The 49,000 rise in manufacturing employment in January speaks favorably to the argument that faster growth can and will create jobs. But manufacturing, which tends to exaggerate upward as well as downward trends in the economy, makes up only a small portion of economic output in the U.S.

The service sector, which makes up a majority of economic activity, has experienced a much slower and uneven expansion, and the fruit of such a recovery has been lackluster job growth.

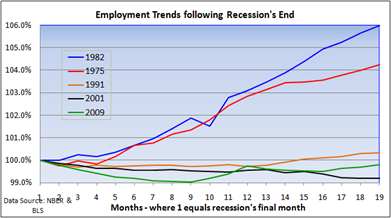

Note: the fast turnaround seen after month 9 came amid the temporary jobs added for the 2010 census; weakness following week 13 came as the temporary census positions came to an end. Additionally, all annual revisions released in today’s data have been incorporated.

The chart above highlights the uncertainty we’ve been seeing in the labor market, as companies continued to shed workers for nine months after the recession ended. Only in recent months has the sluggish pace of employment growth exceeded the weakness seen following the end of the mild recession of 2001.

Adding to the misery facing many of the unemployed, the level of employment is still not back to where it was when the recession ended let alone anywhere near its former peak!

For comparison purposes, the second chart highlights the much more robust recoveries that followed the steep recessions of 1974-75 and 1981-82 and the subsequent job growth.

Moving back to the present, much of the recent data is suggesting that an acceleration in economic activity that began late last year is continuing into 2011. And continued growth will eventually encourage employment growth.

The big question is when, and I’m still optimistic that this will occur sooner rather than later. A look at the latest ISM employment indices reveals that most firms are beginning to create new jobs.

One thing that is certain, the latest employment data will do nothing to discourage the Fed from bumping up interest rates nor encourage the Fed to rein in its plan to buy $600 billion in longer-term Treasuries.

And don’t expect fears of inflation that have been emanating from some corners to take center stage at the central bank.

Commodity prices are at elevated levels, which the Fed acknowledged in its latest statement, but with core inflation below 1% and job growth mostly lackluster, don’t expect any additional warnings on prices, which would likely be interpreted as a signal of an impending shift in policy.

0 comments:

Post a Comment