That’s good news for consumers – at least short term as the IEA’s press release appears to have had its intended effect.

But all is not OK in the world oil markets.

First, the move almost smacks of desperation, as the world economy slows under the pressure of weak U.S. growth, debt worries in Greece and a modest slowdown in China.

An interesting and unsettling side note: stocks did not react favorably to the drop in crude prices, and instead continued to a sell-off that was tied to Bernanke’s sobering economic remarks made yesterday afternoon.

Second, the unrest in Libya has taken about 132 million barrels of light, sweet crude off the market up through the end of May per the IEA.

And despite talk by Saudi Arabia that it would make up the difference, the announcement suggests otherwise.

But the temporary increase in oil production is just that – temporary, and it’s possible that a further downward slide in prices could be met by a quiet cutback in OPEC or Saudi production.

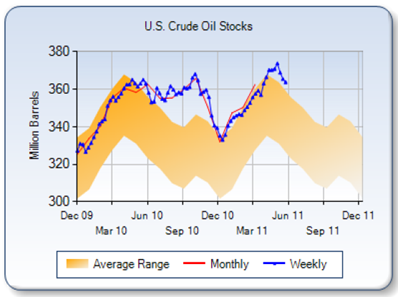

Moreover, the US market is well supplied with crude at the present time, as the chart from the EIA reflects.

Consequently, the pullback in prices may turn into a more temporary phenomenon.

Additional supply disruptions or still weaker economic growth will very likely have more of an impact on prices down the road than today’s news.

0 comments:

Post a Comment