Tuesday, July 27, 2010

Jump in new home sales signals some stability in volatile market

New home sales bounced from a record low of 267,000 annualized units in May to 330,000 in June, beating most estimates. Following a near freefall after the expiration of the tax credit in April, the rise is an indication that that market may be starting to stabilize, which is welcome news for builders.

The sale of new homes benefitted tremendously from the extra cash the government gave buyers who signed contracts by April 30; however, many model homes resembled ghost towns in May because numerous buyers moved up purchases.

There has been plenty of volatility in the wake of the expiration of the tax credit, and the solid rise in June indicates buyers are starting to test the waters.

Still, sales are very low by historical standards and builder sentiment has taken a beating. Until foreclosures begin to subside, potential buyers no longer believe prices could decline, consumer confidence picks up and significant job creation begins, stability may be the best we can hope for in the near-term.

Thursday, July 22, 2010

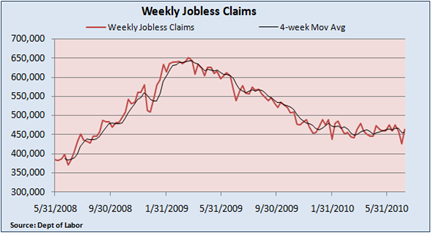

Weekly jobless claims back in narrow range

This week’s 37,000 increase to 464,000 puts claims back in the range its been since the end of last year. And per Bloomberg News, the Labor Department is blaming factors tied to the July 4th weekend for the drop one week ago.

In the meantime, continuing jobless claims, which have recently been on a roller coaster ride, declined by 223,000 to 4.43 million. The dip is welcome news, but the decline is more likely due to the expiration of standard benefits, rather than unemployed workers finding jobs.

Until weekly jobless claims embark on a downward trend, job creation is likely to be muted. Additionally, the steady but elevated trend in claims is among the clearest signs that the economic recovery thus far is modest at best.

Monday, July 19, 2010

Home builder sentiment hits the skids

Designed to measure home builder sentiment, the survey showed that builder confidence fell from 17 in June to 14 in July, the second-consecutive decline and the lowest reading since April 2009.

A level of 50 suggests builders are neither confident nor pessimistic about the market, which signals that gains earlier in the year, though encouraging, reflect a new home market that is far from healthy.

It’s no surprise, in my view, that National Association of Home Builders Chief Economist David Crowe said, “"This month's lower HMI reflects a number of underlying market conditions that builders are seeing, including hesitant home buyers, tight consumer credit, and continuing competition from foreclosed and distressed properties that are priced below the cost of construction."

However, he did concede that the pause in buying following the expiration of the tax credit is turning out to be “longer than anticipated” due to the sluggish pace of the recovery.

Crowe is cautiously optimistic, noting that “low mortgage rates, affordable prices, and demographic trends will help revive consumer demand for new homes this year.”

A quick comment on the final statement:

Thus far, record low mortgage rates and affordable prices have done little to inject confidence in the wake of the expired tax credit.

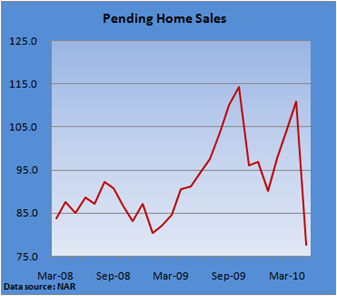

Pending home sales plunged in the latest month, and the weekly U.S. MBA Purchase Index, which did a great job in May foreshadowing the weakness in the housing market that was to come, continues to hover near a 14-year low.

Significant job creation and increased job security, a decline in foreclosures and a conviction among potential buyers that housing prices have stabilized or are even creeping higher are all part of the equation that will put a firm foundation under the still-troubled home market.

Saturday, July 17, 2010

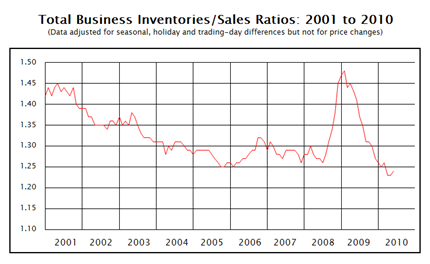

Business inventories pointing to slowing recovery

A tiny 0.1% rise in business inventories in May and a corresponding 0.9% decline in sales could be suggesting that the fast-paced expansion in manufacturing production may soon run its course, as the re-stocking needed to replenish bare shelves begins to fade.

The drop in sales resulted in a rise in the inventory-to-sales ratio from 1.23 to 1.24.

Granted, companies are still running lean and are not having to liquidate bloated stockpiles. But demand in the U.S. economy has softened recently, and recent surveys of the manufacturing landscape suggest that the sharpest increases in production are behind us.

At a time when –

- consumer demand is lackluster,

- government stimulus is beginning to fade while taxes appear set to jump next year,

- housing has weakened with the expiration of the tax credit and

- the inventory rebuilding cycle may be drawing to a close

The business cycle is entering a new phase – a slowdown in an already uneven recovery.

Economic fears level consumer sentiment

Nearly all economic indicators are showing that the recovery has entered a soft patch, and the slowdown in the already shallow recovery is beginning to darken the mood among consumers.

The Reuters/University of Michigan survey of consumer sentiment tumbled nearly 10.0 points to 66.0 in mid-July, far below the estimate offered up by Bloomberg of 75.0 and the lowest reading since last August.

It is not as if the unemployment rate has surged back above 10%. And though employment growth has been anemic, the economy stopped shedding jobs late last year.

Still, there are a number of factors that are depressing consumer attitudes, including a falling stock market, a weak housing market, concerns about housing prices, and of course, continued insecurities in the labor market and the obstacles that persist in seeking employment.

Though not directly affecting consumers, the persistent federal deficit, problems overseas and the divisive spirit that has invaded the political arena are all having an indirect impact on sentiment.

I am not in the camp that expects a rare double dip recession, but the erosion in consumer sentiment is something to be concerned about.

If unexpected weakness in retail sales is reflected in the languishing survey of consumer confidence, calls for a new round of economic stimulus will grow. And we could see new moves by the Fed.

With interest rates near zero, quantitative easing by the central bank – hinted at in the latest FOMC minutes – would seem to be the most likely path.

Thursday, July 15, 2010

Regional manufacturing slows

Empire and Philly Fed suggest steep rebound may be abating

The slowdown in spending by consumers and the soft patch in the broad-based service sector are starting to spread to the fast-paced recovery in manufacturing. The Empire Manufacturing Index fell 15 points in July to 5.1, while the Philly Fed Index decreased from 8.0 in June to 5.1 in July. A reading above zero signals an expansion.

First, the Empire survey, which looks at New York.

New orders and shipments slowed, while a rise in inventories suggests that a pullback in sales may be allowing goods on hand to perk up a bit. That could give GDP a boost in the short run but may also translate into a moderation in production.

Manufacturers are still adding to staff, but the rate decelerated, while the average workweek declined for the first time since December.

Despite the pause in activity, businesses in the New York region remained fairly optimistic in July compared to June, signaling that most manufacturers are not anticipating an outright slump in activity.

Philly Fed also measuring a slowdown

The Philly Fed Index, which looks at manufacturing in the mid-Atlantic region, shows activity continues to expand, but the rate of growth has slowed over the past two months.

New orders turned negative for the first time in a year, indicating that the pullback in production will likely continue through the short-term, while shipments decelerated.

A little more worrisome was the steep decline of 15.2 points in the six month outlook to 25.0.

Both surveys are not signaling a recession and tend to be more volatile than the national index released by the Institute for Supply Management. However, the Philly Index did a great job of turning early in both the 2001 and the current recession.

A prolonged period of weakness would be something to be concerned about.

Thursday, July 8, 2010

Housing is in a funk

The expiration of the housing tax credit has left a gaping hole in housing sales. The Purchase Index released weekly by the U.S. Mortgage Bankers Association first pointed to a severe pullback in sales, and this week’s report from the U.S. MBA is not very encouraging.

The Purchase Index, which looks at applications to buy homes, dipped 2% in the latest week and is now down in eight of the last nine weeks. Even record low mortgage rates that are hovering well below 5% for a 30-year fixed loan have failed to encourage buyers.

A stronger economy, significant job creation, waning foreclosures and a sense that the decline in housing prices is over are among the major factors needed to place a solid foundation under a shaky market.

Weekly jobless claims fall but hold the applause

Some good news for a change on the employment front – weekly initial jobless claims fell 21,000 to 454,000, the 4-week moving average dipped by 1,250 to 466,000, and continuing claims plunged 244,000 to 4.4 million.

However, let’s not get too excited, as some did today, about one week’s worth of data. As the chart above reveals, claims have been hovering in a narrow range for several months.

The uneven recovery did cool some in June and any further moderation would likely stymie any downward trend that might be ready to develop in jobless claims. The drop in weekly claims is welcome and is obviously preferred to a 21,000 increase in the volatile series.

Still, let’s wait a few more weeks in order to determine if we are finally breaking out of the narrow range.

Thursday, July 1, 2010

Pending home sales crumble

What the U.S. Mortgage Bankers Association Index has been suggesting appears set to happen. The end of the home buyers tax credit that encourage a new burst of sales in the spring has given way a huge drop off in expected sales.

The Pending Home Sales Index fell 30.0% in May to 77.6. The index, which looks at contracts signed but not yet closed for existing homes (or over 90% of sales), is signaling a huge drop in the near term, as the government in no longer providing that big cash incentive.

Clearly, consumers took advantage of the tax credit and moved their purchases forward, accounting for the big decline.

Others remain unconvinced that the economy will improve noticeably and remain fearful over their jobs, blunting the tailwind from the record low mortgage rates we’ve been seeing.

Even if the tax credit is renewed, data suggest that much of the low hanging fruit has been picked and a new credit might not provide quite the bang as the prior deadlines have – November 30 and April 30.

Until the overhang of foreclosures is dealt with and the economy begins to create employment, housing could struggle through much of the year.

Manufacturing slows but still expanding

The ISM Manufacturing Index fell but activity still shows that the sector is in a recovery.

Details at Examiner.com.

Weekly jobless claims underscore labor market weakness

A 13,000 increase in weekly jobless claims to 472,000 highlights how tenuous conditions are in the labor market and also points to the uncertainty many businesses still feel, even as the economy slowly recovers.

The 4-week moving average rose by 3,250 to 46.6500.

As the chart above reveals, there has been little progress since the beginning of the year. More worrisome, claims have actually trended higher over the past two month.