Because the labor report and stress test from the Fed took up most of the spotlight late in the week, I thought I’d take a few moments now to look across the Atlantic and discuss actions taken by the European Central Bank on Thursday.

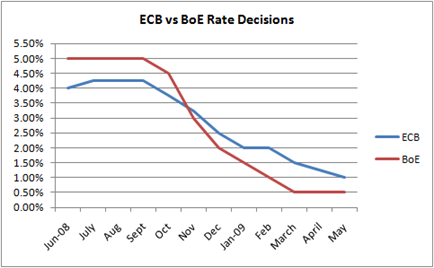

First, a brief synopsis on the situation. The European Central Bank has been slow to react to the global crisis, lagging behind its major counterparts in cutting interest rates as it held steadfast to its inflation-focused mandate. The graph below highlights the ECB’s rate decisions over the past year versus what has occurred at the Bank of England. The Fed began easing in late 2007.

In the meantime, Germany, the biggest economy in the eurozone, has been among the hardest hit of the large industrial nations because of its heavy dependence on exports.

The International Monetary Fund expects the country’s GDP will contract a steep 5.6% this year amid the near collapse in worldwide demand. Germany did get some welcome news when the government reported a jump in industrial orders recently and business confidence has stabilized, but problems remain. Only Japan is expected to see a larger drop in total output.

ECB fiddled while Germany burned

The ECB’s stubborn resistance to lending support to the sagging fortunes of the eurozone has contributed to the decline in output. The bank sheepishly acknowledged that 1Q was weaker than forecast and cut rates by a quarter point to 1.0% on Thursday. And it did not close the door on further reductions.

But more importantly, officials promised to purchase 60 billion euros (about $80 billion) in covered bond – bonds collateralized by mortgages or government loans. The move is seen as a way to support the housing market and aid the struggling eurozone economy, which is beginning to show signs of trying to stabilize.

Though there has been criticism in some corners that the ECB did not go far enough, monetary officials are taking more serious steps to jump-start growth.

0 comments:

Post a Comment