Ataman Ozyildirim, economist at The Conference Board, said, “November’s sharp increase in the LEI, the fifth consecutive gain, is an early sign that the expansion is gaining momentum and spreading.

"Nearly all components rose in November. Continuing strength in financial indicators is now joined by gains in manufacturing and consumer expectations, but housing remains weak.”

Ken Goldstein, also an economist at The Conference Board, added, “The U.S. economy is showing some sparks of life in late 2010. Overall, the indicators point to a mild pickup after a slow winter. Looking further out, possible clouds on the medium term horizon include weaknesses in housing and employment.”

The latest rise is a hopeful sign that the burgeoning economic recovery might be broadening and gaining momentum heading into early 2011. With the uncertainty about the tax situation out of the way and a two percentage point cut in the social security taxes assured, the outlook is set to improve even further.

However, a bit of caution is in order.

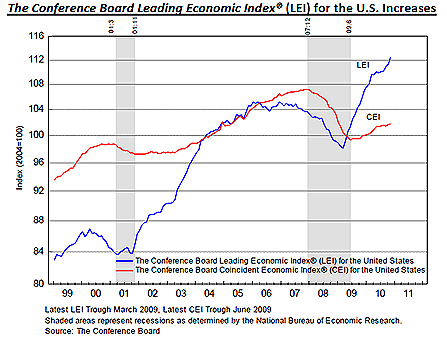

The LEI did an excellent job of turning up just a few months before the recession ended, signaling the impeding recovery but the strong rise in the LEI has not been matched by activity in the real economy (see chart).

Likely reason: the interest rate spread and stock prices, which make up two of the ten components, have performed in a way that suggests a solid economic recovery would be on the horizon.

But these historical indicators of future activity, which normally might provide a sneak peek going forward, are more intangible indicators of what might be coming down the road.

Rising money supply may have also contributed to big rise in the LEI.

In the meantime, the Coincident Economic Index (CEI), which measures current economic activity, has done a good job of capturing the fragile economic recovery that has been in place for over a year. The CEI rose 0.1% last month, following a 0.2% increase in October and a 0.1% decline in September.

0 comments:

Post a Comment