Sunday, July 31, 2011

Two minutes to midnight–Aug 2 deadline upon us

Upbeat earnings seem to have been the one bright spot preventing additional losses in stocks last week. But the looming August 2 deadline and the drama on Capitol Hill have overshadowed any good news.

And virtually no one wants to navigate the uncharted waters of a debt default should the deadline be breached.

I suspect that if there is no agreement, and I still believe we’ll see one before Wednesday, the government will continue to make interest and principal payments and seniors won’t miss a social security check, but the chaos that would ensue would likely rattle markets even further.

But even with an agreement, numbers being bannered about fall far short of what S&P says is needed - $4 trillion in savings over 10 years – to avoid a downgrade.

Democrats want a plan that saves over $2 trillion and raises the debt ceiling by a like amount that would put off another vote until after the 2012 elections. Republicans complain that about $1 trillion in savings is coming from the winding down of the wars in Iraq and Afghanistan - money that wasn't going to be spend anyway.

Republicans want to save about $1 trillion over the next ten years and vote again on the debt ceiling, before the 2012 elections. They would also like to vote on a balanced budget amendment at that time.

It's not surprise why each side is offering their own separate plan.

Republicans would like to see Democrats squirm just prior to the election, when they'd likely vote against a balanced budget amendment. And it would remind voters that trillions of dollars in red ink have accumulated under Obama's watch.

On the other hand, Democrats would like to avoid another bitter display of partisanship next summer and kick the can to 2013.

Given the uncertainty the markets are dealing with, it seems reasonable not to manufacture another crisis a year from now.

Still, even with an agreement, it seems likely that at least one credit agency will void the county’s AAA credit rating. In theory, that translates into more risk and higher interest rates, especially if some pension funds and institutions, which can only hold AAA debt, are forced to sell.

But what will actually happen is unclear, and experts are divided since we’d be in uncharted territory.

Alarm bells at the Fed

The economy right now does not need higher interest rates. An early look at Q2 GDP that came out on Friday reflects the fragile nature of the recovery. And the unexpected downward revision to Q1 only adds to the uncertainty.

It’s becoming increasingly clear that Fed Chairman Ben Bernanke’s plan to buy $600 billion in Treasuries – popularly known as QE2 – has failed to boost output.

It helped lift stock prices and it exacerbated commodity inflation, but the extra money sloshing around the banking system has not helped the economy.

Unfortunately, weak job growth and a sharp slowdown during the first half of the year has Bernanke talking about another round of easing. But the evidence suggests that it would only fuel speculation, create additional distortions, and risk more inflation.

Thursday, July 28, 2011

Weekly jobless claims back below 400k but special factors muddy data

Good news…sort of. Weekly jobless claims are back below 400,000 for the first time since early April. But seasonal adjustments may not be capturing certain factors that led to the welcome decline.

Weekly initial jobless claims dropped 24,000 in the latest week to 398,000.

The 4-week moving average, which smooths away some of the volatility in the weekly number, dropped 8,500 to 413,750. Continuing claims were down 17,000 to 3.7 million.

Anytime we see jobless claims come in well above or below the consensus forecast – in this case, 425,000 per Bloomberg – its important to footnote the drop by noting that this number can be volatile on a week by week basis.

Moreover, retooling in the auto sector at this time of year further muddies the data, even with seasonal adjustments.

At a time when gauges of economic activity are detecting economic weakness, the dip is welcome, but let’s keep a close eye over the next couple of weeks so we can confirm whether or not a very modest pick up in economic activity is at hand.

Wednesday, July 27, 2011

Nervousness in stocks not seen in Treasury market

The remainder of the article is available below.

With August 2 deadline for a debt deal casting a long shadow over U.S. and global equity markets, the Treasury market, which would be immediately impacted by a default, doesn’t seem to be as rattled.

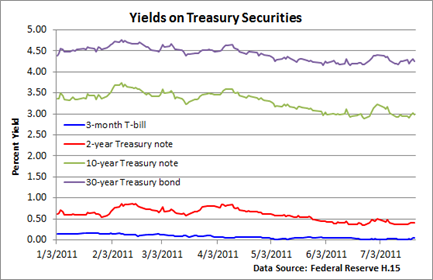

Yields on T-bills over the past month have traded between 1 – 5 basis points, which realistically means you and I can park cash short-term and more or less earn what we could if we stashed it under a mattress.

And the benchmark 10-year bond is offering a yield of just about 3%, so longer-term, a domestic or foreign investors receives something for lending the government cash, but the paltry yield suggests nothing out of the ordinary looms in the foreground.

Further, measures of risk, such as the 2-year interest rate swap spread, or the difference between the yield on the two-year note and the yield on a two year swap, has been well-behaved.

All of this suggests that bond players believe the Republicans and Democrats will pass some type of increase in the debt ceiling before Treasury misses an interest payment.

AAA going the way of the dinosaur?

Of course, credit agencies have been carefully monitoring the situation and have warned that a debt ceiling increase must be accompanied by a credible plan to reduce the federal deficit.

If a more symbolic plan to reduce deficit spending is enacted, i.e., smoke and mirrors and phony cuts, the U.S. faces the real possibility of losing its coveted AAA credit rating.

And one would have to assume that both domestic and foreign investors would demand a higher premium to buy U.S. debt.

That means higher interest rates at a time when the fragile recovery does not need another impediment to growth.

Wednesday, July 20, 2011

Existing home sales languish

As traders focus on a spate of upbeat earnings and politicians continue to tease the public with talk of sizable debt reduction, housing remains a headwind to a more permanent recovery.

Existing home sales eased up slightly in June, falling from an annualized pace of 4.81 million units in May to 4.77 million units in June, marking the third consecutive monthly drop in sales.

Unfortunately, the supply of houses on the market continues to edge higher, which seems likely to keep pressure on prices.

Housing affordability is at a record high, according to the National Association of Realtors, and mortgage rates have been hovering well below 5%.

But there is just too much uncertainty in the housing market and the economy in general.

Some of potential buyers are still reluctant to enter the market and are taking a wait and see attitude on prices, while others who would like to move up are struggling to sell their house.

Still, there’s another segment of the population that has been forced out of their homes and are simply not in a position to buy at the current time.

Friday, July 15, 2011

Falling gasoline prices mask rise in core CPI

Food costs were also well behaved, rising just 0.2% last month, the smallest increase since last December.

But falling energy prices last month masked an overall upward trend in retail inflation.

The core CPI, which excludes the more volatile food and energy categories, rose 0.3% in June, the second such monthly increase in as many months.

Year-over-year, the CPI held steady at 3.4%, while the core CPI edged up from 1.5% to 1.6%.

At 1.6%, core inflation, which has been creeping higher, appears to be relatively well behaved. But the y/y rate does not reflect the recent jump in the broader price level.

Thanks mostly to higher auto and apparel costs, core inflation is up 3.0% at an annualized pace over the last six months, according to government data.

That’s well above the Fed’s implied target of just under 2%! Of course, I'm not comparing apples to apples, i.e., y/y versus a six month annualized pace, but the recent uptick, though transitory in the Fed's view, is a bit troubling.

QE3 chatter

On Wednesday, Fed Chief Ben Bernanke opened the door to another round of monetary easing, offering three different options – two of which have largely been untested.

Stocks reacted favorably but Bernanke dampened enthusiasm on Thursday.

“We’re not prepared at this point to take further action,” Bernanke told a Senate panel yesterday in his Q&A session, per Bloomberg news.

“Today the situation is more complex,” he told lawmakers. “Inflation is higher. Inflation expectations are close to our target.”

With core inflation moving forward at an annualized pace over the last six months of 3%, inflation is up, which is complicating the Fed’s job.

A side note: In my view, the $600 billion in bond purchases between November and June have played a significant role in rising commodity prices (see QE2 and its economic impact – chart 2).

And businesses, which still must deal with fragile aggregate demand, have had some success in passing along higher costs.

So it was not surprising to hear Bernanke put the brakes on QE3 chatter, especially since, there was a two month gap between the first mention of new bond buys and the actual implementation of QE2.

The Fed will continue to closely monitor economic activity, especially job creation. And if we continue to see weak growth, odds of a policy shift will rise.

Thursday, July 14, 2011

Bernanke acknowledges additional options on the table

Much of the prepared remarks were generally anticipated: weaker-than-expected recovery is probably temporary, spike in inflation probably transitory and weakness in job market, consumer spending and housing were all mentioned.

And of course, recent Fed actions to support the economy were a part of his written testimony.

Bernanke had recently commented that another round of easing by the Fed is unlikely, implicitly suggesting that the hurdle for QE3 or some other type of unconventional easing is quite high.

But yesterday’s comments caught the market off guard, indicating that Bernanke has lowered the bar.

The Fed Chief reiterated that he expects economic activity will pick up during the second half of the year, as factors that have dampened growth subside.

Still, policymakers at the Fed are concerned that the recent weakness could persist, as Bernanke added that the outlook is unusually uncertain.

In his own words, he said, “The possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support.”

He went on to list three possible options that remain in the Fed’s arsenal.

- Provide more explicit guidance about the period over which the federal funds rate and the balance sheet would remain at their current levels.

- Initiate more securities purchases or increase the average maturity of its holdings.

- And finally, the Fed could cut the rate it currently pays on bank reserves held at the Fed – 25 basis points – in the hope that it might put downward pressure on short-term rates more generally.

In reality, this shouldn’t have been as surprising as it first appeared since the FOMC minutes out on Tuesday revealed the heightened level of uncertainty among Fed officials.

On the one hand, they offered up a detailed plan for an exit strategy, but some members noted, “The Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run.”

Bernanke was quick to admit that “experience with these policies remains relatively limited, and employing them would entail potential risks and costs.”

He’s right and one must ask, “Will such additional stimulus work, or are we in a liquidity trap where extra cash that’s injected into the economy does little to influence interest rates?"

Deflationary risks – extremely small

I disagree with Bernanke’s assertion that deflationary risks might re-emerge.

Oil prices are near $100 per barrel and raw materials in general, though off their highs, remain at a very elevated level. Inflation expectations, which cratered last summer, are more stable this time around, and we're still seeing solid growth coming out of China based on its latest GDP number.

Further, businesses are still grappling with higher input costs, and the uptick in core inflation bears this out.

Nonetheless, the Fed is keenly aware of the uptick in the unemployment rate and the considerable slowdown in job creation.

I had suspected it might take a month or two of weak job growth before the Fed publicly discussed the possibility of a third round of easy, but the troubling slowdown and resulting weakness in hiring has tipped the Fed’s hand.

If I had to take an educated stab at what will eventually happen, weak job creation through July and August seems to be the most obvious path. And that is going to be upper most on the Fed’s mind.

But the uptick in core inflation is troubling and further easing could quickly cause renewed speculation in commodities, putting additional pressure on core inflation.

Still, just telegraphing the possibility to the financial markets suggests at least a 50% chance of some type of shift in policy. Look for comments from regional Fed officials in the near term for clarity.

Drop in jobless claims may be related to special factors

But special factors may have played a role.

Weekly initial jobless claims fell 22,000 in the latest week to 405,000, matching the Bloomberg forecast. The 4-week moving average dipped 3,750 to 423,250, while continuing claims edged up 15,000 to 3.73 million.

What might normally be greeted favorably must be looked at somewhat skeptically.

Seasonality is taken into account each week by the Department of Labor but adjustments sometimes get a bit tricky following a major holiday weekend.

Additionally, the timing of auto shutdowns for re-tooling, which takes place each year at about this time, can also skew the data, Bloomberg News pointed out.

Or course, the decent-sized drop is welcome, but let’s wait a couple of weeks and see how this plays out before stating that the downward trend we saw earlier in the year has reasserted itself.

Tuesday, July 12, 2011

FOMC minutes reveal members discussed the ‘how to’ but not when for an exit strategy

The FOMC minutes noted that growth in consumer spending has declined, the labor market has softened, and activity in the housing market remains depressed.

Exit stage left

At the conclusion of the meeting, the FOMC decided that when the time comes to begin normalizing policy, it plans to:

- Stop reinvesting some or all principal repayments

- Modify its forward guidance on the path of the fed funds rate and initiate temporary reserve-draining operations aimed at supporting the implementation of increases in the fed funds rate when appropriate

- When conditions warrant, begin raising the target for the fed funds rate

- Sale of agency securities likely to begin sometime after the first hike in the fed funds rate, with timing and pace communicated to the public in advance

- Once sales begin, the pace of sales is expected to be aimed at eliminating the holdings of agency securities over a period of three to five years

- And finally the FOMC stands ready to adjust its exit strategy depending on economic and financial conditions.

Currently, the Fed is battling a slowdown in economic activity and an acceleration in core inflation.

Further increases in inflation would greatly complicate the Fed’s job of promoting its statutory mandate of maximum employment and price stability.

Commodity prices have jumped, which is fueling the rise in inflation, but wage gains have been stagnant, and excess capacity and subdued demand suggest any further and unwanted gains in inflation are probably not on the horizon.

Additionally, the Committee pointed out that longer-run inflation expectations remain stable.

Most participants expected that much of the rise in headline inflation this year would prove transitory, and inflation over the medium term would be subdued as long as commodity prices did not continue to rise rapidly and longer-term inflation expectations remained stable.

Nevertheless, a number of participants judged the risks to the outlook for inflation as tilted to the upside. Moreover, a few participants saw a continuation of the current stance of monetary policy as posing some upside risk to inflation expectations and actual inflation over time.

But Committee members were divided on what to do.

On the one hand, a few members noted that, depending on how economic conditions evolve, the Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run. QE3?

But a few members viewed the increase in inflation risks as suggesting that economic conditions might well evolve in a way that would warrant the Committee taking steps to begin removing policy accommodation sooner than currently anticipated.

Consequently, the Fed stayed on its expected path, signaling it will hold the fed funds rate at the current level for an extended period and concluded the meeting by stating it will end its planned purchases of $600 billion in Treasuries by the end of June.

Friday, July 8, 2011

Euphoria to despair–weak nonfarm payroll growth throws cold water on ADP report

But today’s report by the BLS that the economy added just 18,000 jobs in June, with 57,000 coming from the private sector, suggests the slowdown in the economy continues to severely hamper job creation. And the reaction on Wall Street has been swift, with stocks taking a tumble, as investors run to Treasuries.

Details and a more formal look are available at Examiner.

Last week I suggested that forecasts calling for a roughly 100,000 rise in nonfarm payrolls may have been a bit too optimistic.

Weekly jobless claims have been holding in an elevated range, and there have been few signs that the economy was set to emerge from its recent soft patch.

Further, businesses have clamped down on hiring amid the slowdown and will likely keep a cautious eye on their markets before bulking up on staff.

Consequently, the nonfarm payroll numbers provided by the government more accurately reflect the recent economic slowdown in my view.

And we are unlikely to see a much-needed acceleration in hiring any time soon.

Thursday, July 7, 2011

Weekly jobless claims edge lower

There has been little change in the rate of jobless claims, which have been holding at an elevated level above 400,000 since April.

In one sense, the recent plateau has been mildly encouraging since this leading indicator of economic activity is not signaling the recovery is about to stall.

However, it’s not suggesting a more vibrant economy is on the horizon either.

Wednesday, July 6, 2011

Uncertainty is highlighted by falling debt service

The reason behind the dramatic decline is fairly simple. Consumers have cut back on spending and borrowing – we refuse or are simply unable to tap our homes like an ATM machine as we did in the prior decade. And the hurdle to take on new debt for purchases has risen.

Falling interest rates have also been a big help, along with modest repayment of debt and consumer defaults on loans.

In normal times, the extra cash in our wallets might provide the fuel that would power consumer spending and put the economic recovery on a much more solid foundation.

But these are anything but normal times.

Instead, most of us have chosen to save the extra cash. And we can detect the new-found interest in rainy day funds simply by looking at the rise in the savings rate.

Following the relatively mild 1990-91 recession, it took nearly four years for the DSR to bottom.

This time around, the recession, which was caused by a financial crisis, has has been far more severe. And contractions that spring from a financial crisis, versus ones caused by high interest rates, historically have produced weak economic recoveries.

To almost no one’s surprise, the recovery this time around has fit that pattern.

Consequently, there is far more uncertainty among consumers, which has slowed spending. And businesses, which are flush with cash, have been reluctant to hire, taking a wait and see attitude.

All of this suggests we won’t be seeing any surge in growth over the next year or two (or more?) as consumers continue to focus on savings.

One final note: savings and debt service are inversely related with a correlation of –0.67 since 1985, where 1 equals perfect correlation, minus 1 equals perfect inverse correlation and 0 equals no correlation.

Not too surprising.

However, the recent surge in gasoline prices appears to have been mostly financed by savings, which suggests that the pullback in gasoline prices over the past two months, though a psychological boost, may serve only to replenish the modest draw down in bank accounts.

ISM services index eases in June

The ISM Non-Manufacturing Index, which measures activity in the broad-based service sector, slipped from 54.6 in May to 53.3 in June, signaling activity in service industries progressed at a slower pace last month.

A reading above 50 suggests the sector is expanding.

Basically, it’s the same story we’ve been hearing about since April when the spike in weekly jobless claims first signaled a soft patch in the recovery was beginning to evolve.

The Fed has acknowledged the recent sluggishness and continues to suggest it is temporary; however, Bernanke recently conceded that policymakers have been unable to pinpoint the exact causes and have admitted they do not have a quick remedy at their disposal.

The tragic earthquake that struck Japan in March has caused disruptions in the global supply chain, which has impacted the recovery.

But the general uncertainty in the economy, weakness in housing, slow job creation and tight credit standards have all played a role.

If there is one bright spot – which in some respects, is just a reflection of latest slowdown – prices eased from 69.6 to 60.9.

Still, the data are not signaling the onset of a new recession.

Tuesday, July 5, 2011

QE2 and its economic impact

The decision by the Fed to launch into a second round of bond buys came in early November, but Fed Chief Ben Bernanke first publicly toyed with the idea at the end of August.

Source: Bloomberg, Federal Reserve

Last summer, the economy was suffering through an economic slowdown and talk of a nasty bout with deflation was rising.

In order to stimulate economic growth, boost inflation expectations and erect a deflationary firewall, the Fed eventually decided to implement a round of bond purchases that would boost liquidity by hundreds of billions of dollars.

Stocks prices reacted favorably but the extra cash also seems to have founds its way into commodities (chart above).

Currently the core CPI is running at an annualized pace of 3.0% over the last three months.

But has the extra cash founds its way into the real economy?

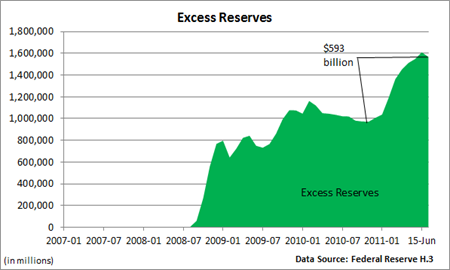

The second chart would strongly suggest it has not.

Excess reserves, defined as funds that are over and above what banks must hold in order to satisfy withdrawal needs of their customers, have soared by about $600 billion – in line with the extra cash the Fed created to buy its Treasury bonds.

Reserves stood at nearly $1 trillion before QE2 was implemented, and it should come as no surprise that the additional liquidity has done little to bolster the real economy (see Excess reserves and heightened uncertainty – Sept 27, 2010).

Liquidity trap? If we’re not there, we sure are close.

No matter how much money the Fed floods into the economy, the central bank is unable to affect interest rates, i.e., a liquidity trap.

Saturday, July 2, 2011

Bulls regain composure

Underscoring last week’s triumph, the Dow Jones Industrials gained nearly 650 points, the biggest weekly point gain since the index of 30 industrials climbed 782 points at the end of November 2008 (MarketWatch).

Talk that some European countries might just roll over maturing Greek debt and the eventual passage of a tough and unpopular list of budget cuts in the Hellenic Republic, which paved the way for new aid, helped avert a near-term default and sparked a big rally in stocks last week.

And relatively sanguine economic data – though nothing to suggest a renewed economic vigor – also aided the advance. Simply put – mix in reasonably decent economic news with a healthy dose of bearish sentiment and you concoct a recipe for an explosive rally.

Victims during the week – Treasuries were hit, with the ten-year yield jumping nearly 30 basis points to 3.18%. The dollar didn’t fare very well either amid a move to riskier assets.

In the meantime, barely a hiccup was registered in credit markets before and during the recent debt crisis if measures of risk are taken into account, suggesting a temporary resolution had been anticipated by banks and bond players – something I’ve harped on over the past three weeks.

Looking forward, investors and analysts will be paying close attention to economic data in the holiday-shortened week and the less-than-robust recovery could provide headwinds for equities.

All eyes will be on the labor report out on Friday, which is expected to show an increase of 110,000 new jobs in June, up from a disappointing 54,000 in May (Bloomberg). The private sector is forecast to add 125,000.

I’ll go out on a limb and say that 110,000 may be a bit optimistic. And 100,000+ is far from impressive. But anything in that neighborhood would likely ease fears that the latest turbulence and continued uncertainty isn’t forcing firms to shelve recent plans to bolster staff.

Friday, July 1, 2011

ISM Manufacturing shows unexpected improvement

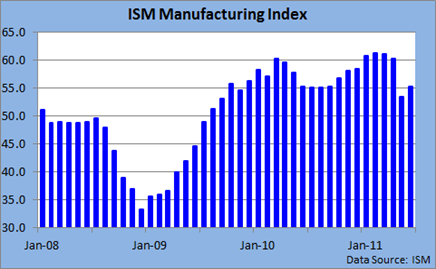

The national look at manufacturing accelerated from 53.5 in May to 55.3 in June, the 23rd straight month of expansion. A reading above 50 is an indication that manufacturing activity is moving ahead.

But the good news (a sigh of relief might be a better way to describe June’s increase) must be tempered by the fact that a jump in inventories was responsible for much of the gain – 48.7 to 54.1.

Nothing worrisome but worth noting.

New orders and production did rise slightly, suggesting stability, but the increase in inventories may hamper production down the road.

Meanwhile, costs are still a burden for most manufacturers. Gasoline and a host of commodities have dropped in price but prices paid managed just a modest decline of 8.5 points to 68.0.

Despite the modest concern from some of the internals in the survey, stocks viewed the report in a favorable light and rallied following the release of the index.

All in all, today's report is just the latest indicating that the recovery still has legs. Short legs, but nonetheless, we're still moving forward.