A tiny 0.1% rise in business inventories in May and a corresponding 0.9% decline in sales could be suggesting that the fast-paced expansion in manufacturing production may soon run its course, as the re-stocking needed to replenish bare shelves begins to fade.

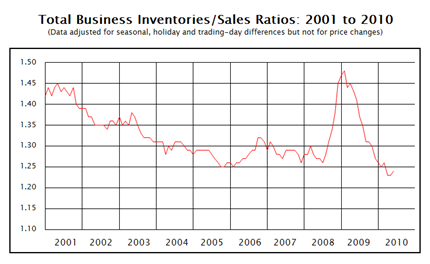

The drop in sales resulted in a rise in the inventory-to-sales ratio from 1.23 to 1.24.

Granted, companies are still running lean and are not having to liquidate bloated stockpiles. But demand in the U.S. economy has softened recently, and recent surveys of the manufacturing landscape suggest that the sharpest increases in production are behind us.

At a time when –

- consumer demand is lackluster,

- government stimulus is beginning to fade while taxes appear set to jump next year,

- housing has weakened with the expiration of the tax credit and

- the inventory rebuilding cycle may be drawing to a close

The business cycle is entering a new phase – a slowdown in an already uneven recovery.

0 comments:

Post a Comment