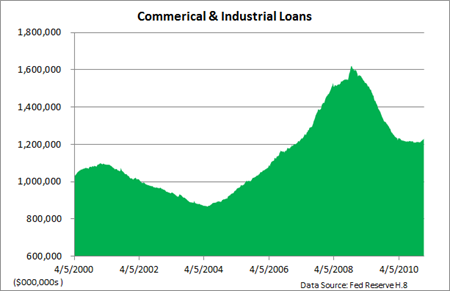

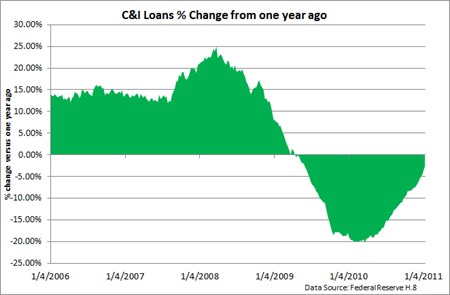

In fact, the latest Federal Reserve data showed that commercial and industrial loans grew at a seasonally adjusted annual rate of 7.6% in December, following a 0.2% annualized increase in November, the first rise since the recession ended over 18 months ago.

However, excess reserves (defined as funds that are over and above what banks are required to hold for emergency needs) once again surpassed $1 trillion according to the latest data, indicating that banks remain cautious.

In order to promote growth and encourage hiring, the Federal Reserve recently embarked on a second round of quantitative easing (QE2) and plans to purchase an additional $600 billion in longer-term Treasury securities.

Some of the extra cash may find its way into booming emerging markets and commodities, while some funds are ending up in stocks. And a portion of the proceeds appear to be ending up at the banks themselves.

But banks are flush with extra cash, and it seems that most would rather hold the excess dollars at the Fed, earning a paltry 0.25%, rather than take a chance on a riskier business loan.

Nonetheless, the frozen tundra that marked the credit markets during the worst of the recession is beginning to thaw, while sentiment is shifting, commercial loans are inching higher, and banks, if they choose, have plenty of funds on hand to fuel lending and the expansion.

0 comments:

Post a Comment