Monday, August 31, 2009

RBA turns more optimistic

The Board said the present accommodative setting of monetary policy remains "appropriate for the time being," but its increasingly optimistic tone suggests it may be setting the stage for a rate hike later in the year, in my view.

However, there was nothing explicit in its language that indicated a tightening is imminent.

China manufacturing accelerates

China's economy has grown dramatically in recent months as well-directed stimulus money has bolstered growth and offset weak exports. Strong lending growth from the banks has also buttressed the expansion, but concerns that the government may restrict lending to prevent new bubbles from developing spooked the market yesterday and sent commodity prices spiraling lower today.

Although the world economy does appear to be poised for a rebound, and copper prices, which have historically been a precursor to economic activity, are well off the lows, a key measure of world activity, the Baltic Dry Index, has shown signs of weakness lately. And I will take a look at the pricing measure shortly.

Sunday, August 30, 2009

Good news from Japan, but will it last

The government in Japan reported that preliminary data showed that industrial production rose 1.4% in July, the fifth-straight monthly increase, while the Nomura/JMMA Manufacturing PMI increased from 50.4 in July in 53.6 in August, the best in over two years and the second-consecutive reading above 50 . A reading of 50 suggests the sector is neither expanding nor contracting.

Production remains sharply lower versus one year ago, but the level on the PMI indicates that manufacturing is expected to continue to expand as companies replenish depleted stockpiles.

However, when inventories rise to more normal levels, the expansion in Japan may flounder unless demand in China remains strong and the US consumer exits hibernation.

Friday, August 28, 2009

Consumer sentiment rises in late August

Turns out consumer sentiment did not fall quite as much in August as numbers released today revealed an upward revision to the preliminary data.

The Reuters/University of Michigan consumer sentiment survey increased from the initial reading of 63.2 to 65.7 in the final August reading. Still, that was down slightly from July’s final number of 66.0 and the lowest in four months.

Worries next year

Issues that may impact the economy next year gave the director of the survey reason for concern.

“The problem looming on the horizon is that after the inventory correction and the exhaustion of the stimulus, consumer demand will not be strong enough to maintain a robust pace of economic growth after mid 2010,” he said.

Though we saw an upward revision from early August, consumers reported “the worst assessments of their personal finances since the surveys began in 1946.”

Much can happen between now and next summer, and an improving economy seems likely to be come a self-perpetuating cycle, which would remove some of the doubts about the sustainability of any expansion past mid-2010.

However, consumers racked up plenty of debt this decade and are more focused on savings and repairing damaged balance sheets. And that may turn into a strong headwind and prevent a more robust recovery, which is typical following a steep recession.

Thursday, August 27, 2009

GDP maintains losing streak but 3Q should be brighter

The government left its estimate of a 1.0% annualized decline in Gross Domestic Product (GDP) unchanged this morning when it released its preliminary estimate (2nd release) of the largest measure of economic output.

Consumption, which makes up 70% of GDP, weakened after an upward blip in 1Q, and spending by businesses continued in a downward trend, though weakness eased, while inventory liquidations lopped off 1.4 percentage points from the headline number.

But uncertainty in the private sector was balanced by a jump in government spending and an improvement in the trade picture.

The second quarter, however, ended 7 weeks ago and it’s time to look ahead.

We are likely to see an end to the four-quarter losing streak that extends back to the 1940s when quarterly records were first kept.

A pick up in housing starts may snap what has been 14 straight declines in residential investment, and the massive liquidation of inventories, which has hurt GDP, may finally come to an end as manufacturers have begun to re-open idle production lines.

The Achilles heel of the economy remains consumer spending. Banks are not in the mood to take any major risks, and debt-burdened consumers are still worried about jobs, which may hamper expected gains in 3Q.

Natural gas inventories bubble to the brim

Falling industrial demand, coupled with a mild summer in much of the nation, have pushed natural gas inventories to 18% above the five-year average for this time of year, according to the Energy Information Administration.

Working Gas in Underground Storage Compared with 5-Year Range

Source: EIA

And with excess gas in storage, the drop in prices to lows not seen since early in the decade or predictable. If the trend continues, it should cost much less this year to heat many of the nation’s homes that are reliant on the odorless/colorless commodity.

Details available at Examiner.

Weekly jobless claims refuse to cooperate

Weekly initial jobless claims fell 10,000 in the latest week to 570,000 but remain unacceptably high as companies continue to trim their workforces. Claims are slowly headed in the right direction but progress has been painfully slow.

Continuing claims fell 119,000 to 6.13 million, but it seems more likely that the standard six months of benefits have run out for those who filed early in the year rather than the unemployed finding gainful employment.

The stubbornly high rate of initial claims is all the more frustrating because economic activity has begun to pick up, yet companies continue to trim payrolls. That is likely a sign that the recovery will be gradual or U-shaped (see L, W, U, V - The alphabet soup of economic recoveries).

Wednesday, August 26, 2009

IFO in Germany in upward trend

Germany’s export-dependent economy continues to benefit from a solid acceleration in economic activity in Asia. The IFO Business Climate Index improved for the fifth-consecutive month, rising from 87.4 in July to 90.5 in August.

Europe’s largest economy was hit extremely hard by the recession, but GDP unexpectedly improved in 2Q amid gains overseas. Headwinds remain, including problems in the banking industry, but conditions appear to be stabilizing as business confidence improves.

Based on the graph below, manufacturing appears to be entering an upswing. Still, without a solid recovery in the US, prospects for the economy will likely be limited.

Durable goods orders surge

Led by a huge jump in transportation/aircraft orders, orders for durable goods jumped 4.9% in July, almost double the forecast. Excluding the jump in transportation, orders were still up a solid 0.8%.

Orders are now up in three of the past four months, signaling that production for goods designed to last at least three years is headed higher. The only soft spot in the volatile report was a small decline in nondefense capital goods ex-aircraft, which is viewed as a proxy for capital spending. Orders in the prior two months, however, were up sharply.

Tuesday, August 25, 2009

Elements for housing recovery in place

Yes, there are still plenty of foreclosures and inventories remain elevated, but potential buyers are feeling increasingly confident that now is the time to purchase homes. With a recovery in economic activity apparently in place, mortgage rates may not stay low for too long. Hence, now may be the time to buy.

See Case-Shiller, FHFA report rise in home prices.

Friday, August 21, 2009

Housing in recovery mode

In the clearest sign yet that the housing market is on the road to recovery, existing home sales jumped an impressive 7.2% in July to a seasonally adjusted annual rate of 5.24 million units, well above the Bloomberg estimate of 5.0 million.

July's advance brings the streak of increases to four months in a row (the first time in 5 years), and according to the National Association of Realtors, the monthly rise was the largest in 23 years.

The chief economist for the NAR said, "The housing has turned decisively for the better." And I agree. Existing home sales are well off the bottom and are being aided by the first time home buyers tax credit, historically low interest rates, while the drop in prices over the last couple of years is finally encouraging reluctant buyers to step into the ring.

The number of homes on the market did increase last month, possibly as sellers decide to test the waters, but the rise in sales kept the supply at 9.4 months.

Thursday, August 20, 2009

ECB's Weber warns against withdrawing rate cuts too quickly

Axel Weber, Germany’s Bundesbank president, said, "The recovery we are now seeing is based largely on public sector support measures – the loose monetary policy, help for the banking sector and the stimulus package."

Weber went on to say that it's too early to start pulling back on the stimulative monetary policy because "the economy is not yet standing on its own feet, and the financial markets are still reliant on central bank help.”

That's good news for a central bank that has been traditionally very hawkish and almost completely focused on inflation.

A disappointing rise in jobless claims

Weekly jobless claims increased 15,000 in the latest week to 576,000, and the four-week moving average rose 4,250 to 570,000. Continuing claims were nearly unchanged at 6.24 million.

Most of the economic data has been fairly positive of late. But the uptick in weekly claims, along with the still-high level, suggests not only another disconcerting employment number for August, but it implies the recovery that has probably begun will be very gradual. See L, W, U, V – the alphabet soup of economic recoveries.

And if history is any guide, gradual economic recoveries produce jobless recoveries.

For additional information, please see, Economy 101: What are weekly jobless claims?

Wednesday, August 19, 2009

Purchase Index perks up

The Purchase Index from the US Mortgage Bankers Association has been lagging behind much of the housing data that has been out recently. But today’s release of the weekly report shows that a 3.9% rise may finally be reflecting a long awaited pick up in mortgage applications.

The US MBA did not provide the exact level, but based on recent data, that puts the index at 277.4.

The look at housing provided by the US MBA has been volatile, but the trend is slowly to the upside.

Tuesday, August 18, 2009

Germany’s ZEW rises to best level in three years

The ZEW Indicator of economic sentiment in Germany jumped 16.6 points to 56.1 points in August, the best reading in over three years and well above the historical average of 26.5 points.

The institute that compiles the respected survey of analysts noted, “A repeated rise of incoming orders and increasing exports have brightened the economic perspectives for Germany in the next months.

In line with the increase of the overall economic expectations for Germany the expectations for all surveyed sectors of the German economy and for the export-oriented sectors particularly, have noticeably improved.”

Germany did post an unexpected gain in 2Q GDP, and prospects for the global economy, especially Asia, have improved.

A recovery does appear to be taking hold in Europe’s largest economy. But in my view, the survey is reflecting runaway optimism in an environment that should reflect a more cautiously optimistic tone.

Producer Prices take a tumble

The core rate, which takes out the volatile food and energy categories, was also lower, testifying to the lack of pricing power in today's tough business environment. Economists had seen a 0.3% decline and a 0.1% increase, respectively.

Prices also eased in the pipeline, with both intermediate and crude goods losing ground. For now, there is little concern that inflation will heat up amid intense competition for consumers and excess capacity throughout the US and global economies.

Commodity prices have jumped recently, but productivity is rising. And wages, which are the biggest cost for most businesses, are stable. Therefore, it seems likely that the disinflationary trend we are witnessing will probably continue for most of 2009.

Year-over-year, wholesale inflation is down 6.4%, thanks mostly to falling oil prices. The core rate continues to recede and is up 2.6% y/y, compared to 3.4% in June.

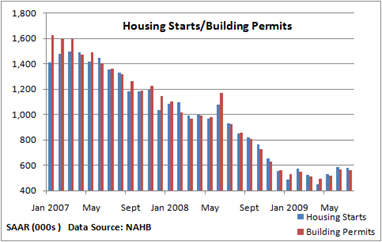

Weakness in multifamily pulls on housing starts

Blame a 1% drop in housing starts in July on a big decline in the volatile multifamily category. Single-family homes remained in an upward trend, rising 1.7%

Building permits, which provide a peek at future activity, were also down a modest 1.8%, but single-family permits were up a solid 5.8% as the outlook for the industry continues to brighten.

One potential cloud on the horizon: the expiration of the $8,000 tax credit on November 30 for first-time home buyers.

Details at Examiner.com.

Monday, August 17, 2009

Housing Market Index reaches 14-month high

The index remains at depressed levels, as a reading of 50 would suggest builders are neither optimistic or pessimistic, but the upward march off the all-time January low of 8 is suggesting a recovery is finally in place.

The NAHB's chief economist was quick to pounce on the improving outlook, noting that "one very positive aspect of today’s report is the big gain registered in the component gauging home builders’ expectations for the next six months."

But the NAHB is not taken any chances and continues to lobby for an extension of the $8,000 first-time home buyer tax credit.

Stocks ignore upbeat Empire survey

Yes, the Empire Manufacturing Index looks at just a sliver of the goods-producing sector in the US, but the increase from –0.6 in July to 12.1 in August signals that the battered group is expanding again. Economists per Bloomberg had forecast a reading of 5.0.

The index stands at the highest since November 2007 and is well above zero, which is the line between expansion and contraction.

Moreover, the future general business conditions index advanced 14 points to 48.2.

Stocks, however, ignored the upbeat number and took a tumble as selling inspired from Friday’s lackluster consumer sentiment survey carried over to the new week.

Sentiment in the market can change quickly as we saw in late June and early July. But the mood quickly turned positive as 2Q earnings season blew out much of the gloom that had been hanging over the market.

Conditions, however, were ripe for a correction, and in my view, that is what we are seeing right now.

Sunday, August 16, 2009

Japan GDP rebounds

Japan's rise comes amid and improvement in manufacturing and follows an unexpected rise in GDP from Germany and France, the largest economies in the eurozone.

Growth in both Germany and Japan had fallen sharply at the end of 2008 and the start of 2009 because of the countries heavy dependence on exports, but the global economy has begun to stabilize, and we will probably see an upturn in the US during the current quarter.

Friday, August 14, 2009

When will inflation bottom?

Today’s release of the Consumer Price Index and falling rates of inflation begs the question, “When will prices begin to rebound?”

Year-over-year, the headline rate of inflation is down 2%, the largest decline since 1949, as oil prices are down sharply from one year ago.

The core rate of inflation, which removes food and energy, are up 1.5% versus one year ago and are in a downward trend.

Therefore, it behooves us to look at past cycles in order to gain some insight into what we may see this time around.

The charts below were provided by the Bureau of Labor Statistics and look at year-over-year headline inflation from the two prior economic cycles.

Although the 1990 recession ended late that year, the CPI entered a long-term downward trend amid stable commodity prices, rising rates of productivity, and globalization, which helped open new manufacturing facilities around the world.

Productivity continued to exhibit gains in the early part of the decade, and inflation headed lower even as the economy slowly rebounded beginning in late 2001. But crude oil and commodity prices began a long march upward, which was something we hadn’t seen in over 20 years.

As a result inflation bottomed earlier in the economic cycle.

Looking ahead, we could see falling rates of core inflation well into 2010, if prior trends hold up. Worries about higher prices from the huge amounts of fiscal and monetary stimulus may not become a concern until 2011 or 2012, in my view.

Consumer sentiment falters

Preliminary data showed that consumer sentiment fell for the second-straight month.

Though housing appears to be on the rebound, stock prices are rising, and job losses are easing, consumers remain skittish, which explains the lack of traction we are seeing in retail sales and spending.

The reaction in the market and details are available in my article, Consumer sentiment comes under pressure, stocks react poorly.

Thursday, August 13, 2009

GDP in Germany, France expands

Unlike the US, where the quarterly changed is annualized, GDP in Europe is reported by the percentage changed versus the previous quarter.

As a result of the unexpected strength in France and Germany, eurozone GDP fell by just 0.1%, signaling the worst in Europe is over.

Germany is especially dependent on exports, and recent gains in manufacturing and growth in emerging markets are helping to offset headwinds from weak consumer spending and rising unemployment.

Retail sales barely tread water

Retail sales are off the bottom, but a flat economy is still taking a toll on the nation’s retailers.

A stimulus package focused more on tax cuts and tax incentives might end up in a savings account, but it would also provide consumers with extra cash to spend.

Business inventories on steep descent

Destocking continues at uninterrupted pace

Business inventories extended their streak to ten consecutive monthly declines as manufacturers continue to rid themselves of excess stockpiles left over from late last year when demand around the world fell dramatically.

Inventories dropped 1.1% in June, while sales increased 0.9%, pulling down the inventories-to-sales ratio, which measures how many months it would take to liquidate all goods on hand, from 1.41 to 1.38.

Leading indicators of manufacturing are showing signs of stabilization and new orders have recently moved into positive territory.

Based on sales, inventories are already back to where they were after the end of the 2001 recession (see chart provided by Commerce Dept), and it seems likely that manufacturers will soon begin to re-open idle production lines.

Industrial production on tap

Tomorrow’s release of industrial production for July is expected to show the first rise in industrial production in nine months.

Because weather across much of the country was unseasonably cool last month, utility production may weigh on the headline figure so a look at manufacturing production, versus industrial production, may provide a more reliable feel at what’s happening among goods-producers.

Import prices take a breather

Import prices dived in the latest month, falling 0.7% in July after having risen in four of the last five months. A 2.8% decline in oil prices helped put the lid on import prices. Year-over-year, prices are down 19.3%.

Still, even without the help from a drop in petroleum, prices were down 0.2%, the first drop since April. Ex-petroleum, prices are off 7.3% from one year ago, underscoring the toll of the global recession on imported inflation.

But the dollar has been slipping lately and the global economy is showing signs of life, and that may put a soft floor under further declines.

With the exception of China and some emerging markets, economies are still weak and there is plenty of excess capacity out there. Despite the huge amounts of monetary and fiscal stimulus still in the pipeline, a new round of import-driven inflation seems unlikely in the short term.

A quick look at prices from major trading partners

Canada -1.0%

Europe 0.2%

Japan 0.1%

China -0.2%

Continuing claims fall

Weekly jobless claims disappoint

Weekly initial jobless claims edged up 4,000 to 558,000 and the four-week moving average increased by 8,500 to 565,000. Jobless claims have been heading in the right direction, but progress has been painfully slow.

Continuing claims fell 141,000 to 6.2 million, and that’s good news, but it’s unclear if the steep drop occurred as more people found jobs are six months of standard benefits ran out.

I believe the economy has bottomed and a slow recovery has begun, but the labor market is lagging behind and weekly claims remain unacceptably high.

Purchase Index lags

The Purchase Index from the US Mortgage Bankers Association increased just 1.1% in the latest week. The organization did not provide a specific level but based on recent gains, that puts the Purchase Index at 267.0.

Mortgage applications are off the March low but based on data we are receiving from the US MBA, housing appears to be dragging along the bottom.

But reports from other groups, including new home sales, housing starts, pending home sales, and existing home sales suggest a little more in the way of housing activity.

Wednesday, August 12, 2009

Trade deficit increases on higher oil import costs

Here are a couple of interesting charts provided by the Commerce Department that reflect the balance of payments. A rise in the nation’s bill for oil helped lift the gap by $1 billion to $27 billion in June.

The improvement in exports, however, continues to point to a slow improvement in the global economy.

Details are available at Examiner.

OECD CLIs show stronger signals

Released late last week, the OECD Composite Leading Indicators (CLIs) for June 2009 point to stronger signs of improvement in the economic outlook of OECD economies compared with last month’s release.

The CLI for the OECD area increased by 1.2 points and is up for the fourth-consecutive month. The CLI in the US gained 1.3 points, accelerating from May’s 1.1 point increase, and 0.5 point rise in April.

According to the OECD, the CLIs are signaling troughs in economic activity in the US, Europe, the UK, and Canada, though signs of improvement or more tentative in Japan and Russia. See charts.

Productivity, labor costs, unemployment and inflation

Productivity jumped in 2Q because businesses continued to reduce hours (-7.6), but cutbacks in output slowed dramatically (-1.7). Normally, productivity surges during the end of a recession and the early stages of a recovery because businesses are reluctant to add workers as output grows.

With the exception of just a 0.1% dip in 1Q and 3Q of 2008, productivity remained positive despite the severity of the recession, highlighting how quickly companies shed workers in the face of falling demand.

The drop in unit labor costs is the direct result of the sharp gains in productivity, which could ease some of the rising cost pressures from increases in commodity prices and gasoline.

Core inflation fell through much of the 1990s amid rising productivity and flat commodity prices. Following the mild slump of 2001, inflation did not bottom until late 2003.

The core CPI has been stuck near the high end of the Fed’s implied target of 1-2%. With expectations of a recovery later in the year and a bounce in commodity prices, worries that inflation could fall to undesirably low levels was not present in the last FOMC statement that accompanied the interest rate decision in June.

Outsized gains in productivity and excess capacity around the world, however, may put downward pressure on inflation going forward, offsetting some of the impact of rising commodity prices and the still-accommodative monetary policy.

A more conventional viewpoint is available at Examiner.com.

Tuesday, August 11, 2009

Japan wholesale inflation falls at record pace

The fall comes just one day after the Bank of Japan acknowledged that core deflation (my term) has worsened. However, crude oil prices are off the lows, the BoJ sees a moderation later in the year, and the month-over-month rate did rise 0.4%.

Japan's economy was mired in deflation for much of the decade, and the worst global recession since WWII has caused inflation to slip back below zero. The BoJ does not see a new deflationary spiral, but it kept its key lending rate at 0.10% as policymakers try to right the world's second-largest economy and turn the country towards price stability.

China takes interesting turn

China's economy is definitely anchored what's been happening in Asia, and for that matter, has helped stabilized output around the world. In fact, the Economist recently noted that GDP in 2Q grew at an estimated 16.5% in the quarter just ended, according to Goldman Sachs. See A second look at China and GDP.

However, China's central bank has highlighted some of the risks to the expansion and a torrent of data that just hit suggests its concerns warrant some attention.

According to Bloomberg News, industrial production is still rising, albeit at a slower pace, but exports, which helped to drive growth earlier in the decade, remain weak as demand from the world's largest economies has yet to fully revive.

Lending plunged to $52 billion, a quarter of June's level, and fixed investment, though up an astounding 32.9% versus one year ago, missed expectations and appears to have rolled over, which is a little worrisome given it is a sign of spending by the government.

Taken together, the economy is still expanding but is not yet on a firm foundation and any tightening by the central bank will likely be delayed. Following the reports, commodity prices, including copper, are under pressure.

Wholesale inventories in sharp descent

Sales increased 0.4% in June, extending May's increase of the same amount, but wholesale inventories tumbled a steep 1.7%, larger than May's substantial 1.2% decline.

As a result, the closely-followed inventories-to-sales ratio, which measures how many months it would take take businesses to liquidate stockpiles, fell from 1.28 to 1.26.

What does all of this tell us?

Despite the gradual recovery in sales that began in April, production at the nation’s factories is not yet picking up as companies continue to work off excess goods left over from the near collapse in demand that occurred following the credit crisis last fall.

And falling inventories have been part of what’s been holding back GDP. However, we will eventually get to the point when items on hand will become sparse, and manufacturers will find it necessary to ramp up production, providing an extra kick to economic activity.

BoJ maintains rates, assessment on economy

The BoJ said, "Economic conditions have stopped worsening. Public investment is increasing and exports and production are picking up. On the other hand, business fixed investment is declining sharply mainly reflecting weak corporate profits.

Private consumption, while there are some signs of a pick-up mainly attributable to the effects of various policy measures, remains generally weak amid the worsening employment and income."

It did note that the rate of decline in the CPI is expected to moderate in the second half of fiscal 2009, but the bank acknowledged that core deflation has accelerated mainly due to lower oil prices, and it is focusing on "the downside risks to economic activity and prices."

Japan's economy does appear to have stabilized and there have been positive developments following a near free-fall in economic activity in 4Q08 and 1Q09.

There are concerns, however, that the current uptick in production is mostly related to re-stocking depleted warehouses, and when more normal levels are reached, growth may flounder again.

Monday, August 10, 2009

Bank of Korea keeps rates steady

Though the slump in domestic demand and exports has moderated further, the bank said, there is still uncertainty because of the "likelihood of delay in the recovery of major economies,", i.e., the US, Japan and Europe.

South Korea is very heavily dependent on sales overseas, and the collapse in demand around the world hit manufacturing extremely hard at the end of last year and early this year.

Production has rebounded sharply in recent months, but the central bank said it expects to maintain an accommodative monetary policy stance "for the time being."

Friday, August 7, 2009

A closer look at the unemployment data

Employment fell 247,000 in June.

Goods producers lost 128,000 jobs, including 76,000 in construction and 52,000 in manufacturing.

The service sector shed 119,000, while education and health care, which has been a bright spot in the recession, gained 17,000.

The unemployment rate came in at 9.4%, down from 9.5%, as the household survey reflected a big drop in the labor force. See Economy 101: What is the unemployment rate.

Adult men: 9.8%

Adult women: 7.5%

Teenagers: 23.8%

White: 8.6%

Black: 14.5%

Hispanic: 12.3%

Germany industrial production eases

Following an upwardly revised and outsized gain in May of 4.3%, industrial production in Germany unexpectedly dipped by 0.1% in June, according to preliminary data.

The decline comes as a disappointment given yesterday’s strong 4.5% increase in industrial orders, which was the fourth-straight monthly rise.

Still, industrial production can be volatile in Europe’s largest economy and the huge rise in May, coupled with rising orders, signals that a rebound may be set to occur.

The country’s economy is heavily dependent upon exports, and the huge drop in demand late last year took a heavy toll on Germany. But China’s economy is moving along nicely and indications the US is set to follow are raising hopes that Germany may see growth this year.

The European economy, however, is likely to shrink for the rest of 2009 before gradually recovering next year, according to the European Central Bank. See ECB calls rates appropriate, BoE increases bond buys.

Unemployment rate improves

Nonfarm payroll losses less than forecast

What a difference one month makes. June’s larger-than-expected increase in nonfarm payrolls cast doubt about prospects for a recovery. Today’s release of a 247,000 drop in nonfarm payrolls has those same folks talking about an economic rebound.

Meanwhile, in a separate survey, the unemployment rate unexpectedly fell from 9.5% to 9.4%.

As I had previously discussed, trends do not move in a straight line and the data taken together pointed to an eventual improvement.

Further improvements won’t be in a straight line either, but the government will probably declare the recession ended in July or August when it finally makes its announcement roughly one year from now.

On average, it takes just two months after a recession has ended before a positive number graces the headlines.

Thursday, August 6, 2009

RBA anticipates no more rate cuts

The Reserve Bank of Australia signaled no more rate cuts will be forthcoming as it judged the current accommodative monetary policy is appropriate for now.

Looking down the road, the RBA said, "Movement towards a more normal setting of monetary policy could be expected at some point if further signs of a durable recovery emerge." In layman's terms, the bank is hinting at an eventual rate hike.

In its statement on monetary policy, the RBA said the global economy is stabilizing, while the pick-up in economic conditions is "most evident in China, where growth has been boosted by a large fiscal stimulus and increased bank lending."

There are fewer signs of recovery in the advanced economies, the RBA said, although the rate at which output is contracting has slowed noticeably. In the US, in particular, there is tentative evidence that the economy is reaching :a turning point," with the housing market showing signs of stabilization.

The key lending rate in Australia is currently at 3%.

ECB call rates appropriate, BoE increases bond buys

The European Central Bank kept its key lending rate unchanged in August at 1.0% as had been widely expected. The ECB said in its press release that “current rates remain appropriate,” signaling no further rate reductions are likely needed.

The central bank added that economic activity over the remainder of this year is expected to remain weak. But there are growing signs that the global recession is bottoming out.

Recent surveys of the eurozone suggest that the pace of contraction is clearly slowing down, and after a period of stability, a gradual recovery is forecast to begin next year.

Nonetheless, worries about the banking system remain, and the ECB once again called for banks to strengthen their capital.

In the meantime, the Bank of England held its main interest rate at 0.5% as forecast by nearly all analysts. The BoE voted to continue with its program of asset purchases financed by the issuance of central bank reserves and to increase its size by £50 billion to £175 billion.

There have been increasing signs that output in the UK’s main export markets is stabilizing, the BoE said. The pace of contraction has moderated, but the central bank added that the “recession (in the UK)appears to have been deeper than previously thought.”

Jobless claims in solid downward trend

Weekly jobless claims remain in a downward trend, falling 38,000 to 550,000 in the week ending August 1. There were no factors that influenced claims this week as there had been for most of July, so it’s clear we are downward trend.

A closer look is available at Examiner.com.

Rising semiconductor sales

The Semiconductor Industry Association (SIA) reported that 2Q sales worldwide sales of semiconductors declined by 20% from the $64.7 billion recorded in the same period one year ago. No surprises there.

More importantly, 2Q sales increased 17% from the prior quarter to $51.7 billion and rose 3.7% in June versus May.

The SIA said recent gains in sales are one indicator the industry is returning to normal seasonal growth patterns.

Industry analysts have recently become more optimistic in their forecasts for key demand drivers as the consensus forecasts for both PC and cell phone sales have brightened. PCs and cell phones account for nearly 60% of worldwide semiconductor consumption, the SIA said.

Breaking down the numbers, the association said, “Consensus estimates for unit sales of PCs are now in the range of –5% to flat compared to 2008, whereas earlier forecasts were projecting year-on-year unit declines of 9-12%.

In cell phone handsets, analysts now believe the unit decline will be in the range of 7-9% compared to earlier forecasts of a decline of around 15%.

Wednesday, August 5, 2009

ISM services disappoints but recovery still at hand

Just when I thought it was safe to give the all-clear sign on the road to recovery, the ISM Non-Manufacturing Index unexpectedly dipped from 47.0 in June to 46.4 in July.

The decline was small and the index is holding below 50, which marks the line between contraction and expansion, but most indicators and corporate commentary suggest a pick up in economic activity in the near term.

Furthermore, the trend continues in an upward direction as reflected in the chart above.

Notably, the prices component fell 12.4 points in July to 41.3, highlighting the lack of pricing power amid sluggish demand. In front of Friday’s labor report, the ISM said the employment component slipped from 43.4 to 41.5.

Overall, the decline is a letdown but not worrisome.

ADP job losses diminish

However, ADP was quick to point out that employment is a lagging indicator and job losses are expected to continue "for at least several more months, albeit at a diminishing rate."

I agree. Companies were quick to begin layoffs when the economy began to slip into a recession at the end of 2007, but are likely to hold off adding to staff in meaningful numbers until they feel confident a recovery is well underway.

Purchase Index treads water

The US Mortgage Banker’s Association (MBA) reported that the Purchase Index increased 0.9% from a week earlier and has “experienced little change over the last three weeks, staying between 260 and 265.”

The MBA did not provide an actual number but based on last week’s figure, the small rise would put the Purchase Index at 264.4.

As I’ve mentioned in previous posts, home sales are rising and prices appear to be stabilizing. Moreover, yesterday’s solid rise in the Pending Home Sales Index points to further gains over the next couple of months in existing home sales.

The index is off the bottom, but the lack of a meaningful response in the Purchase Index suggests some type of disconnect in the MBA’s leading indicator of housing sales, in my view.

Tuesday, August 4, 2009

Pending home sales power ahead

If there is any doubt that the home market has begun to recover, one only has to look at the Pending Home Sales Index. The forward-looking indicator of existing home sales is up for the the fifth consecutive month, the first time in six years for such a streak, according to the National Association of Realtors.

Details are available at Examiner.com.

A quick side note, the chart above dramatically underscores how the credit crisis last fall ended what had appeared to be the beginnings of a recovery in home sales.

Monday, August 3, 2009

ISM leaps ahead

Manufacturing has nearly stabilized according to the closely-watched ISM survey, and today’s better-than-expected report suggests that August will be the turning point.

The ISM Manufacturing Index jumped 4.1 points in July to 48.9, easily beating the Bloomberg forecast of 46.5. A reading of 50 reflects neither improvement nor decline.

More impressively, production increased 5.4 points to 57.9 and a strong 6.1 rise in new orders to 55.3 suggests industrial production is set to bottom.

But an improvement in manufacturing is not without costs, and prices paid rose from 50.0 to 55.0, the first time above 50 since September 2008.

It is becoming clear that the economy is at a bottom. And if we receive a couple of more outsized gains in the ISM survey, we will likely start to hear chatter about a V-shaped recovery.