Retailers in some districts also mentioned they had implemented price increases or were anticipating such action in the next few months.

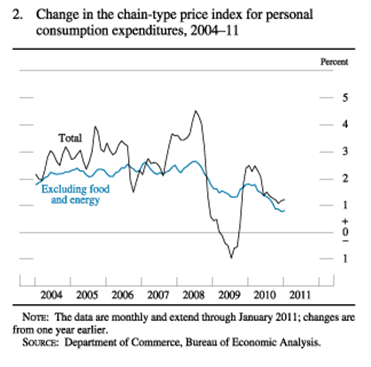

Core inflation remains very low, as evidenced by the chart provided in yesterday’s Monetary Report to the Congress.

However, commodity prices have been in a strong upward trend, and regional and national manufacturing surveys have revealed that firms are being pinched by much higher raw material prices.

Nonetheless, policymakers at the Fed still see plenty of slack in the economy, while wages, the largest expense for most businesses, have moved either sideways or marginally higher. And yields for long-term Treasuries, which would be reacting if investors were sensing a spike in inflation, have been well-behaved.

As a result, the latest forecasts by the Fed show that core inflation is expected to creep upward but not exceed 2.0% by the year 2013.

Much of their optimism is based on the fact that longer-term inflation expectations remain anchored, but I sense their attitudes toward price stability may be too sanguine.

Still-high commodity prices and surging gasoline prices in recent weeks do threaten to undermine some of the confidence that consumers have regarding price stability.

Core inflation has likely bottomed and February’s 0.2% rise in the core rate was the fastest increase in 15 months. By itself, a 0.2% monthly increase does not mean much, but the best news on inflation is probably behind us.

If we begin to see a modest uptick in core prices (odds, though declining, don’t favor this scenario), Fed Chairman Ben Bernanke would find himself in a very difficult predicament, having to choose between a tighter policy, even as unemployment remains high, or keeping the monetary pedal-to-the-metal in the face of rising prices.

Given current political realities, it seems unlikely the Fed would turn its guns on inflation.

0 comments:

Post a Comment