Today, the European Central Bank offered little comfort with the exception of touting its past achievements that have kept the woefully under-capitalized banking system from blowing apart at the seems.

I guess we really should be thankful for small favors.

ECB President Mario Draghi still believes the euro-zone will experience a gradual recovery in the second half of the year, but he added a caveat - that any recovery is “subject to downside risks.”

It sounds as if he may be losing a little faith in his own forecast. At 75 bp, monetary policy is accommodative, but he’s not offering much more stimulus.

A rate cut was discussed “extensively,'” but a 25 bp or even a 50 bp rate reduction would be mostly symbolic. And don’t expect much in the way of fiscal stimulus.

Europe’s in a mess, and its weak banking system isn’t in a position to supply needed credit.

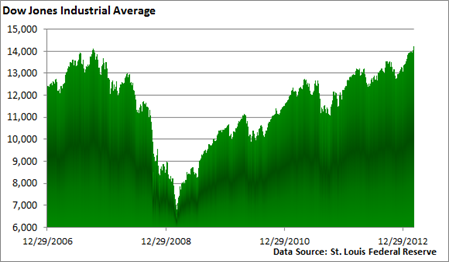

All this shouldn’t be lost in the U.S. investor. Sure, the market has pierced all-time highs, but weak sales in Europe seem likely to hinder profits at home.

Keep an eye on comments from the multinationals, as they report profits.