Employment up but other indicators flashing yellow

Since December, employers have added an impressive 530,000 positions to payrolls, according to the establishment survey, with 483,000 coming from the private sector.

Though more volatile, the household survey, which is used to calculate the unemployment rate and is believed to do a better job capturing trends at small businesses, showed that companies added 550,000 in April and 264,000 in March.

The unemployment rate, however, ticked up from 9.7% to 9.9% because over 800,000 individuals jumped back into the labor force last month. Likely reason: most believe that an improving economy is starting to generate new jobs and formerly discouraged workers are starting to look again.

Not all is rosy

It’s going to take time to whittle away at the unemployment rate. Unfortunately, other data are yet to confirm a noticeable pick up in hiring.

The Institute for Supply Management releases two detailed looks at economic activity, measuring the pulse of manufacturing and the service sector.

Manufacturing was hit especially hard in the recession and steep cuts in production resulted in massive layoffs in the industry. But production has coming roaring back, and as the chart below reveals, manufacturers are once again hiring.

And that has been confirmed by the establishment survey, which showed goods-producers added an impressive 44,000 to payrolls last month.

A reading of 50 suggests firms are neither firing or hiring.

But manufacturing makes up just a small part of the economy. Improvement in the service sector is critical to future economic growth and overall job gains.

According to the ISM survey, the the drop in employment in the service sector has just about come to an end, but there hasn’t been any pick up in hiring either.

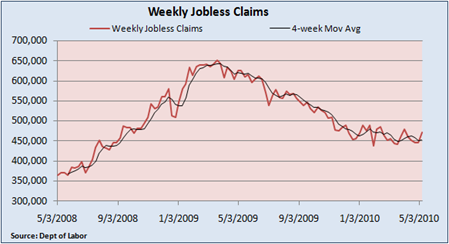

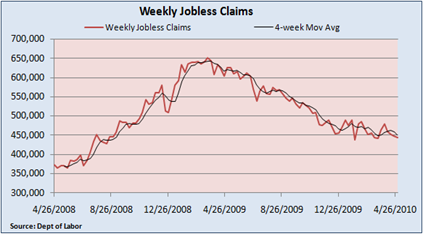

Weekly jobless claims have also been stuck at elevated levels for about five months after steadily declining from its peak early last year.

Why one government survey shows fairly robust hiring while another one is signaling uncertainty is a mystery. And we aren’t getting any confirmation from the ISM that jobs are finally being created in the largest sector of the economy.

We could see downward revisions in the next month or two to March and April’s strong gains. Or lagging weekly claims and the ISM employment index for non-manufacturers may just be a sign that near-term job growth will be limited.

With business spending ramping up, consumer spending turning higher and manufacturers experiencing what can only be described as a V-shaped recovery, signs are pointing to an improving labor market. We just aren’t getting all the key measures of employment to flash the all-clear sign.