Falling prices, however, are still remote

Tuesday’s

Fed statement had all the markings of a central bank that seems ready to pull the trigger on a more aggressive round of quantitative easing, i.e., purchases of longer-term Treasurys in order to fight a perceived threat – deflation.

And its remarks weren’t lost on bond traders, who snapped up government bonds in anticipation of new buying.

Comments such as, “Measures of underlying inflation are currently at levels

somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability.”

And it is “… prepared to provide additional accommodation if needed to support the economic recovery and

to return inflation, over time, to levels consistent with its mandate.”

Still, the Fed did leave itself an out as it said it still expects inflation to rise “to levels the Committee considers consistent with its mandate.” At a minimum, the comment suggests that policymakers believe the odds inflation will fall below zero are still remote.

Don’t know much about history

First a short history lesson is in order. Looking back at the last six years, the Consumer Price Index moved in a mostly upward trend until July 2008, when it peaked at 5.5%, its highest level since January 2001, according to BLS data.

Higher food prices lent support to the headline number, but big gains in crude oil were the primary culprit. Who can forget gasoline selling at $4 per gallon during the summer of 2008?

Core inflation, which minuses out food and energy, was more muted, as higher energy prices did not noticeably bleed into the general price level.

Enter the collapse of oil prices and the onset of the Great Recession: headline inflation plunged to levels not seen since the early days of the Truman administration.

The disinflationary trend (a falling rate of inflation) in core inflation, however, has been more gradual, as annual price increases fell back below 2%, generally considered the top end of the Fed’s comfort zone, in December 2008.

From there, core inflation has gradually been heading south amid the rise in unemployment, falling/sluggish demand in the economy and weak wage growth.

The second chart highlights the subtle slide in core inflation pressures and the eventual descent below 1%, which is generally considered the bottom of the range of what the Fed is comfortable with.

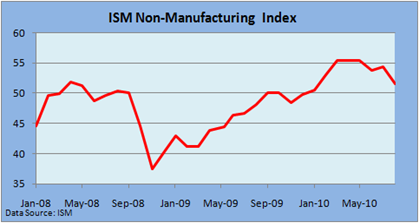

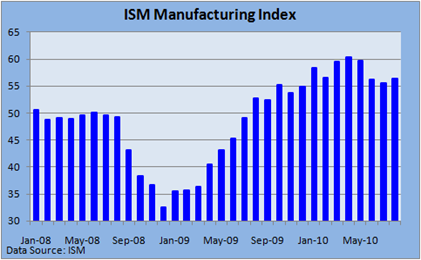

Note, however, that core inflation has been holding steady at 0.9% over the past five month, interrupting the downward trend that actually began in late 2006 (see top chart). And commodity prices have exhibited modest strength in recent weeks, suggesting the global recovery is continuing uninterrupted.

It would be highly unlikely that deflation could take hold in the U.S. without a significant drop in commodity prices.

Still, it’s still too early to call a bottom, but the slowly expanding economy seems likely to put a floor under prices and prevent a slide to zero, in my view.

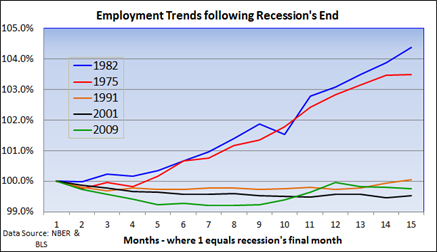

Turning Japanese?

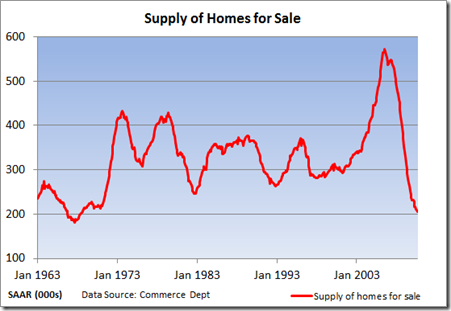

Japan saw its twin bubbles, stocks and real estate, burst in 1990, which was followed by feeble attempts by the Bank of Japan to revive the economy. Instead, huge government outlays were tried without much success.

Many, including myself, believe that the BoJ was too slow to act, and the Japanese economy eventually slid into a deflationary swamp.

Taking its cues from Japan, Ben Bernanke took a much harsher tone on the rate front. And when he ran out of bullets in his conventional arsenal, the Fed authorized purchases of government securities.

The big concern is that falling prices will further encourage consumers to put off purchases and weaken the recovery or send the economy into another recession.

And falling wages, which would likely ensue, would exacerbate tensions in the financial markets. Debt, however, does not shrink on its own, increasing the odds of more defaults.

So it’s easy to see why deflation is not the preferred outcome. Put more bluntly, it’s to be avoided.

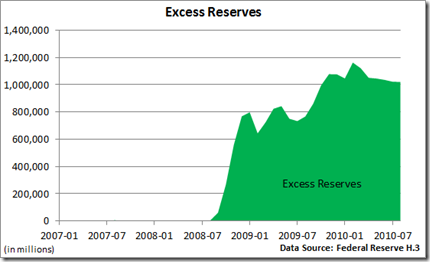

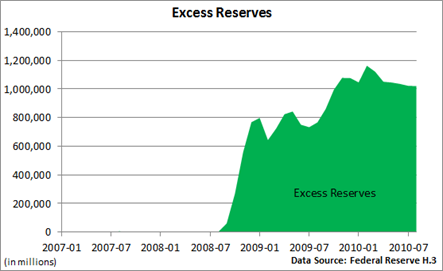

Let’s create lots of money

The Fed chief, who earned the nickname Helicopter Ben for his remark in a

2002 speech that “a money-financed tax cut is essentially equivalent to Milton Friedman's famous ‘helicopter drop’ of money,” appears ready to leave the landing pad with a pile of cash.

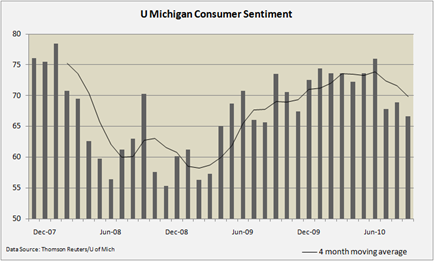

Some question whether such a strategy will truly boost growth amid lackluster consumer and business confidence and a skittish public that has shied away from borrowing, even at rock-bottom rates. There are risks to such a strategy, and it could mark the beginning phase of a new bubble, but the Fed appears determined to avoid a Japan-like outcome.