Consumer spending is up and output at the nation’s factories continues to expand, but so far, the broadening recovery has not spilled over to housing and construction.

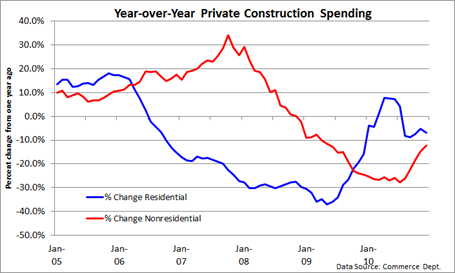

Construction spending in December fell 2.5% to $787.9 billion. Residential construction, which the charts below focus on, dropped 4.1% to $226.4 billion. Private nonresidential construction dipped 0.5% to $260.5 billion.

With a backlog of foreclosures threatening to boost inventory, coupled with a cautious home buyer, the slump in spending that began in early 2006 seems likely to continue into its fifth year, lending little support to GDP.

If there is a silver lining to what’s going on in housing, residential real estate makes up a much small percentage of GDP than it did in early 2006 when the slump in spending began.

0 comments:

Post a Comment