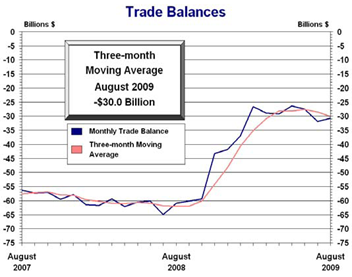

The steep contraction the economy experienced in the months after the failure of Lehman Brothers and the subsequent freezing in the credit markets are well behind us and the improvement in consumer sentiment, as measured by the University of Michigan’s survey, has improved considerably.

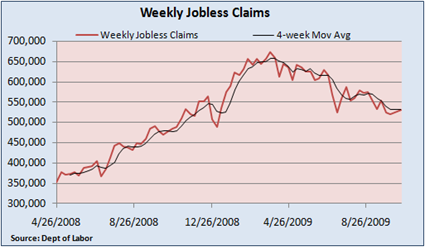

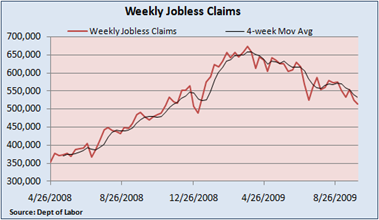

But the fallout from the worst recession in decades has severely impacted the labor market. With the unemployment rate probably poised to break past 10%, consumer confidence has barely budged out of the range it has been over the last 6 month.

So it shouldn’t come as a surprise that job insecurities and worries about finances pushed the index from 73.5 in September to 70.6 in October.

The majority of consumers reported that their finances had worsened in October for the thirteenth consecutive month—the longest and deepest decline in the sixty-year history of the survey, according to the University of Michigan.

The economy has begun to climb out of the deep hole it fell into over the last 18 months, but many of us are not feeling much better about the economy.

And with the Christmas shopping season just around the corner, a lack of visible improvement in consumer attitudes may depress spending in the final months of the year.