There weren’t any big surprises to come out of the Fed’s press release that followed the conclusion of its two-day meeting.

The FOMC acknowledged the slowdown in the economy, telegraphed that interest rates aren’t going higher anytime soon, will no longer expand its balance sheet and believes the growth will eventually accelerate. A cut and dry look is available at Examiner.

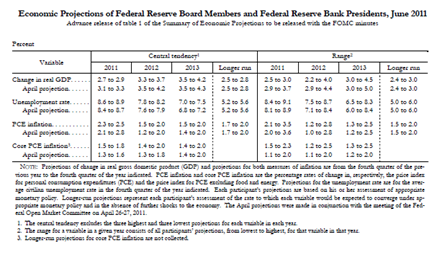

(Source: Fed)

Further, the Fed also cut its forecast on GDP growth for the second time this year. Unfortunately, the FOMC expects unemployment to remain uncomfortable high through the end of 2013.

(Source: Fed)

What did seem to catch the markets off guard occurred in the press conference that followed the FOMC meeting.

The Fed noted in its press release, “The slower pace of the recovery reflects in part factors that are likely to be temporary, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan.”

'In part' implies there were other factors impacting the economy and an astute reporter quickly picked up on this, asking what else might be responsible for the sluggish recovery.

Bernanke responded that monetary officials don’t have a precise read as to why slower pace is persisting. But some of the headwinds that are of concern included “weakness in the financial sector, problems in the housing sector, balance sheet and deleveraging issues.”

He added that some of these headwinds may be stronger and more persistent than “we thought.”

Of course, questions about Europe and Greece surfaced and the potential impact on the U.S.

Bernanke said the Fed has been “very assiduous” in examining the exposures financial institutions have countries that have been plagued by debt issues.

U.S. banks are not significantly exposed to those countries, including Greece, as direct exposure is “pretty small.” Exposure is larger in the more stable countries, such as Germany and France.

The same holds true with money market funds. Exposure is minor in peripheral countries but there is substantial exposure in European banks in so-called core countries, Germany, France etc.

Not surprisingly, Bernanke said a disorderly default would “no doubt roil financial markets globally would have a big impact on credit spreads (thus far, its been minor), stock prices and so on. Effects in US would be quite significant.”

It’s the disorderly default the Fed is hoping to prevent.

Bernanke to economy: You're on your own

Well, Bernanke didn't utter those words, but one has to ask, "What has the Fed chairman done?"

Bernanke took credit for eliminating the small but growing threat of deflation that was emerging last summer and noted that job creation picked up amid the QE2 bond purchases.

Other than that, the Fed chairman seemed more like a deer in the headlights, conceding that growth is slowing and some of the causes may be more than temporary.

He offered little solace to those of have been heavily impacted by job losses or those who've yet to see stock and retirement portfolios fully recovery from the 2008-09 bear market.

In other words, monetary policy has its limits.

0 comments:

Post a Comment