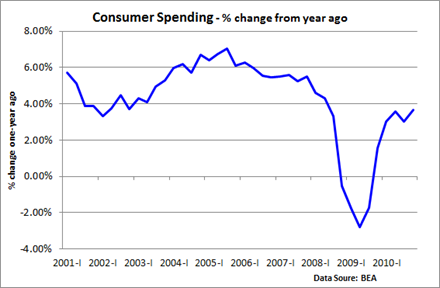

Consumer spending jumped a better-than-expected 0.7% in December. But a respectable 0.4% rise in personal income was not enough to fuel the impressive jump in outlays, as consumers tapped into savings, knocking down the personal savings rate from 5.5% in November to 5.3% in December.

The economic recovery has been uneven and fragile since the recession officially ended back in the summer of 2009. Manufacturing and the rebuilding of depleted inventories, along with growth in China and emerging markets, has supported the U.S. economy.

But housing has faltered and consumers, who drive 70% of economic activity, have been reluctant to part with their dollars amid job insecurities.

Sovereign debt worries in Europe brought about instability in the financial markets last summer, cooling what was already a weak recovery and raising fears that the U.S. economy might be headed for a double-dip recession.

Growth, however, resumed in the fall as financial markets calmed and a new round of quantitative easing by the Fed lifted commodity and stock prices.

Now it appears that consumers are finally doing some of the heavy lifting necessary to put the economy on a self-sustaining path.

Price stability

Retail inflation, which looms as a possibility longer-term, is showing no signs of bubbling up at the present time.

The core Personal Consumption Expenditures Index, which is a broad look at the price level and is closely followed by the Fed, continued its downward drift, dropping from 0.8% year-over-year (y/y) in November to just 0.7% y/y in December.

With unemployment above 9% and retail inflation stuck at an uncomfortably low level for the Fed, don't expect the Fed to hint at an exit strategy any time soon.

0 comments:

Post a Comment