Here, I want to look at changes in some of the sub-components that make up GDP. Changes are on an annualized basis.

........1Q09........... 2Q09

- 0.6%........ -1.2%......... Consumption

- -50.5....... -20.4......... Gross private domestic investment (GDPI)

- -2.6 .............5.6.......... Government spending

- 0.44......... -0.88.......... Consumption

- –8.98...... -2.64........ GPDI

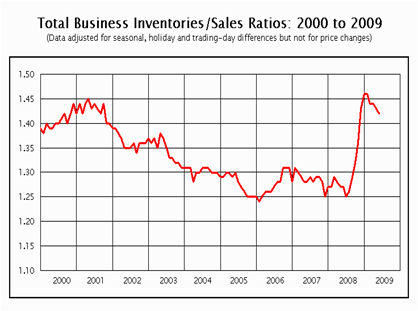

- -2.36........ -0.83......... change in inventories (sub category of GPDI)

- -0.52.......... 1.12......... Government spending

- 2.64............ 1.38......... Net exports of goods and services

The contribution provided by the balance of trade should not come as a surprise because the US trade deficit has narrowed, and exports improved in the month of May.

If we see another gain in exports in June, there is the possibility we could see an upward revision to GDP; however, inventories continue in a downward trend, which would detract from the broad measure of output.

Eventually, businesses will see the need to rebuild falling languishing stockpiles, which will aid economic activity.

One final point, the 50.5% decline in GDPI in 1Q is nearly incomprehensible. The drop in 2Q shows pressure is easing. But the contraction in manufacturing that we have witnessed highlights how badly the falloff in demand that followed the credit squeeze last year jarred manufacturers.