Companies continue to let goods on hand slide as business inventories fell 1.0% in May to $1.4 trillion. Sales dipped just 0.1% to $966.1 billion.

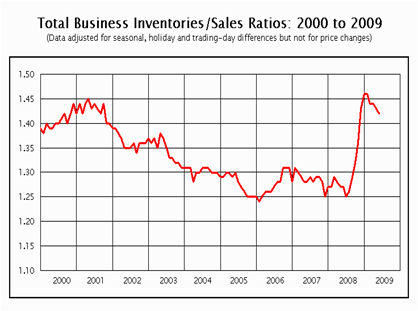

The painful adjustment, or destocking as many call it, brought the inventories-to-sales ratio, which measures how many months it would take to liquidate all stockpiles if production ceased, from 1.43 to 1.42.

In a $14 trillion economy, one can quickly see how $1.4 trillion in goods can influence overall GDP. Sales started quickly falling late last year and are down 17.8% from May 2008.

Companies were caught off guard by the buyers strike that ensued after the freeze in the credit markets and had to quickly squelch production. Hence, inventories are down 8.0% from a year ago, contributing to the contraction in GDP.

US surveys that measure manufacturing are indicating that manufacturers are still cutting back on production but the pace of decline has eased considerably.

An interesting chart in The Economist showed that the JP Morgan global Purchasing Managers Index has jumped from just below 30at the end of last year to about 50. A reading above 50 suggests increased production, while a reading below 50 suggests cutbacks in production.

Maybe a V-shaped recovery for global manufacturers, with Asia leading the way, is shaping up. Some of this, however, has come from Japan, which is replenishing dwindling goods and may not be sustainable.

0 comments:

Post a Comment