Purchase Index stuck in neutral

Housing starts have jumped, new home sales just recorded the largest monthly increase in eight years, pending home sales are on an upward march, and existing home sales have been edging higher.

Even housing prices appear to be bottoming. But the weekly survey of mortgage applications continues to lag, and a miniscule drop in the Purchase Index is the latest in what can only be described as a disappointing trend.

Given the preponderance of evidence that seems to be signaling that housing has already hit a bottom and is starting to recover, the Purchase Index, which should be acting like a leading indicator, may not be capturing all of the activity in housing.

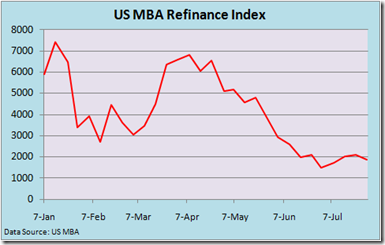

Refinancings down in week

The Refinance Index is well off highs recorded back in the spring and fell modestly in the latest week amid an uptick in mortgage rates.

Not surprisingly, higher rates discourage homeowners, and the boom we saw in March and April when rates dropped south of 5% for a 30-year fixed mortgage has faded.

0 comments:

Post a Comment