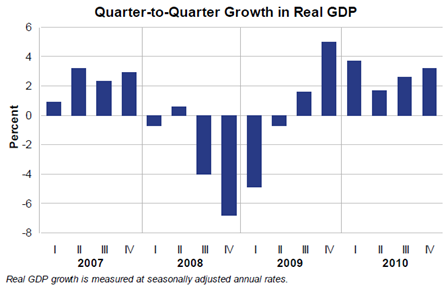

At first glance, the 3.2% annualized increase in GDP appears to be a disappointment since economists surveyed by a number of organizations had forecast 3.5%.

However, a steep decline in inventories, which detracted 3.7 percentage points from growth, masked what was otherwise a rather impressive report.

(supplied by the BEA)

Consumer spending accounted for 3 percentage points of the increase and rising exports added another full percentage point. Real final sales, which excludes changes in inventory, grew a very robust 7.1%, the best gain since the second quarter of 1984!

Nonetheless, the Fed made it clear on Wednesday it remains unconvinced that the recent improvement in the economy will be enough to take a significant bite out of the jobless rate, and it sees no need to alter its plan to pump hundreds of billions of dollars into the economy.

Moreover, the advance data showed that core inflation rose at an annual rate of only 0.4% in the final quarter of the year, which is well below the Fed’s comfort zone of near 2%.

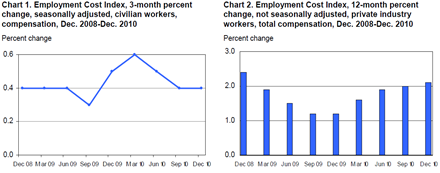

Labor costs, a key component in the inflation equation and something the Fed closely follows, haven’t changed much in recent quarters, so the argument from policymakers that rising prices won’t be an issue in the short term has some credence to it.

(supplied by the BLS)

Inflation could become a problem down the road, but that is not the Fed's immediate concern since it believes it can craft and implement an exit strategy before inflationary pressures build through the economy.

Looking ahead, any easing in already tight credit conditions could unleash more pent up demand, which would continue to boost output. Plus, the contraction in inventories, which weighed on GDP, might actually fuel gains later in the year, as businesses re-stock shelves in order to meet both global and domestic demand.

(click to enlarge)

No doubt about it, headwinds remain, such as housing, sovereign debt worries in Europe and a reluctance among banks to lend, but the recovery is broadening and accelerating, which, if history is any guide (see chart and 30-year history above), should encourage companies to boost hiring.

Separately, a look at today’s advance GDP number is also available at Examiner.com.

0 comments:

Post a Comment