Fed Chief Ben Bernanke moves to the Senate today after testifying before a House Committee on Wednesday.

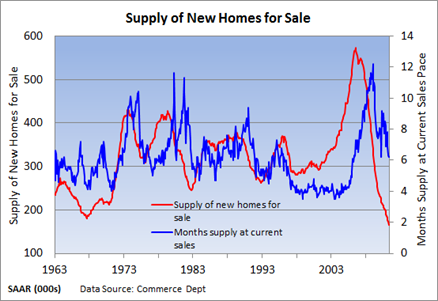

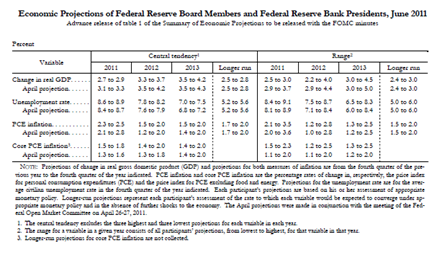

Much of the prepared remarks were generally anticipated: weaker-than-expected recovery is probably temporary, spike in inflation probably transitory and weakness in job market, consumer spending and housing were all mentioned.

And of course, recent Fed actions to support the economy were a part of his written testimony.

Bernanke had recently commented that another round of easing by the Fed is unlikely, implicitly suggesting that the hurdle for QE3 or some other type of unconventional easing is quite high.

But yesterday’s comments caught the market off guard, indicating that Bernanke has lowered the bar.

The Fed Chief reiterated that he expects economic activity will pick up during the second half of the year, as factors that have dampened growth subside.

Still, policymakers at the Fed are concerned that the recent weakness could persist, as Bernanke added that the outlook is unusually uncertain.

In his own words, he said, “The possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support.”

He went on to list three possible options that remain in the Fed’s arsenal.

- Provide more explicit guidance about the period over which the federal funds rate and the balance sheet would remain at their current levels.

- Initiate more securities purchases or increase the average maturity of its holdings.

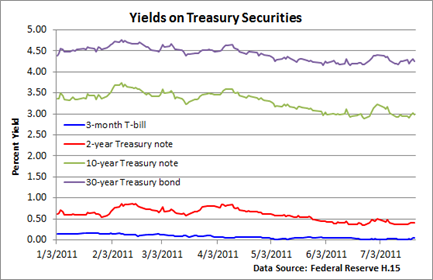

- And finally, the Fed could cut the rate it currently pays on bank reserves held at the Fed – 25 basis points – in the hope that it might put downward pressure on short-term rates more generally.

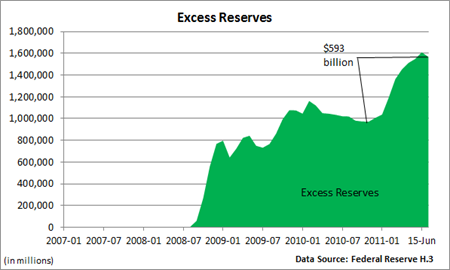

I might add that the Fed hopes a cut in reserve balances would encourage some banks to loosen lending standards and open up to businesses and consumers. With excess reserves at $1.6 trillion (see

QE2 and its economic impact – chart 2), there’s plenty of dry powder in bank vaults to fuel economic activity.

In reality, this shouldn’t have been as surprising as it first appeared since the

FOMC minutes out on Tuesday revealed the heightened level of uncertainty among Fed officials.

On the one hand, they offered up a detailed plan for an exit strategy, but some members noted, “The Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run.”

Bernanke was quick to admit that “experience with these policies remains relatively limited, and employing them would entail potential risks and costs.”

He’s right and one must ask, “Will such additional stimulus work, or are we in a liquidity trap where extra cash that’s injected into the economy does little to influence interest rates?"

Deflationary risks – extremely small

I disagree with Bernanke’s assertion that deflationary risks might re-emerge.

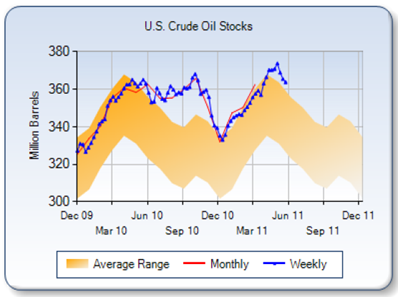

Oil prices are near $100 per barrel and raw materials in general, though off their highs, remain at a very elevated level. Inflation expectations, which cratered last summer, are more stable this time around, and we're still seeing solid growth coming out of China based on its latest GDP number.

Further, businesses are still grappling with higher input costs, and the uptick in core inflation bears this out.

Nonetheless, the Fed is keenly aware of the uptick in the unemployment rate and the considerable slowdown in job creation.

I had suspected it might take a month or two of weak job growth before the Fed publicly discussed the possibility of a third round of easy, but the troubling slowdown and resulting weakness in hiring has tipped the Fed’s hand.

If I had to take an educated stab at what will eventually happen, weak job creation through July and August seems to be the most obvious path. And that is going to be upper most on the Fed’s mind.

But the uptick in core inflation is troubling and further easing could quickly cause renewed speculation in commodities, putting additional pressure on core inflation.

Still, just telegraphing the possibility to the financial markets suggests at least a 50% chance of some type of shift in policy. Look for comments from regional Fed officials in the near term for clarity.