The remainder of the article is available below.

With August 2 deadline for a debt deal casting a long shadow over U.S. and global equity markets, the Treasury market, which would be immediately impacted by a default, doesn’t seem to be as rattled.

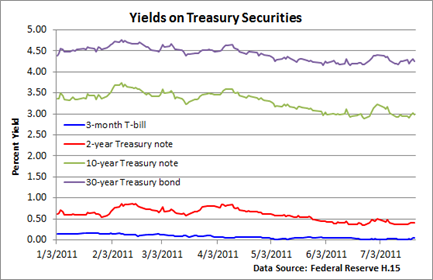

Yields on T-bills over the past month have traded between 1 – 5 basis points, which realistically means you and I can park cash short-term and more or less earn what we could if we stashed it under a mattress.

And the benchmark 10-year bond is offering a yield of just about 3%, so longer-term, a domestic or foreign investors receives something for lending the government cash, but the paltry yield suggests nothing out of the ordinary looms in the foreground.

Further, measures of risk, such as the 2-year interest rate swap spread, or the difference between the yield on the two-year note and the yield on a two year swap, has been well-behaved.

All of this suggests that bond players believe the Republicans and Democrats will pass some type of increase in the debt ceiling before Treasury misses an interest payment.

AAA going the way of the dinosaur?

Of course, credit agencies have been carefully monitoring the situation and have warned that a debt ceiling increase must be accompanied by a credible plan to reduce the federal deficit.

If a more symbolic plan to reduce deficit spending is enacted, i.e., smoke and mirrors and phony cuts, the U.S. faces the real possibility of losing its coveted AAA credit rating.

And one would have to assume that both domestic and foreign investors would demand a higher premium to buy U.S. debt.

That means higher interest rates at a time when the fragile recovery does not need another impediment to growth.

0 comments:

Post a Comment