The core rate of inflation, which minuses out food and energy, rose by 0.2%, in line with forecasts.

Year-over-year, the headline rate of inflation at the wholesales level rose from 6.6% to 7.0%, the fastest increase since July 2008. Removing food and energy, the y/y rate held steady at a more modest 2.1%.

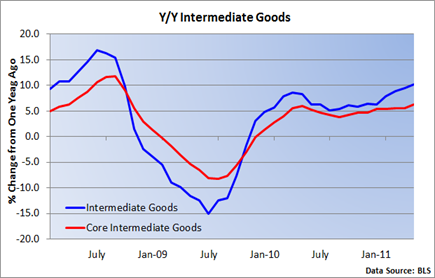

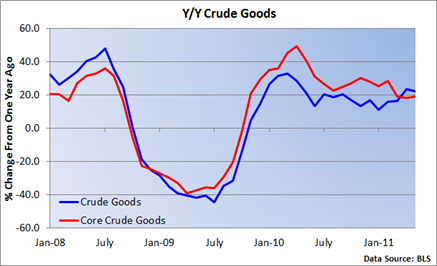

Taking a look at the second and third charts, we’re still seeing price pressures at the early stages of production.

However, the recent slowdown in the economy is going to make it difficult for most producers to fully pass along higher costs. Not that some won’t attempt price hikes, but attention has now shifted away from inflation to the recent weakness in the economy and the sharp slowdown in job creation.

Oil has fallen from its recent peak and gasoline prices are down about 25 cents per gallon, according the latest EIA survey.

If commodity price remain well behaved in the coming months, pricing pressure at the early stages of production should begin to subside.

Any lessening of commodity inflation would give the Fed more leeway to maintain interest rates at rock bottom levels, but as Fed Chief Ben Bernanke said last week, monetary policy alone is not enough to get the recovery back on track.

0 comments:

Post a Comment