Sunday, March 24, 2013

Cyprus keeps it interesting

The European Central Bank has done a remarkable job of holding the financial system in Europe together, but what is truly needed is economic growth. Until the recession in Europe ends, its under-capitalized banking system will remain under considerable stress.

Still, muted market reaction in the U.S and in Europe - a lack of reaction in Spanish and Italian debt yields - is signaling a lack of anxiety over contagion.

Monday is the deadline for Cyprus to accept German/IMF terms. If Cyprus rejects, its banking system will collapse, and we will likely see some renewed volatility, as the market tests ECB President Draghi's pledge to do whatever it takes to preserve the euro.

If Cyprus cries "uncle" (it really doesn't have much choice and that is what markets are pricing in), we limp through the latest euro-zone debt crisis.

Monday, March 18, 2013

Cyprus hopes to trip up the bulls

Not surprisingly, we saw a run on ATM machines in the country, but no bank lines as the financial institutions were closed today and are expected to be closed until Thursday.

The uncertainty created by the situation on the tiny island in the eastern Mediterranean shook global markets amid concerns that we might evenutally see a repeat in larger countries like Spain or Italy. The last thing we want to see is Italian depositors lining up around the block, demanding their life savings.

Stocks in the U.S. opened lower but pared losses by the close. In a flight to safety, Treasuries jumped as trading began but came off highs as cooler heads prevailed. Even better, junk bond fund fully recovered from early losses. Want a canary in the cold mine? High-yield funds are the closest you'll get.

What we saw today was an attempt by U.S. markets to sort through the noise.

But let's take a step back. Cyprus is barely 0.25% of euro-zone GDP, and countries such as Greece, Italy, Spain, Portugal, and Ireland have failed to sink the euro.

I don't have a crystal ball, but it seems unlikely that a cataclysmic euro-zone event might originate with Cyprus. Volatility? Probably. Stocks never move in a straight line.

Bottom line - Europe's problems have subsided and the relative calm in the credit markets has been a boon to U.S. stocks - think the removal of a roadblock. As we saw today, euro-zone woes haven't been put to rest.

Wednesday, March 6, 2013

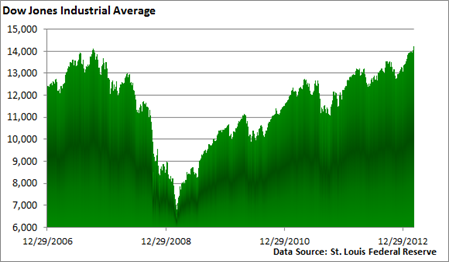

The Dow tops a psychological milestone

The bulls have been gunning for the Dow’s all-time high for several weeks, and on Tuesday, positive sentiment finally helped the oldest and best known of the major market averages close above a threshold that hadn’t been seen since Oct 2007.

Yes, it may be just a psychological barrier, but it’s one that gets plenty of attention. And today, in a rocky session, the Dow added another 42 points.

General themes that have been driving equities higher include:

· Slow but steady economic growth

· Profits are topping a low hurdle

· Quieter credit markets in Europe (more of a removal a roadblock)

· The search for yield

· A very accommodative Fed policy

· The renewed interest in LBOs and mergers

· A sense that China’s economy won’t stall

· Europe is expected to exit its recession later in the year

· The fiscal cliff was avoided at the beginning of the year.

Are there risks? You bet. Some include the possibility that European credit markets could flare-up again, China could experience a hard landing, or the U.S. recovery could stall.