It turns out that nonfarm productivity advanced at an annual rate of 1.6% in 1Q. That compares favorably to the initial report of a 0.8% rise and the forecast per Bloomberg News of 1.2%. Productivity has gradually trended lower because businesses have not been able to reduce hours worked as quickly as cutting back on output.

In 1Q, output tumbled by 7.6%, and hours worked fell 9.0%, the fastest pace in over 30 years. Do the math and you come up with 1.6%.

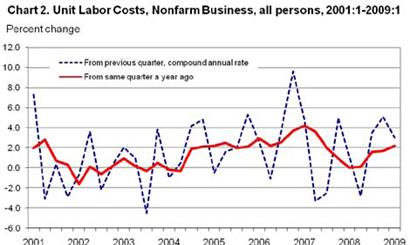

Let’s look at unit labor costs. Unit labor costs rose at an annual rate of 3.0% in 1Q as hourly compensation increased by 4.6%. Again, it’s simple arithmetic. 4.6 minus 1.6 (productivity) brings us to 3.0.

For many businesses, labor is the most expensive input. In good economic times, companies may find it difficult to find qualified employees and will bid up salaries in order to retain and acquire good workers. The pinch to the profit margin is usually resolved by raising prices. And when demand is strong, firms are typically able to make price increases stick.

So what’s going on? Business is terrible but unit labor costs are in a gradual upward trend. Companies may be shedding employees at a near record pace (remember, hours factor into productivity), but they apparently are not cutting back so quickly as to significantly boost productivity and bring down unit labor costs.

The apparent result, coupled with the lingering effect of last year’s surge in commodity prices, is a rate of core inflation, prices less food and energy, that is holding up near the top end of the Fed’s implied range of 1-2%.

0 comments:

Post a Comment