the central bank’s bond buys and held them in reserve, doing little for the economy – think liquidity trap.

Still, the Fed's talk last fall about loosening the monetary reins and the eventual implementation of a second round of quantitative easing does appear to be encouraging speculation in commodities; if not with QE2 dollars, then individual investors as well as hedge funds and institutional investors.

I don’t believe we are on the cusp of sharply higher inflation, as there is still plenty of slack in the economy, and wage pressures remain muted mostly due to the modest labor market uncertainty that still plagues many who are employed and the huge pool of labor that’s available.

Also, longer-term inflation expectations – a key driver of future inflation – remain under control. Besides, we wouldn’t have a ten-year Treasury sitting at a yield of just below 3.50% if investors were openly fretting about inflation.

Nonetheless, the economy is now running under its own power and monetary policy remains extremely accommodative, which means the Fed is beginning to run the risk that it may spark a bout of unwanted inflation down the road.

Hence, it must begin to consider and implement and exit strategy sooner rather than later.

I doubt the Fed will end its QE2 plan early, but very small and measured hikes in the fed funds rate would send a strong signal to the financial markets that all the Fed’s chatter about its willingness to battle inflation isn’t just talk.

A fed funds rate of 50 bp, or 75 bp or even 1%, raised in stages, would still be extremely accommodative by historical standards.