Since Congress has not raised the debt ceiling, the U.S. Treasury Department put a plan into motion that will stave off any default for about 11 weeks.

In the meantime, Democrats hope to raise the debt limit and prevent a default, while Republicans hope to extract spending concessions in order to rein in the burgeoning federal deficit.

Both sides appear to be far apart, but given the recent dip in Treasury yields, investors aren't betting on a default.

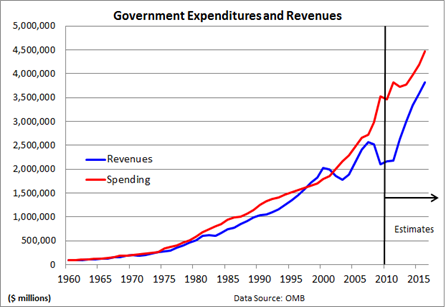

Still, the headlines provide us with the opportunity to look at the growing federal deficit (chart 1), spending and revenues as a percent of GDP (chart 2), and an overall view of spending and tax receipts (chart 3).

The surge in spending and the huge drop in revenues was tied to the worst recession since the 1930s. The Office of Management and Budget’s numbers do point to a narrower deficit through 2016, but its economic and employment forecasts appear to be a bit aggressive.

Notably, the CPI is up almost 30% since 2000, according to government data, but spending has surged more than 100% over the past decade.

0 comments:

Post a Comment