The decision by the Fed to launch into a second round of bond buys came in early November, but Fed Chief Ben Bernanke first publicly toyed with the idea at the end of August.

Source: Bloomberg, Federal Reserve

Last summer, the economy was suffering through an economic slowdown and talk of a nasty bout with deflation was rising.

In order to stimulate economic growth, boost inflation expectations and erect a deflationary firewall, the Fed eventually decided to implement a round of bond purchases that would boost liquidity by hundreds of billions of dollars.

Stocks prices reacted favorably but the extra cash also seems to have founds its way into commodities (chart above).

Currently the core CPI is running at an annualized pace of 3.0% over the last three months.

But has the extra cash founds its way into the real economy?

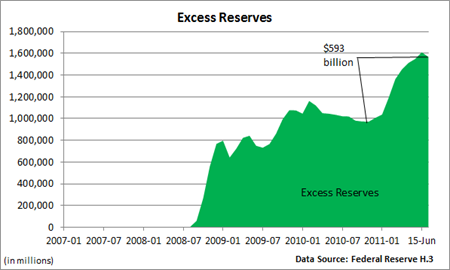

The second chart would strongly suggest it has not.

Excess reserves, defined as funds that are over and above what banks must hold in order to satisfy withdrawal needs of their customers, have soared by about $600 billion – in line with the extra cash the Fed created to buy its Treasury bonds.

Reserves stood at nearly $1 trillion before QE2 was implemented, and it should come as no surprise that the additional liquidity has done little to bolster the real economy (see Excess reserves and heightened uncertainty – Sept 27, 2010).

Liquidity trap? If we’re not there, we sure are close.

No matter how much money the Fed floods into the economy, the central bank is unable to affect interest rates, i.e., a liquidity trap.

0 comments:

Post a Comment