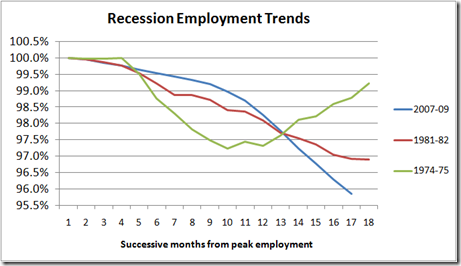

Japan’s economy just registered its steepest contraction since records began and is shrinking at a pace that would be labeled a depression in the US. On a percentage basis, US nonfarm payrolls have declined more than the severe recessions of 1974 and 1982, and industrial production fell 20% on an annualized basis over the first three months of 2009, giving rise to the term Great Recession.

Germany, Europe’s largest economy, and the eurozone, the second-largest economic zone in the world, saw their respective economies shrink dramatically in 1Q. And the IMF recently offered a sobering analysis of the crushing debt load the global economy still faces.

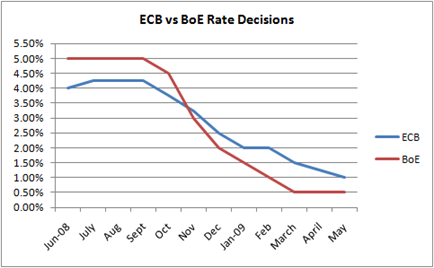

Interest rates have been driven to rock-bottom levels by central banks in order to stimulate growth. But so far, the deleveraging that is taking place around the world has overwhelmed monetary stimulus.

With all of the bad news getting plenty of coverage, I would like to take a few moments to survey the economic landscape, focusing in on some of the emerging signs that suggest the economy is near or at a bottom.

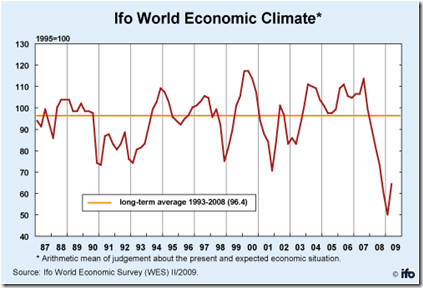

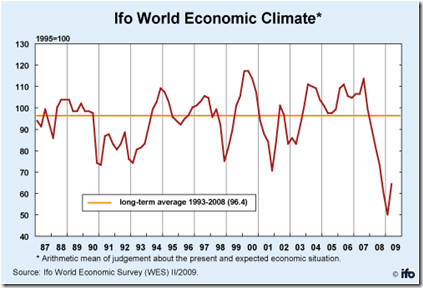

The IFO World Climate Indicator increased in 2Q2009, the first time since 3Q2007, with North America and Asia showing the best improvement. Europe lagged.

Moreover, the survey indicated that price increases are expected to weaken further in the course of the coming six months. The decline of inflation is particularly strong in Western Europe and North America. Inflation fears through the end of 2009 are greatly exaggerated in my opinion.

Released yesterday, the influential ZEW survey of German institutional sentiment jumped 18.1 points in May to 31.1 points, rising above its historical average of 26.2 points. Despite the strong backing by many analysts, it does seem to have gotten a little bit ahead of itself. Nonetheless, the rise in sentiment is welcome.

Elsewhere around the globe

China is unlikely to return to growth rates seen earlier in the decade until world trade rebounds, but aided by government spending, manufacturing has turned positive.

Consumer confidence in Japan is up for the fourth month in a row and exports appear to be stabilizing. Consumer sentiment in the US is also off its low, suggesting the worst may be over. And jobless claims in the US, though still high, have probably peaked.

Commodity prices and oil have also perked up, signaling a stabilization in demand. One of the best known measures of a broad range of raw materials, the Reuters-CRB Index, is up 20% off the early March low.

Part of the rise may be in response to the recent weakness in the dollar. But these commodities are very sensitive to changes in supply and demand and recent gains may also signaling that global economic activity is stabilizing.