Sunday, January 31, 2010

Surging GDP masks economic pitfalls

By itself, the news is good given the deep economic recession that has caused the unemployment rate to spike past 10%. One piece of good news - capital spending posted a double-digit gain, suggesting companies are beginning to respond in a favorable way to the recovery.

But much of the rebound last quarter occurred as companies replenished dwindling stockpiles. Looking back over the past year, falling demand has been met sharp declines in production. This kept bloated inventory levels from soaring to untenable heights.

The painful cuts in production have brought inventories back to reasonable levels, and rising output accounted for 3.4 percentage points of the 5.7 point increase. But it seems implausible that 2Q will see the same level of growth if consumer spending does not noticeably pick up.

The Fed plans to end its purchases of government securities by the end of March, and fiscal stimulus may not provide the bang needed. Moreover, banks remain under pressure and have not loosened up on the purse strings in a way that might give the recovery the push needed to put it on a self-sustaining path.

I'm not expecting a double-dip recession, and the Leading Index and surveys of manufacturing are still suggesting further gains. But headwinds remains stiff and slow growth seems to be the most likely path.

Friday, January 29, 2010

Small rise in Employment Cost Index underscores weak labor market

On the one hand, the scant rise in labor costs, coupled with outsized increases in productivity, allows policy makers to keep their focus on job creation because the data strongly suggest that inflation is not a problem at the present time.

(A noted to those well versed in the theories of economics: this is not an endorsement of the Phillips curve. The lack of inflation at the present time and expectations that price increases will remain tame allow for a loose monetary policy.)

However, the lack of meaningful wage gains (wages make up 70% of the index while benefits account for the remainder) is symptomatic of what's going on in the labor market.

Employers have plenty of qualified applicants to choose from and do not need to compete by offering higher wages, while the deep recession has crimped profit margins, forcing many employers to keep a close eye on expenses. With job insecurities still high, many employees are grateful just to have a job.

Unfortunately, the lack of significant income growth could limit gains in spending, which may also limit GDP growth.

Thursday, January 28, 2010

Anticipated end of homebuyer tax credit hits Dec housing

New homes, builders struggle

December’s drop in housing sales came as no surprise, only the magnitude of the decline caught some off guard. Given that an $8,000 tax credit for first time buyers had never expired before, forecasting its impact is a bit difficult so let’s not be too harsh on the forecasters who took a stab at it.

Existing home sales in December plunged 16.7% to a seasonally adjusted annual rate of 5.45 million units in December from 6.54 million in November but remain 15.0% above the 4.74 million-unit level in December 2008.

It’s pretty obvious that potential homebuyers rushed to beat the November 30 deadline to close in what had previously been the expiration of the credit. Congress has since expanded and extended the cash incentive.

What’s unclear is how much the credit caused buyers to move up planned purchases, and how many fence sitters made their decision based on the credit.

Sales were clearly borrowed from future months, but low interest rates and the extension and expansion of the credit is expected to fuel sales again in the spring. Increased job security and hiring would go a long way toward building a solid foundation under the housing market.

New home sales come under pressure, builder sentiment slides

Sales of new homes, however, have struggled. Sales fell a greater-than-expected 7.6% to an annual rate of 342,000 units in December. More troubling, new home sales are down in five of the past six months. And sentiment among builders reflects what’s been going on with sales.

As noted from the chart above, the Housing Market Index, which measures sentiment among builders, remains well above the extreme lows seen early last year but has been been weakening recently.

Housing starts are no longer declining, thanks to sales that have also ended their downward spiral. But builders have not shared equally in the housing recovery so far. Note: existing home sales surged in late summer and early fall.

If there is a silver lining for builders, permits, which are a good forward-looking indicator, jumped last month, but it’s going to take more than just one good month to solve the many problems still facing the nation’s builders.

From an economic standpoint, new homes means new construction. And that will help spur economic activity. Existing home sales, however, make up over 90% of all sales, helping to support prices that have sagged over the past two years.

Thursday, January 21, 2010

Jump in jobless claims blamed on special factors

Weekly initial jobless claims jumped 36,000 in the latest week to 482,000, easily exceeding the forecast offered by Bloomberg of 440,000. The 4-week moving average rose 7,000 to 448,250, while continuing claims dropped a scant 18,000 to 4.6 million.

Continuing claims are over 2 million below the peak set last year, though the steep drop is unlikely the result of increases in employment but mostly do to unemployed workers losing standard benefits, which normally run six months.

Before we go setting of any alarms bells over the unexpectedly-large rise in weekly claims, let’s look at an explanation offered up by Bloomberg News:

The Labor Department said claims piled up due to short holiday staffing at state processing centers. Market News International is quoting a Labor Department analyst as saying the week's gain is "not economic, but administrative."

Starting with the next report, the government analyst expects the effect to reverse making for a steady decline in coming weeks. An implication here is that short-staffing this year was greater than prior years and is not offset by seasonal adjustments. Note also that data from an unusually large number of seven states had to be estimated for the current report.

Seasonal adjustments can be difficult during part of the year for this volatile report. The Labor Department’s reasoning is plausible, and the rise should not be cause for concern.

Sunday, January 17, 2010

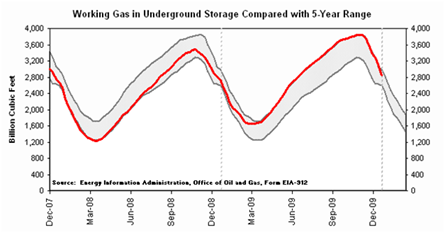

Natural gas supplies plummet

Prices mostly in check

The Energy Information Administration reported on Thursday that natural gas supplies tumbled 266 billion cubit feet (bcf) to 2.85 trillion cubit feet in the last week.

The culprit: very cold weather in much of the country. In fact, natural gas supplies are now just 103 bcf higher than last year at this time and 121 bcf above the 5-year average of 2,731 bcf. That’s down from about 500 bcf just one month ago.

Although natural gas prices have crept higher recently in response to heavy usage, the threat that abundant supplies still in the ground might come to market appears to have kept prices from jumping much higher.

Thursday, January 14, 2010

Rising business inventories signal more growth

Business inventories increased by 0.4% in November to $1.3 trillion as manufacturers, wholesalers, and retailers begin to increase inventories in response the huge drawdown in stockpiles experienced through much of last year.

Meanwhile, sales jumped an impressive 2%, bringing the closely-followed inventories-to-sales ratio from 1.30 to 1.28. At the current level, inventories-to-sales are back in the range seen through much of 2005 through the middle of 2008, before the Lehman Brothers’ crisis sent the economy into a tailspin.

Interestingly, the ratio is well below where is stood just after the 2001 recession officially ended in November of that year, highlighting how quickly companies slashed production and orders.

What is the significance of all this?

Businesses hit the brakes on inventory accumulation at the start of 2009, weighing heavily on economic activity. With inventories back inline in relation to sales, companies are increasing orders and production, which is lending support to the economy.

Manufacturing is only a small portion of the total economy, but the sector is more volatile than the service sector so increases (or decreases) can spur GDP growth (or decreases can and do exacerbate a downturn).

In this case, continued increases in aggregate demand will likely stoke economic activity in the short and medium term. And that’s good news!

Retail sales, jobless claims disappoint

But a deeper look offers reasons for optimism

Advance retail sales unexpectedly fell in December and weekly initial jobless claims rose more than forecast.

Favorable trends, however, are still intact for both economic indicators, while retail sales received a nice upward revision to November.

A more detailed look will be available shortly on my homepage at Examiner.com.

Monday, January 11, 2010

Unemployment – the long road to recovery

Following a tiny drop in November payrolls, there was plenty of hype on the Street that December might result in the first decent increase in jobs since December 2007.

Unfortunately, the 85,000 drop in nonfarm payrolls last month dashed hopes that a long-awaited recovery in jobs was about to begin. Although we saw a small 4,000 increase in November due to revision, the tiny gain was offset by a drop in the previous month.

One thing is for certain, the weak payroll report pushed back expectations for an eventual rate hike by the Federal Reserve and was a start reminder that companies are still very reluctant to ramp up hiring, even has layoffs ease.

So when might we see meaningful gains in employment? Talk from the White House suggests that we are only a few months away, with rising employment happening by spring.

Robust economic recoveries that followed the steep recessions of 1974 and 1982 produced impressive job growth; however, the relatively shallow recessions in 1990 and 2001 led to anemic economic recoveries and much slower job growth.

Increases in nonfarm payrolls in excess of 100,000 took 13 months to achieve after the early 1990s recession officially ended (March 1991), according to the Bureau of Labor Statistics.

And hiring was delayed even longer following 2001 slump, with meaningful gains in employment occurring two years after the official end of that recession – November 2001.

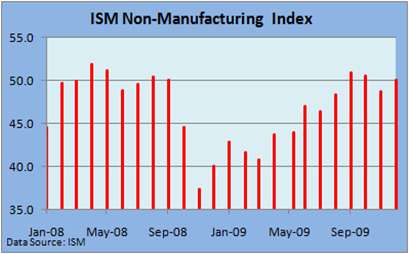

A look at the Employment Indices provided by the Institute of Supply Management suggests that any gains in the labor market may be slow to unfold.

As evidenced by the chart below, manufacturing took a huge hit in late 2008 and early 2009 before showing modest signs of strength over the last three months.

Note: a reading of 50 indicates no gains in employment , while a reading above 50 suggests hiring and a level below 50 is indicative of job losses.

The service sector, which makes up the large bulk of the economy, has exhibited much slower increases, and over the last seven months has held in a narrow range between 40 and 45.

The modest economic recovery so far has produced huge gains in productivity, as companies meet rising demand with continued cost cutting and layoffs.

Looking at how the ISM measures hiring, rising employment may take a back seat to continued caution.

Clearly, the labor market is stabilizing, and recent gains in temporary hiring suggest the foundation for an improvement in the labor market is at hand; however, a slow economic recovery could put a damper on nascent enthusiasm in the job market.

Thursday, January 7, 2010

Weekly jobless claims little changed

Trend remains positive

With the exception of reporting on the specifics of the data, not a whole lot can be said about weekly initial jobless claims this week. Initial claims inched up by 1,000 to 434,000, while the 4-week-moving average continues to fall, dropping 10,250 to 450,250, and continuing claims declined 179,000 to 4.8 million.

Not much action in the latest week, but the drop in the 4-week moving average, which washes out most of the volatility, tells me the economy continues to improve.

And continuing claims are down almost 2 million from the peak, though much of the decline may be due to the jobless losing standard benefits that typically last six months and not from gainful employment.

Initial claims remain at an historically high level. And though layoffs are clearly easing, further gains in economic activity are needed in order to bring claims to a more acceptable level as well bring about respectable increases in employment.

Wednesday, January 6, 2010

ISM services post small gain

The ISM Non-Manufacturing Index managed to end a two-month losing streak, moving back into expansionary territory in the latest month. The closely-followed survey that looks at the broad service sector increased from 48.7 in November to 50.1 in November but came up a little short of expectations.

Though above 50, the boundary that marks expansion and contraction, the survey suggests that the service sector was barely expanding at the end of the year. However, the overall trend continues to be in the right direction, despite recent sluggishness in the index.

The ISM survey shows that employment improved slightly but continues to lag, which is in contrast to November’s nonfarm payroll report, which showed the economy lost just 11,000 jobs.

Friday’s release of December nonfarm payrolls is expected to show that the economy gained 10,000 jobs in the final month of the year, according to Bloomberg. That’s a far cry from the number of jobs the economy needs to create in order to bring down the unemployment rate to more acceptable levels.

But given recent trends, we will probably see a respectable report within a couple of month, though upbeat numbers are likely to be sporadic until the recovery settles into a more sustainable, upward path.

Tuesday, January 5, 2010

Winning streak for pending homes sales ends

The nine-consecutive monthly increases in pending homes sales finally came to an end in November as potential first-time home buyers rushed to beat the expected expiration of the first-time tax credit.

This index designed to forecast future existing home sales fell a steep 16.0% to 96.0. A decline had been widely anticipated. But the severity of the drop caught some analysts by surprise, and Treasury bonds rallied on the news.

Predictably, Lawrence Yun, the chief economist for the National Association of Realtors, said, “It will be at least early spring before we see notable gains in sales activity as home buyers respond to the recently extended and expanded tax credit.”

Other analysts are less certain and believe the much of the demand from first-time buyers was absorbed before the originally-expected expiration of the $8,000 tax credit on November 30.

However, Congress authorized a $6,500 tax credit for buyers who have been in their homes at least five years, and mortgage rates remain near historic lows, which will likely support the beleaguered housing industry.

Although the outsized pullback is a little disconcerting, pending homes sales remain 15.5% higher versus a year ago, lending support to the argument that the housing industry has bottomed.

Monday, January 4, 2010

ISM points to further economic gains

The ISM Manufacturing Index hit its highest level since April 2006, rising from 53.6 in November to 55.9 in December.

New orders remain strong and customer inventories are too low, according to the survey, signaling that manufacturing should continue to expand in the near term.

Moreover, the upward trend in the well-respected survey remains intact.

Separately, a purchasing managers survey of eurozone manufacturing hit its highest level in over 20 months and a similar index in China reached its best level in about 5 years, indicating the worldwide recovery among goods-producers continues.

Another look at today’s report is available at Examiner.com.