Productivity is one of those statistics that few really get excited about, unless one is either an economist or someone who has spent plenty of time studying the field of economics. Despite the apparent lack of interest, let’s take a stab at it.

This morning the government reported that 4Q nonfarm productivity surged at an annual rate of 6.9%, well ahead of the initial estimate of 6.2%. This came about as output grew by 7.6% and hours worked rose 0.6%. A quick review of the math, and some rounding, gives us the 6.9 figure.

Given the huge jump in productivity and the small increases workers are receiving in compensation, it comes as no surprise that unit labor costs plunged 5.9%, faster than the originally-reported drop of 4.4%.

As I’ve already mentioned, few get excited about this release, but changes in productivity and unit labor costs impact all of us.

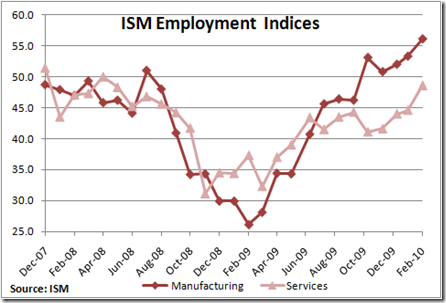

Typically, productivity surges in the early stages of an economic recovery because companies start to ramp up output without adding staff. Needless to say, this recovery is no exception!

But as companies start to increase hiring, productivity increases level off.

So why is all of this important?

Strong gains in productivity over time enable companies to increase wages and benefits without adding to inflation. And rising compensation without an accompanying increase in inflation raises living standards.

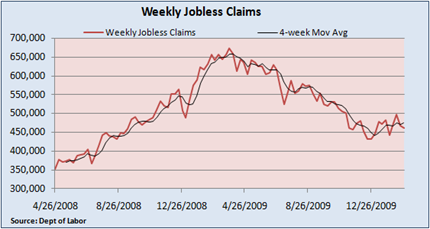

However, during the initial phase of an economic recovery, the jump in productivity has its downside – a jobless recovery.

A second important component of this report is unit labor costs. Wages and benefits are the largest single cost for most companies. If higher productivity mitigates increased salary expenses, inflation is much less likely to get entrenched during an economic cycle.

Looking at what is going on today, we are seeing plenty of excess capacity and small increases in overall demand, making it very difficult for businesses to raise prices. Moreover, unit labor costs are falling, which helps corporate profits and dramatically lessens the need for price hikes.

In this environment, inflation simply is not a threat at the present time, allowing Federal Reserve officials to focus on the dreadful employment picture and not inflation.

Down the road, the Fed will be faced with the delicate task of raising interest rates and nipping any potential inflation threat in the bud.