The recovery is finally kicking into high gear, as evidenced by much of the economic data out recently – see the latest ISM surveys and falling jobless claims, which I’ll discuss shortly. But the government’s monthly release of nonfarm payrolls has been agonizingly slow to detect that the labor market is benefiting from the improvement in economic activity.

So with the government’s labor report out tomorrow, I wanted to take some time to review what other measures of the job market have been detecting, and much of it has been positive.

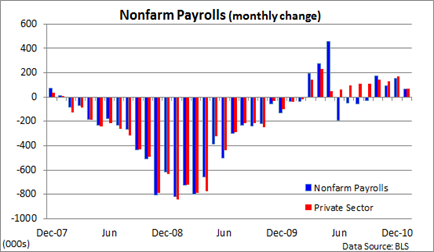

As the first chart below reveals, we did see a spike in hiring earlier last year, but that was tied to the temporary jobs generated by the 2010 census, which was then followed by four months job losses as those positions came to an end.

Further, the last three months have been disappointing, despite the drop in the unemployment rate, which is derived from the household survey of families, as opposed to nonfarm payrolls, which comes from the establishment survey of companies.

Private-sector growth, however, has been more consistent but not enough to instill confidence in most job seekers.

Fewer are joining the ranks of the unemployed

Weekly jobless claims is released each week and is one of my favorite economic indicators because of its timeliness and how accurately it measures business confidence.

Falling claims tells us that fewer individuals are entering the ranks of the unemployed, but it does not necessarily suggest that firms are ratcheting up on hiring.

What it does say is that business confidence is improving, as companies choose to hang onto their employees amid an improvement in the business climate. And an improving business climate is a key part of the hiring equation.

ADP is detecting movement

Moving along, the ADP survey of the private sector, unlike the nonfarm payroll survey, has been detecting job growth.

As evidenced by the chart below, job growth has improved in the private sector in four of the last five months in response to faster economic activity.

Nonetheless, most analysts, economists, investors and politicians want to see a confirmation from government data that a renewed vigor in hiring is at hand.

Meanwhile, the Fed Chief Ben Bernanke said in his semiannual Monetary Policy Report to the Congress on Wednesday that “we do see some grounds for optimism about the job market over the next few quarters,” including as “improvement in firms' hiring plans.”

The ISM is seeing growth

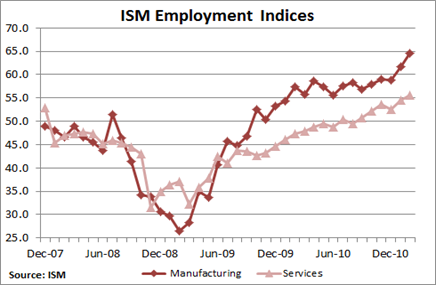

A look at the sub-components of the ISM manufacturing and service surveys does reveal that companies are in the process of ramping up hiring.

In fact, hiring among manufacturers is now at the highest levels since the early 1970s (see last chart) , while service industries, which make up most of the activity in the U.S. economy, have also been showing signs of life in recent months (see chart below). A reading above 50 suggests companies are adding employees.

In a sign that the production side of the U.S. economy is firing on all cylinders, the final chart below, which looks at data going back to 1965, provides indisputable evidence, in my view, that U.S. manufacturers are experiencing hefty increases in demand and are responding with plenty of '”help wanted signs.”

Still, the economy is dominated by the service side so it is encouraging to see the ISM services survey detect a renewed interest in bringing folks aboard.

Looking ahead, tomorrow’s release of nonfarm payrolls is expected to show that the economy generated about 180,000 new jobs. Anything just short of 200,000 would be encouraging, however, it's important to point out that forecasters have been too optimistic in recent months. To be fair, the monthly number is very difficult to pinpoint.

Still, based on the evidence that economic activity is accelerating, the recovery is broadening and surveys of the labor market are pointing in the right direction, it’s only a matter of time before the nonfarm payroll survey reflects what’s going on in the economy in my view.

0 comments:

Post a Comment