QE2, or the second round of the Fed’s program of quantitative easing as it is popularly called, was launched with plenty of fanfare and controversy last November, but was crafted as an insurance policy against deflation as well as a way to jump-start a sluggish recovery that had failed to create a significant number of new jobs.

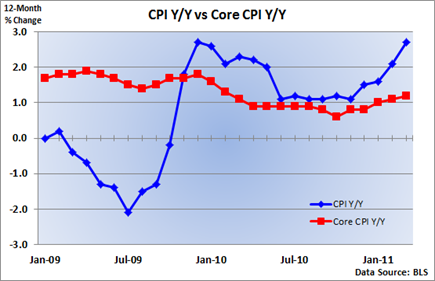

Since its plan to buy an additional $600 billion in longer-term Treasuries, stocks have rallied, the economy has side-stepped a double-dip recession but inflation worries have surfaced amid soaring commodity prices.

Not surprisingly, the Fed has been content to take credit for the rally in stocks and the reinvigorated economy but not the surge in commodity prices.

Looking more closely at the data, the Fed’s actions, at best, may be having only a very limited impact on the economy as I’ll explain below.

First, let’s define quantitative easing before analyzing its effect on the economy. Quantitative easing is a tool that a central bank uses in order to provide more liquidity, or cash, than is needed to keep short term rates at zero.

In other words, a central bank, such as the Federal Reserve or the Bank of Japan, resorts to unconventional means when conventional policies that drive short-term rates to zero fail to stimulate economic growth.

In early 2009, the Fed, in its efforts to clear the logjam in the credit markets, clarified its planned asset buys by announcing it would purchase $1.25 trillion of agency mortgage-backed securities, up to $200 billion of agency debt and $300 billion in Treasury securities by the end of the year.

How does the Fed do it? What is essentially happening is that the Fed creates cash and buys government bonds from a bond dealer. When the Fed receives its newly purchased bond, the bond dealer receives cash, which it deposits into its bank account.

The bank now has new deposits which it can lend to businesses and consumers, after holding a small percentage in reserve. Anything above that minimum-required reserve is called “excess reserves.”

Normally, banks minimize excess reserves because they earn nothing sitting in the vault, and a bank is in business to make a profit by paying you and I a certain return on our deposit before lending it out at a higher rate.

When late 2008 rolled around, there was absolutely nothing normal happening in the credit markets, and risk-averse banks tightened credit standards and used the extra cash to shore up balance sheets.

As you can see from the chart above, much of the Fed’s actions in late 2008 and most of 2009 simply ended up back at the Fed in the form of these excess reserves.

A quick note: Unlike in past years the Fed began paying a very small amount, 0.25%, on excess reserves held at the Fed. That’s better than what banks can get for overnight loans on the fed funds market and better than holding it the vault. Remember, the Fed is targeting a fed funds rate at between 0 – 0.25%.

The second round of QE, or QE2, has had a similar impact, as excess reserves are up nearly $400 billion since the program was initiated (see chart above). Excess reserves now stand at almost $1.4 trillion.

What is this suggesting? Simply that banks are not lending out the extra cash to businesses or consumers and instead are holding them at the Fed in the form of excess reserves, which earn a paltry 0.25%.

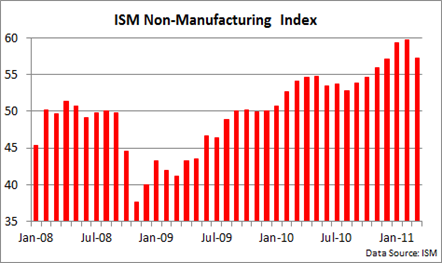

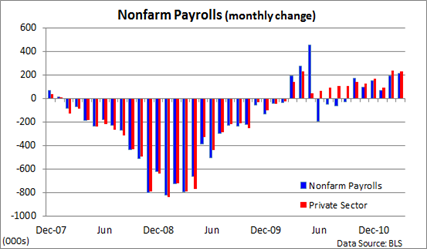

A quick look at the second and third charts seems to confirm the newly minted Federal Reserve dollars aren’t finding their way into the real economy because lending standards remain tight and consumers, who are still reeling from the worst recession in 70 years, continue to shore up savings accounts and focus on debt.

At this point in the cycle, the Fed’s extraordinarily accommodative monetary policy does not appear to be responsible for the improvement in economic activity in recent months.

Think “liquidity trap,” where monetary policy becomes largely ineffective.

Still, the very modest uptick in consumer lending and the stabilization in commercial and industrial loans are encouraging, but we’re going to need to see a greater willingness among banks to lend before the recovery kicks into high gear.