Thursday, April 30, 2009

Consumers retreat, savings grow

The data show that despite signs spending may be stabilizing and consumer confidence is slowly improving, consumers remain uneasy and the economy is not yet on solid ground.

In the meantime, the rate of inflation held steady in March. The core Personal Consumption Expenditures Index, a broad measure of prices that is closely followed by the Fed, rose 0.2% for the third month in a row.

There has been plenty of chatter about deflation and the Fed reiterated yesterday that "inflation could persist for a time below rates that best foster economic growth and price stability." Nonetheless, the biggest two-quarter drop in GDP since 1957 has yet to bring the rate of price increases to dangerously low levels.

This may partly be occurring due to the residual impact of the steep rise in commodities and oil prices that occurred in much of the decade. Commodity prices have since tumbled but are off the lows amid indications that economic activity may be getting ready to stabilize, so the risk of deflation seems low in my opinion.

Wage growth, however, is nearly flat, and in some cases, is actually falling. And the smallest rise in Employment Cost Index on record in 1Q bears watching since it may hinder spending and raise the odds of inflation falling below the Fed's implied target of 1-2%.

Steep recessions and subsequent recoveries

Much has been made about the current recession and there are lingering worries that the banking crisis and debacle in housing will prevent anything other than a sluggish recovery.

Tight credit conditions and the desire by banks to forgo all but the safest loans have many analysts concerned, including myself. And yesterday’s disappointing Gross Domestic Product report (see: GDP tumbles in 1Q) only served to remind us of the difficulties that must be overcome.

But we have seen the resilient American economy shake off tough times before and bounce back vibrantly as the chart below indicates. Despite the challenges we face, a decent rebound is a possibility.

1957-58 Recession - GDP

| 4Q1957 | 1Q1958 | 2Q1958 | 3Q1958 | 4Q1958 | 1Q1959 |

| -4.2% | -10.4 | 2.4 | 9.6 | 9.5 | 7.9 |

1974-75 Recession - GDP

| 3Q1974 | 4Q1974 | 1Q1975 | 2Q1975 | 3Q1975 | 4Q1975 |

| -3.8% | -1.6 | -4.7 | 3.0 | 6.9 | 5.4 |

| 4Q1981 | 1Q1982 | 2Q1982 | 3Q1982 | 4Q1982 | 1Q1983 |

| -4.9% | -6.4 | 2.2 | -1.5 | 0.4 | 5.0 |

Current Recession - GDP

| 3Q2008 | 4Q2008 | 1Q2009 | 2Q2009 | 3Q2009 | 4Q2009 |

| -0.5% | -6.3 | -6.1* | ? | ? | ? |

*advance Data provided by BEA Note: the current recession began in late 2007 but the full brunt was not felt until late 2008

Many of us are aware of the steep recession that occurred in the 1970s, which was followed by the Fed-led contraction of the early 1980s when interest rates soared to double-digit levels. Each of these slumps was followed by solid recoveries, though the late 1970s were plagued by high inflation.

But to find a larger two-quarter drop in GDP, one has to go back to the late 1950s. There are differences this time around, but like today, manufacturing was hard hit and global growth came under pressure. Still, the economy came roaring back.

Wednesday, April 29, 2009

Fed infers worst may be past

The Federal Reserve's decision to unanimously vote to keep the fed funds rate in the range of 0 to 0.25% comes as no surprise given the magnitude of the recession. As always, policymakers released a more detailed statement regarding the economy and recent actions taken to support economic activity.

For the most part, the Federal Open Market Committee (FOMC), which is the arm of the Fed that decides monetary policy and interest rates, made just small adjustments in its commentary. Fed officials just barely bumped up the assessment on the economy, noting that "household spending has shown signs of stabilizing" and the "outlook has improved modestly since the March meeting."

But the Committee remains concerned that inflation could fall to undesirable levels, and it reiterated that it will "employ all available tools" to promote a recovery and preserve price stability.

One item traders were looking closely at was whether the Fed would alter last month's decision to buy up to $300 billion of Treasury securities. Those hoping for new purchases or any details were disappointed as the Fed stood by its prior decision, and Treasury prices reacted negatively.

The Federal Reserve has taken extraordinary measures to prevent the worst recession in over 50 years from becoming our first depression since the 1930s. Fed Chief Ben Bernanke is probably the foremost expert on the causes of the Great Depression, and so far, the Fed can claim success.

But an eventual economic recovery presents Bernanke with a new challenge: How to carefully remove excess stimulus and prevent a new round of inflation from materializing without creating new turmoil in the bond markets.

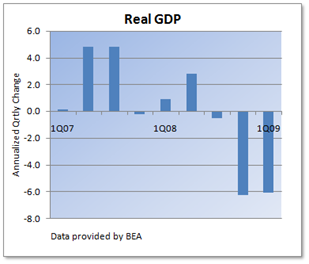

GDP contracts more than forecast

Those who expected the fallout from September's flare-up in the credit crisis to trip up the economy have something else to crow about today. The initial estimate for Gross Domestic Product , or advance GDP, fell at a larger-than-expected annualized rate of 6.1% in the first quarter, exceeding the consensus view of a nearly 5.0% drop.

The decline in the January-March period follows a 6.3% contraction in the final quarter of last year, which eclipses the worst two-quarter period of the 1982 recession as well as the 1974 contraction, which was caused by the oil embargo and spike in oil prices.

Personal consumption, which makes up close to 70% of the economy, managed to rebound by an annualized 2.2% rate following weakness in the second half of 2008, suggesting that the modest improvement in consumer confidence (Consumer mood brightens) is being reflected at the retail level. And that improvement is helping to support stocks.

But the culprit for the plunge in activity comes from a record 51.8% decline in investment spending, underscoring how much businesses have been slashing outlays in response to falling demand and tight credit.

In addition, a 30.0% decline in exports is more proof that the global economy has not been immune to the swift falloff in US economic activity. Clearly, this recession is shaping up as the worst in over 60 years.

One final thought. Most observers feel that the worst of this mess in the rear-view mirror - remember, the report is backward-looking. The improvement in personal consumption is an indication that a bottom is taking shape, and the early look at output for the world's largest economy will be revised during the next month when data is more complete.

Tuesday, April 28, 2009

Consumer mood brightens

The survey of 5,000 households showed that consumer confidence increased from 26.9 in March to 39.2 in April, with the Present Index rising modestly while the Expectations portion of the survey improved considerably. Despite rising unemployment and steady layoffs, the public is starting to feel better about job prospects. And if consumers start to feel more comfortable with their personal economic situation, they may be more inclined to spend, lending support to economic activity.

Wall Street liked what it saw in the numbers, helping shares erase early losses. Still, the index is hovering well south of the 100 mark, which was seen when the economy was expanding.

Meanwhile, tomorrow's first look at 1Q GDP and the conclusion of the Fed's two-day meeting will come into focus. Gross Domestic Product is the broadest measure of economic activity and encompasses the value of all goods and services produced. Most economists see another steep drop of about 5% on an annualized basis, but recent data suggest we will see some improvement from here.

The Fed's press release and interest rate decision out in the middle of the day tomorrow is always closely followed by analysts and traders. Policymakers will likely keep the fed funds rate at rock-bottom levels so their take on the economy and a read on the many unconventional measures taken so far to support economic activity will be highly sought after.

Monday, April 27, 2009

Swine Flu Fears Met with Yawns

Confidence is the cornerstone that keeps our capital markets afloat, helping us maintain a vibrant financial system even as banks hemorrhage red ink and stock prices wither from the heat of the recession.

One only has to look as far as last September when the failure of Lehman Brothers caused a very small number of money market funds to post losses, which rattled confidence and nearly caused a full-blown panic to develop.

Today’s modest pullback in stocks following this weekend’s heavy coverage of the swine flu suggests that, at least for now, the possibility of a pandemic seems remote and noticeable damage to the economy is unlikely. Now I’m the first to realize that sentiment can get out of whack. Many of us are still smarting from the rampant pessimism that bogged the Street down in March and took the Dow Jones Industrials below the 6,600 mark.

The markets may not have a perfect track record when it comes to divining future events, but at this juncture, the collective wisdom of all investors - both novice and seasoned - signals that the latest worries will eventually fade. Stay tuned.

The IMF Weighs In

Prior to the failure of Lehman Brothers, many on the continent felt their banks could withstand the financial shocks emanating from the US, and leaders were caught flat-footed when the American tidal wave came ashore.

The always-inflation-vigilant European Central Bank (ECB) actually raised interest rates last summer and has reacted too tepidly as its benchmark rate still stands above 1%. Compare this to rates in the US, Japan, Canada and England, which all sit well below 1%.

In the press release that followed a small rate cut in April, the ECB said it sees "the risks to the outlook for economic activity as being broadly balanced." Another words, central bankers don't see a need to aggressively turn to monetary policy to stimulate demand, and they appear to be in a state of denial regarding the severity of the recession.

The major banks in Japan have not been hit nearly has hard by the subprime debacle and securitization as its counterparts in Europe and the US. But it has its own set of problems to deal with. Japan is heavily reliant on exports, and the strong yen, which raises the price of sales overseas, coupled with falling demand in the US, Europe, and weakness in China, are taking a heavy toll on output.

Saturday, April 25, 2009

G7 Nations See Eventual Recovery

The G7 nations consist of the United States, Canada, Britain, France, Germany, Italy and Japan. The group typically meets about every couple of months to discuss and tackle the major economic issues of the day and how they can present a unified front to the financial markets.

In past years, the weak dollar and trade imbalances were typically addressed. But today's economic crisis is the worst in decades, providing the backdrop for the latest meeting.

The leaders of the countries are fully aware that a steady economic recovery will have trouble taking hold until the major banks rid themselves of problem loans and securities that have bogged down efforts to jump-start lending. Cleaning up these messy balance sheets is truly a complex, time-consuming, and costly undertaking.

In my view, they stated the obvious. But can you really fault seven powerful nations, each with their own self-interests, on their inability to agree on detailed actions to right the problems in the global economy?

Past communiques have been usually been broad in scope but have lacked concrete proposals. And not wanting to offending any particular country has usually resulted in watered-down statements. At least the money chiefs promised to keep cooperating.

Friday, April 24, 2009

A Bottoming Process

There is still plenty of inventory to choose from and job worries abound, which will likely keep pressure on prices. But recent trends show that home sales seem to be stabilizing amid sizable discounts and record low mortgage rates.

Next, let's look at durable goods orders. Defined as manufactured goods designed to last more than three years, this is another important indicator that is used when trying to determine the health of the economy. The chart provided below by the Census Bureau underscores how badly goods-producers in the US have suffered following the blow-up in the financial markets last September.

Recent signs, however, suggest that orders are attempting to stabilize, and March's smaller-than-expected 0.8% decline is also raising hopes that a bottom is forming. In addition, non-defense capital goods that exclude aircraft posted a respectable gain for the second month in a row.

Why is this subset of the data important? Because these orders are a good proxy for business spending, and emerging indications that companies may be starting to loosen up on their purse strings provide us with another sign that the economic slump is starting to abate. One caveat, durable goods orders can be very volatile so I'll want to see this trend confirmed over the next couple of months.

Thursday, April 23, 2009

The Sweet Taste of Apple

These fun little devices that allow users to take pictures, listen to music, search the Internet, and make phone calls show how a creative manufacturer of discretionary items - goods that consumers want but don't need at any given moment - can survive and even thrive a steep downturn. Better-than-expected iPod sales also aided results.

Jobless Claims Disappoint

First-time filers rose by 27,000 to 640,000 in the week of April 18, just topping expectations and signaling that many firms remain uncomfortable with the environment. Last week, I mentioned that this report is one of my favorite indicators when it comes to gauging the temperature of the economy because it is current and provides a look at how business executives and owners feel about near-term prospects.

Falling claims suggest that companies are feeling more optimistic about conditions and want to hold onto their workers, while rising claims would signal the opposite. Looking at the trend over the last six to eight weeks, filings appear to have stabilized at a high level.

One final look at another piece of the report - continuing claims rose by almost 100,000 to a record 6.1 million, highlighting the difficulty that laid-off workers are having finding employment.

Wednesday, April 22, 2009

Crude Bubbles Up

But today's global environment is a far cry from what we saw 12-18 months ago, and demand for the key commodity that keeps the world's economic engine from breaking down has withered and US supplies have surged. And this week is no exception as inventories jumped almost 4 million barrels to the highest level in nearly 20 years.

Source: EIA - This Week in Petroleum

What's bad for producers has been good for consumers. We are awash in oil, and prices have plunged from a high of over $145 per barrel last year to under $50 per barrel today. OPEC has tried to keep up by reducing output, but sliding demand has been more than enough to offset cutbacks.

Plus, diminishing demand for gasoline has caused refineries to slash output, which has also accounted for the rise in raw supplies, and for now, has helped to put a floor under gasoline prices - note that the price at the pump has crept off December's low.

Source: EIA - This Week in Petroleum

One last point, crude prices have rallied modestly on hopes that the global contraction is nearing an end. Still, all of the oil that is sloshing around the US and the world could become an overhang on prices if economic data keep telegraphing further weakness.

Tuesday, April 21, 2009

Caterpillar Crawls

When the economy is strong and businesses are expanding, Caterpillar cranks out giant earth-movers used in the construction of new buildings, housing developments, highways, and mines. But we are in a steep global recession and many companies are cutting back, so the need for the company's products has waned.

As a result, what CAT says provides us with clues to what we may see looking about six to nine months down the road. Unfortunately, there is not that much to be excited about.

Today the company cut its full-year revenue forecast, citing a weaker economic outlook and a high degree of economic uncertainty in the global economy. It added that it expects total global demand to decline about 1.3% in 2009 and remain in a recession for most of the year, making this the "worst year of global growth in the postwar period." Yikes!

If you are wondering about all the government stimulus plans set to take effect around the world, CAT pointed out that the timing and impact of all these measures make it difficult to forecast sales. Another words, when will the spending hit and what will governments buy?

One thing we have seen is a rebound in the price of copper - a key industrial metal. Many have credited stimulus spending out of China and some look to speculators who have been stepping back into the metal because they believe the worst of the global contraction is in the rear view mirror. But recent uncertainty in US data has put a lid on the copper rally for now.

Monday, April 20, 2009

Stocks Hit the Skids

Financial shares have been big winners in recent weeks, but they received a beating today, kicking the legs out of the rest of the market. The Dow Jones Industrials fell about 3.5% and the broader market lost around 4%, thanks in large part to sobering comments from Bank of America about its credit quality. Returning storm clouds and a stronger dollar also depressed oil prices, which approached $46 per barrel.

I'll do my best to stay away from dissecting each wiggle in shares, and I wanted to point out that we've seen a big run-up since the March lows. Consequently, a setback or two is not to be unexpected. But attempting to call short-term movements in stock prices is fraught with peril, and I plan to leave my crystal ball in the back of my closet.

Sunday, April 19, 2009

A Sneak Peek at the Week

New home sales are out on Friday and a tiny decline is forecast for March following a decent rebound in February. The jump we're seeing in foreclosures is providing a rare opportunity for buyers to snag great deals and finance them at record low rates. The combination is providing some much-needed support for the residential real estate market, but supply is plentiful and pricing power among sellers in most markets is unlikely to return anytime soon.

Friday, April 17, 2009

Consumers See Some Light

They say it's darkest before dawn, and the unemployment rate has been rocketing higher and many of us feel uncertain about our jobs. The economy still faces many hurdles, including banks that are bogged down by bad loans, out-sized risk premiums in the money markets (LIBOR rates are still too high), and headlines continue to chronicle the major layoffs in the US and abroad.

But the latest reading from the University of Michigan's survey on consumer sentiment shows that some of us are starting to see the first signs of dawn in what has been a dark recession.

Consumer sentiment rose a larger-than-forecast 4.6 points in April to 61.9, it's highest reading in over six months. Why is this important? Because consumer spending accounts for over two-thirds of economic output. And if consumers are starting to feel better and perceive the economy may be approaching a bottom, it's more likely they will contemplate making discretionary purchases that can stabilize economic activity. When that starts to happen, corporate cutbacks will likely abate, production cuts should dissipate, and the business cycles will begin anew.

Reasons for this budding optimism include mortgage rates that are near or at historic lows, monetary stimulus that continues unabated, bargains designed to attract cautious buyers (who doesn't like a good deal!), and with all of its detractors, the government is set to pump hundreds of billions of dollars into the economy.

Before we get carried away with rampant optimism, the level of confidence remains mired in a range we have seen for much of the recession, but at least the trend is in the right direction. Interestingly, with all of the deflation talk that's been in the air, inflation expectations rose, likely owing to gasoline prices that are now hovering near $2 per gallon.

Thursday, April 16, 2009

Creaky Foundation

A large drop in multi-family housing paved the way for a greater-than-expected 10.8% decline in new home construction last month, while future-looking building permits hit a new low. There are just too many houses still left on the market that are commanding the attention of bargain hunters and those hoping for a steal among the many foreclosures that dot the landscape, diverting attention away from new home builders. If there is a silver lining in the report, and it takes a bit of searching to find one, single-family home starts have been little changed recently, suggesting the new home market is trying to establish a bottom.

Is there anything to smile about?

We did get some relatively good news on the manufacturing front this morning and weekly initial jobless claims fell 53,000 to 610,000, lower than expected. First, let's look at the Philly Fed's take on the environment in the mid-Atlantic region. The survey showed that conditions continue to worsen, albeit at a slower pace, as the closely-followed index rose from -35.0 in March to -24.4 in April. A reading below zero indicates the sector is contracting.

The pricing components show no signs manufacturers have any pricing power, indicating considerable strains remain and core inflation (prices minus food and energy) will probably ease in the coming months. But the data compiled may be starting to signal that the heavy rains pounding the economy are starting to lessen, echoing some of the sentiment from yesterday's Beige Book from the Fed. And the gauge of expectations going out six months rose to the highest level since late 2007! The economy may yet find its way out of the woods.

Wrapping up a busy day, I wanted to briefly touch on the decline in jobless claims. This is one of my favorite indicators of economic activity because it is released weekly, is much more current than most reports, and is a reflection of confidence or lack thereof among businesses.

The drop in weekly claims is welcome and further declines would obviously be gratifiying. It is important to point out, however, that the survey was taken over a holiday period. Though the Labor Department attempts to adjust for seasonal factors, they are usually less than successful accounting for such events. Unfortunately, the decline has to be taken with just a few grains of salt, at least for this week.

It's a Gas Gas Gas

Natural gas supplies are more than adequate as we wind up the winter heating season. Weather plays a key role in the demand for the odorless and colorless commodity used to warm our homes because production is fairly predictable given that few supplies are shipped in from overseas.

Taking a look below, you can see that producers pump gas into storage during the warmer summer months and utilities draw down these stockpiles in the winter when the weather turns colder. Abnormally hot summer temperatures can slow the buildup of supplies because some utilities require natural gas to produce electricity.

However, the Energy Information Administration reports that rig count has dropped in half since September and that should eventually cut into natural gas production. Gas production is up through January, versus a year ago, but uncertainty continues to characterize the market, the EIA said, as both the duration of the falloff in industrial demand and the timing and magnitude of the expected decline in production remain unknown.

Wednesday, April 15, 2009

Bad News Piles Up

Fed Chairman Ben Bernanke said yesterday there are "tentative signs" that the sharp decline in economic activity may be slowing, but the latest numbers coming from the nation's factories clearly show we are not out of the woods yet. Industrial production tumbled 1.5% in March, mirroring February's sharp decline and bringing the annualized drop in 1Q to a stunning 20%.

Industrial production is down almost 13% versus a year ago, barely eclipsing the slide that took place in the severe recession of 1974. Factories, like many companies across the country, have been quickly shedding jobs in response to poor economic conditions, and the decline in output highlights the speed at which the economy has been contracting.

Capacity utilization, which is tied to the release of industrial production, also underscores how bad conditions are in the manufacturing sector. Capacity utilization fell from 70.3% in February to 69.3% in March, about double the expected decline, leaving the country with the most slack in its industrial base since the series was first calculated back in 1967. And that could lead to even more plant closures and the shuttering of assembly lines in the near term.

Pricing data mixed

A decline in energy prices last month led to a 0.1% drop in the Consumer Price Index, but the core rate of inflation, which excludes the more volatile food and energy groups, marched ahead at a modest rate of 0.2% for the third straight month. A 0.1% rise was forecast. Compared to a year ago, the core rate of inflation is up 1.8% and has been holding in that range since the end of last year.

The worsening recession and the slack in the economy do suggest that we may eventually see inflation decline to near the low end of the Fed's implied target of 1-2%, especially as last year's drop in commodities and flat labor costs work their way through the pipeline. And policymakers have openly fretted inflation could persist for a time below rates that best foster economic growth and price stability. However, unless the already steep recession gets much worse, I still believe concerns that outright deflation is set to spread through the economy are probably overblown - see PPI post below.

Tuesday, April 14, 2009

Glimmer of Hope Dims

Sales had been trying to stabilize recently as the sizable drop in gasoline prices from last year has put extra dollars into the economy, while bargains offered by many retailers have helped to lure reluctant shoppers. But steep job losses in recent months and general insecurities among consumers sent retail sales down in March by a surprising 1.1%, compared to expectations of a small gain. Losses last month were broad-based and come despite tax refunds that are being sent out, with nearly every category except for staple items showing declines.

The US government has passed a huge stimulus plan and the Federal Reserve has flooded the system with massive amounts of liquidity to prop up the faltering economy. Fed Chief Ben Bernanke did say in prepared remarks today that there are "tentative signs" that the sharp decline in economic activity may be slowing. Thus far, however, concrete signs of economic stability remain elusive. Over the past 12 months, sales are down a whopping 10.7%, highlighting the obstacles to a recovery at this time as well as the anxiety that many stores are having to deal with.

Tumbling wholesale prices

An unexpected drop of 1.2% in the Producer Price Index in March - an unchanged reading had generally been expected - more than offset recent gains and is once again raising the specter that the economy may be facing a debilitating bout with deflation. Year-over-year, prices are down 3.5% at the wholesale level, the biggest drop in more than 50 years. Pull out food and energy and prices were unchanged. Year-over-year, however, the core PPI is up 3.8% and has been receding at a much slower pace.

The Fed has cut interest rates to near zero and has been taking unprecedented action to stabilize the economy and preempt a general decline in the price level. This, coupled with massive new spending goals by the government, has prompted some to worry that inflation stands ready to rear its ugly head. In the short term, I believe this is premature.

There is excess capacity in the US and around the world, demand continues to shrink in the world's largest economy, and businesses have been handing out very small raises, assuming you were lucky enough to receive one. Add that businesses have been stuck with unwanted stockpiles and you have just the recipe needed for price stability.

But what about deflation? Prices continue to fall at the early stages of production and the economy has yet to stabilize in the US; however, we are seeing some signs that the huge drop in commodity prices that occurred at the end of last year may have run its course - prices have actually edged off lows (thank signs that China is stabilizing, though the upside is probably limited given the weakness in the world's major economies, but that's a story for another time). Gold prices remain at elevated levels - due in part to worries about the financial system, and gasoline and oil prices have come off their respective bottoms. Plus, the Fed is doing almost everything in its power to flood the system with money and prevent deflation from getting embedded in the economy.

Monday, April 13, 2009

Upcoming Inflation and Retail Figures

What's interesting is that the core rate is still up a surprising 4.0% even though the economy has been quickly contracting and prices at the early stages of production have tumbled. Still, I would suspect that the "stickiness" in core prices will eventually abate since the economy remains sluggish and employers have been very stingy handing out raises - assuming you were lucky enough to receive an annual increase.

Following a small dip in January, retail sales rebounded in February and are expected to grow modestly in March when the data hits early tomorrow. Many stores have found it necessary to offer discounts in order to attract shell-shocked consumers since the awful economy has taken a big bite out of payrolls and scared the daylights out of many. But gasoline prices are still well off the highs of last year - putting extra dollars in the pockets of consumers, and some may be choosing to put their tax refunds to work at their local retailer rather than paying down debt or stashing away the cash in a savings account.