One-time factors mostly to blame

The

Producer Price Index, which measures inflation at the wholesale level, jumped by 0.8% in January, as energy continued its fourth consecutive double-digit annualized increase, rising 1.8%. Increases in food prices, however, eased to 0.3%.

The core rate of inflation (minus food and energy), which has been well under control, perked up a bit to start the new year, rising a faster-than-forecast 0.5%, the largest rise in over two years. More on that in a moment.

Year-over-year, the PPI actually eased from 4.1% to 3.7%, while the core rate rose for the second straight month, increasing from 1.4% to 1.6%. Still, core inflation remains under control, though prices have bottomed.

In the meantime, intermediate goods increased 1.1% and core intermediate goods rose 1.0%. Crude goods, which look at prices at the early stages of production, jumped 3.3%. Core crude goods were up a more worrisome 4.0%.

Looking at the chart above, price pressures for intermediate goods remain generally modest and stable, arguing against the idea that the wholesale inflation genie is coming out of the bottle.

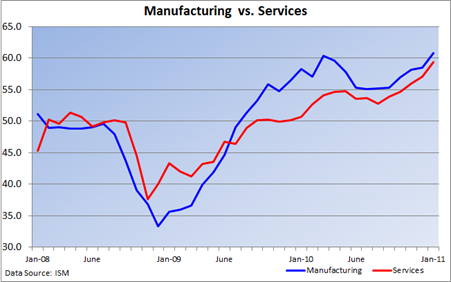

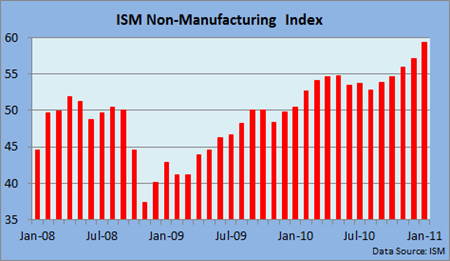

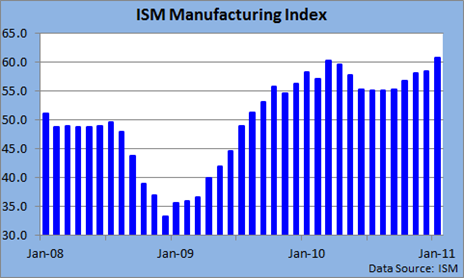

Somewhat surprisingly, especially given the strong gains in commodity prices and manufacturing surveys that reveal an acceleration in price pressures at the initial stage of production, the rate of increase in crude goods has eased significantly over much of last year (see chart below), which may eventually mute some, but not all, of the pressures that have been growing in the pipeline.

Turning back to the monthly data, forty percent of the 0.5% rise in core inflation can be traced to a 1.4% rise in “pharmaceutical operations,” according the the government’s report.

This suggests that we may see some moderation in upcoming months since the overall rise was not broad-based. Additionally, the PPI is subject to greater swings than the retail price data, so a large rise, or for that matter an unexpected drop, shouldn’t be taken out of context.

Consequently, talk today that the seeds of an inflationary trend are beginning to sprout are premature in my opinion. That rings even louder when what's happening at the earlier stages of production are taken into account.

Furthermore, wage increases, which makes up the bulk of costs for most businesses, are still very mild, and the economy has plenty of excess capacity, making it difficult for businesses to implement all but the smallest price hikes.

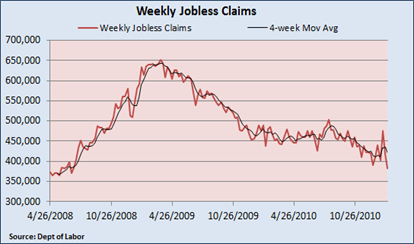

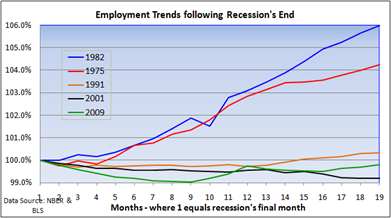

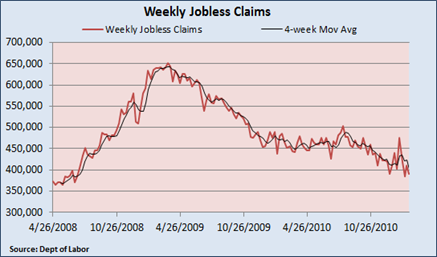

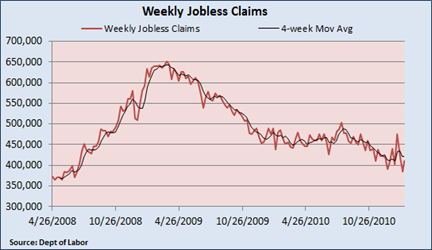

Inflation risks are likely to grow, however, if the recovery picks up steam, and the Fed is slow to enact and exit strategy. With employment gains still weak, don't expect any changes in Fed policy or hints of any changes in the near term.

![[image[26].png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh6nM4Ldx4GEUw7D23VSekgpfgO9oxJGXBb1aKL0ZR1PLDiww0GTyioyDtjw3HnnY1E4XSus9FPVI4nyQDxIwsndvRb8SulkhrUiTaPyfyOZM_e2Br3_o1KftFxfC9msDovCLaVed-zmnE/s1600/image%5B26%5D.png)