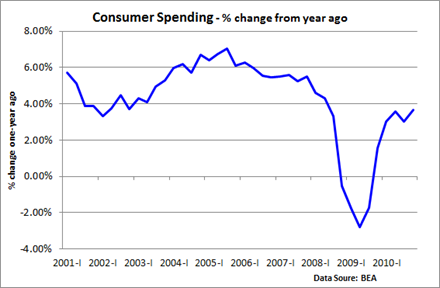

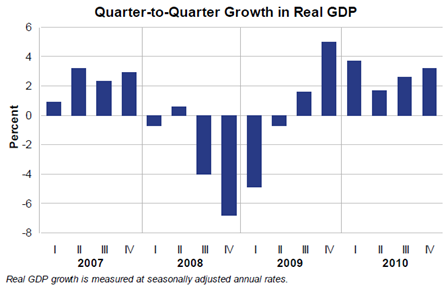

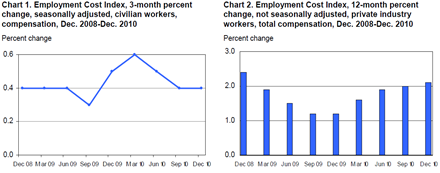

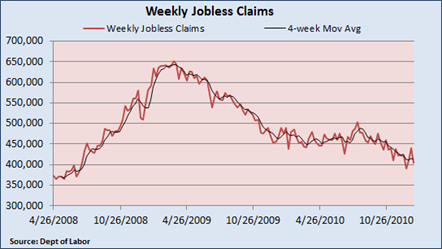

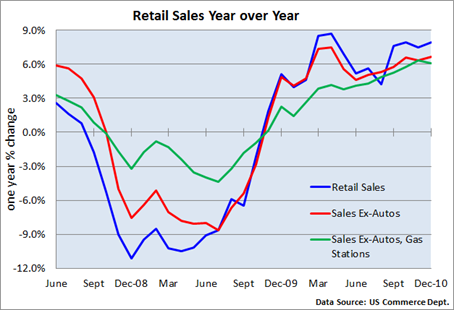

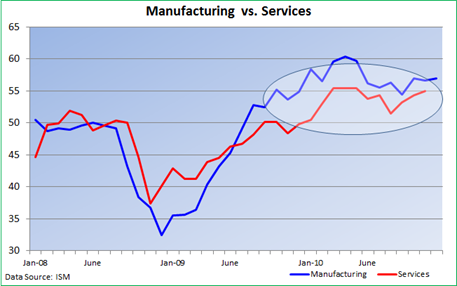

The gradual economic recovery that many of us are witnessing has been slow and uneven for much of the last 18 months, as evidenced by the stubbornly high rate of unemployment. But recent data suggest that the recovery is accelerating and broadening.

The

service sector is displaying a renewed vigor,

retail sales are growing, and more importantly,

weekly jobless claims are in a downward trend. And the dip in layoffs appears to be boosting consumer confidence according to a report released by the Conference Board today (see my piece on Examiner entitled

Consumer confidence jumps to eight month high).

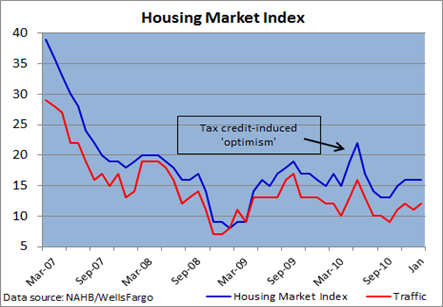

Despite the improvement in a growing number of sectors of the economy, housing continues to muddle near the bottom amid the lack of any meaningful job creation, fears over the direction of prices, tight credit and the still high-level of foreclosures that continue to weigh on the market.

Brand spankin’ new – a look at new homes for sale

Housing starts, which directly impact GDP, fell 4.3% last month to a seasonally adjusted annual rate of 529,000 units. Starts among single-family units fared even worse, dropping 9.0% to 417,000 units. News, however, was a little bit better when building permits, which are more forward looking, were taken into account.

Though single-family permits have fallen from the near-term high early last year (see chart above) that was aided by the home buyers tax credits, it does appear the market is stabilizing and even edging higher. Still, there is little reason for a burst of enthusiasm, as the market continues to glide along the bottom.

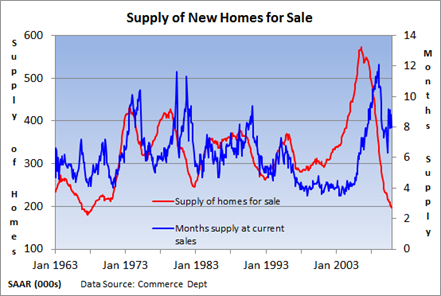

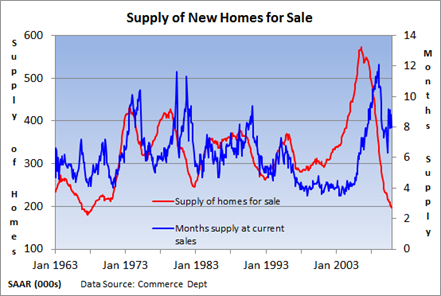

Thin inventory...sort of

One factor that favors an uptick is the near absence of homes available from builders. As the second chart below reveals, the absolute number of houses for sale from builders is at the lowest level since the 1960s. Any jump in demand would likely catch many off guard and could support a burst of new construction.

However, the large number of foreclosures of late model homes that compete for the new home buyer remains a very large overhang for the market.

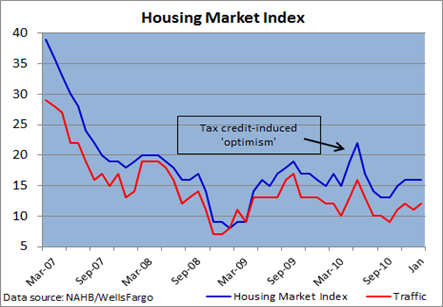

And builder confidence and traffic – see third chart below – continue to wallow at very low levels (a reading of 50 suggests that home builders are neither confident nor pessimistic). Remove the artificial boost in sentiment brought on by the home buyers tax credit and builders are still in a sullen mood.

Looking at the number of new homes sold (chart below), one can quickly see why the industry isn’t ready to celebrate a recovery anytime soon, as 2010 was just a plain awful year.

The expiration at the tax credit at the end of April served mostly to move summer sales into the spring, and the market has yet to return to levels seen during the worst of the national recession.

More than one owner – what’s up with existing homes

More than one owner – what’s up with existing homes

Sales of existing homes make up over 90% of the housing market. And though they do not directly affect GDP, the ups and downs in the market support or detract from a number of related industries.

Existing home sales, as the chart below indicates, continue to suffer but have managed to come off extremely low levels that were seen after the tax credit’s expiration. That's at least one silver lining in the still-struggling residential market.

In December, sales jumped a solid 12.3% to a seasonally adjusted annual rate of 5.28 million units. The uptick in mortgage rates may have actually been partly responsible for the spike in sales, as the rise may have encouraged those who feared rates might go even higher.

That may be unlikely in the short term, but as any realtor will tell you, a sudden and unwanted movement in mortgage rates can encourage fence-sitters to take action.

Competing forces

Mortgage rates remain at historically low levels, and combined with falling home prices,

affordability is at a record high. And there’s plenty of inventory to choose from in most locales. That should encourage buyers.

But the tailwind from low mortgage rates and reasonable prices is being offset by continued worries about the job market, still-tight lending standards and fears that a flood of new foreclosures could put renewed pressure on prices.

So what's needed? Meaningful job creation, further gains in consumer confidence, no ugly surprises in mortgage rates, easier access to credit and a downward drift in foreclosures (unfortunately, this year and not last year is expected to be the peak).

That's a tall order for an economy that continues to suffer from the lingering impact of a very nasty recession.