Worries about the nuclear disaster in Japan and the surrounding uncertainty sent stocks sharply lower at the beginning of the week, but shares managed to limit losses by Friday.

With the economic data taking a backseat to global events, I wanted to take a moment and look at a couple of important releases during the week.

First, weekly jobless claims tumbled 16,000 to 385,000. With seasonal factors out of the way, the reassuring decline indicates that the labor market continues to slowly heal as the pick up in economic activity hinders layoffs. So far, the jump in gasoline prices is not doing much to slow the recovery.

Second, a quick overview of retail inflation.

Not surprisingly, the Consumer Price Index jumped 0.5% in February amid a 3.4% rise in energy costs and a 0.6% rise in food. Energy has jumped by more than 1% in six of the last seven months, and the latest surge in gasoline prices last month continues to push energy higher.

Food is a different matter. Agricultural costs began their upward climb last year, but the CPI didn’t detect rising retail prices until January. Given the steep rise in energy and the increase in food prices, the jump in the year-over-year headline rate is to be expected.

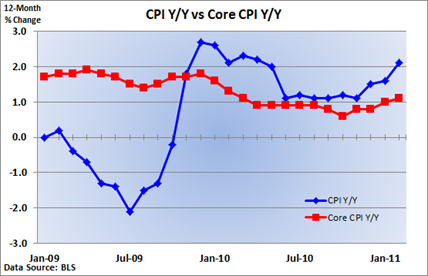

However, the Fed tends to throw out food and energy costs when it looks at price stability, and core inflation, though ticking higher, remains well-behaved on a year-over-year basis.

Nonetheless, a note of caution is warranted. The core rate has risen 0.2% in both January and February. Not a big deal except prior to January, we had to go back to October 2009 before we saw prices rise at that rate.

That’s still modest but the CPI is beginning to detect a slow acceleration in inflation, as the recovery picks up steam and steep increases in raw material prices are slowly passed on to consumers.

As I mentioned last month, the best news on inflation is behind us. But I’d be careful about betting on any tightening in Fed policy at this juncture, especially given the uncertainty that has crept into the economic outlook in recent weeks.

0 comments:

Post a Comment