Nonfarm payrolls rose a disappointing 69k in May, less than half what was expected; June revised downward from 115k to 77k

The unemployment rate rose from 8.1% to 8.2%.

The internals of the nonfarm payrolls number were poor.

I’m hearing some chatter that this is still weather-related payback from a mild winter? So let’s look at some of the numbers.

· The service sector produced 218k in Feb, including 89k in professional and business services in Feb.

But in May those categories fell to 97k and -1k, respectively.

It’s hard to argue that a hiring manager in a high-rise looks out the window and checks the Weather Channel before making his/her hiring decision.

If there is a silver lining, the household survey that measures the unemployment rate showed a 422k rise in employment, but a 642k increase in the labor force produced the 0.1% increase in the unemployment rate. Pick up in June activity?

This is a volatile measure of employment and markets ignored it. DJIA futures went from -100 to -200 in the blink of an eye, and the 10-year Treasury fell from 1.53 to 1.48%.

The Fed –

This raises chatter of QE3, but the 10-yr is already near 1.5%!

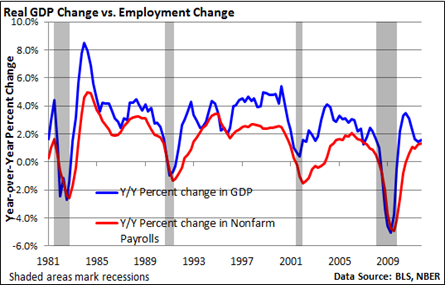

If the Fed wants to get rates down, Europe and economic worries are accomplishing this. However, the action in the bond market, coupled with weakness in employment and commodities is troubling. And low rates just aren’t jump-starting growth.

That a monetary policy that focuses on asset appreciation. Still, there’s only a tenuous link between higher stock prices and consumer action. And the blunt action of Fed bond buys could reignite commodity inflation.

But if the Fed moves ahead, purchases of mortgage-backed securities may be considered, as the 30-year fixed mortgage has badly lagged the drop in the 10-year Treasury.

One last point, action in commodities and the recent “collapse” in 10-year yields is worrisome. The bond market, which does a better job than the stock market in terms of future activity, is screaming the “R” word.

Bernanke’s testimony next Thursday now becomes an even bigger market event.