Source: Federal Reserve Bank of Philadelphia

Most of the subcomponents in the index declined, suggesting a broad-based slowdown is continuing into May.

New orders, a proxy for future activity, fell from 18.8 to 5.4 and shipments slid from 29.1 to 6.5. Price pressures remain but receded amid the recent dip in commodity prices.

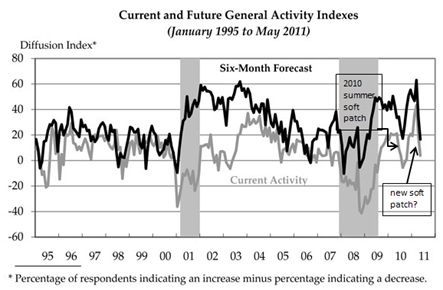

In the meantime, manufacturers are less optimistic going forward, according to the six-month outlook, with the index falling from 33.6 to 16.6.

Industrial production last month was unchanged, as the kink in the supply chain caused by the earthquake in Japan hit auto manufacturers last month.

Given the early look at May’s data, it appears that softness is the sector is continuing.

Jobless claims fall but remain elevated

Despite the recent spate of unsettling economic news, the second weekly decline in unemployment claims indicates that economic activity is not grinding to a halt.

Weekly initial jobless claims fell 29,000 in the latest week to 409,000, while the 4-week moving average edged up 1,250 to 439.000. Continuing claims slid 81,000 the 3.71 million.

Special factors that were not accounted for in the seasonal adjustments were responsible for the surge to 478,000 claims a couple of weeks ago.

Although the recent decline to the lowest reading in four weeks is reassuring, the elevated level – claims have been above 400,000 for six weeks – suggests the recent progress in the labor market may slow.

And the upward drift also implies the economy has hit a bump in the road.

0 comments:

Post a Comment