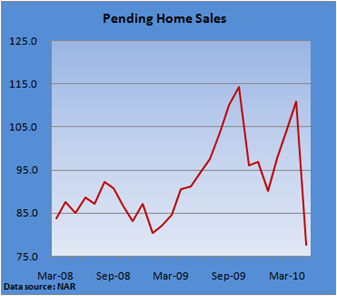

What the U.S. Mortgage Bankers Association Index has been suggesting appears set to happen. The end of the home buyers tax credit that encourage a new burst of sales in the spring has given way a huge drop off in expected sales.

The Pending Home Sales Index fell 30.0% in May to 77.6. The index, which looks at contracts signed but not yet closed for existing homes (or over 90% of sales), is signaling a huge drop in the near term, as the government in no longer providing that big cash incentive.

Clearly, consumers took advantage of the tax credit and moved their purchases forward, accounting for the big decline.

Others remain unconvinced that the economy will improve noticeably and remain fearful over their jobs, blunting the tailwind from the record low mortgage rates we’ve been seeing.

Even if the tax credit is renewed, data suggest that much of the low hanging fruit has been picked and a new credit might not provide quite the bang as the prior deadlines have – November 30 and April 30.

Until the overhang of foreclosures is dealt with and the economy begins to create employment, housing could struggle through much of the year.

Manufacturing slows but still expanding

The ISM Manufacturing Index fell but activity still shows that the sector is in a recovery.

Details at Examiner.com.

0 comments:

Post a Comment