Weekly initial jobless claims rose to the highest level since November 2009, signaling that an already-struggling labor market continues to tighten amid weak economic growth.

Jobless claims in the latest week increased by 12,000 to 500,000, higher than the consensus forecast from Bloomberg of 480,000. The 4-week moving average, which smoothes out some of the weekly volatility, jumped 8,000 to 482,500.

The rise in claims is adding to the argument that the economy may not be able to avoid a double-dip recession.

Business confidence appears to be waning, according to the report, while the rise in joblessness suggests that August nonfarm payrolls may disappoint once again.

Philly Fed foreshadowing tougher times

In the meantime, the manufacturing sector, which has helped to fuel the current recovery, is showing signs that growth may be stalling.

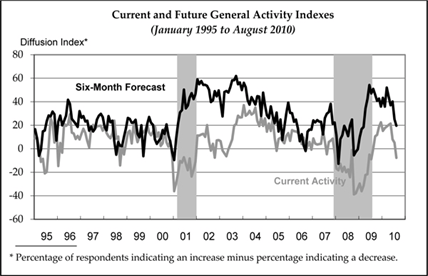

The Philly Fed’s Business Activity Index turned negative for the first time in over a year.

Designed to measure manufacturing in the mid-Atlantic region, the survey unexpectedly fell from 5.1 in July to ‐7.7 in August. A reading of zero marks the line between expansion and contraction.

Indexes for new orders and shipments also suggest sluggish this month;

the new orders index fell slightly, to -7.1, while the shipments index turned negative, declining to -4.5.

The lack of pricing power is also highlighting the difficulty many firms face in the current economic environment, as prices paid fell from 13.1 to 11.8, and prices received dropped from –8.4 to –12.5. One thing’s for sure – inflation is not the issue.

Moreover, optimism continues to wane, as the forecast going out six months continued in its downward trend. However, despite the summer slowdown, the companies surveyed continue to expect business to improve through the rest of the year, albeit, at a slow pace.

0 comments:

Post a Comment