The unemployment rate rose from 8.5% in March to 8.9% in April, the highest level in 26 years and companies continued to trim payroll. Details can be found on my post at Examiner.com. What I want to do here is compare the three worst recessions since the 1970s and how they affected employment on a percentage basis.

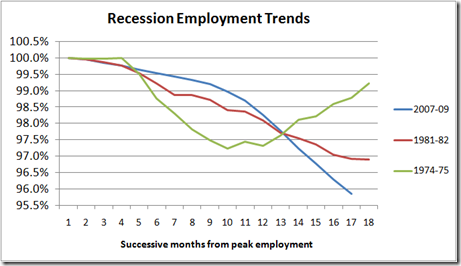

The chart I put together comes from data provided by the Bureau of Labor Statistics and reflects the percentage decline in the number of jobs from the peak of employment, i.e., month number one is the peak in jobs before the onset of each recession. Why percentage comparisons? Because growth in population makes for distorted comparisons with prior periods.The chart shows that the current contraction is the worst of the three, resulting in a 4.2% loss in the number of jobs since the top of the employment cycle in December 1997. We are now just shy of the percentage drop in payrolls seen in the 1958 recession and another half-million loss in payrolls would make this the worst labor market in terms of percentage job losses in over 60 years. Does the word "sobering" come to mind?

In contrast, nonfarm payrolls fell just over 3% in the 1982 recession and 2.8% in the recession of 1974, when the economy was racked by double-digit inflation and an oil embargo.

You can see that the drop in employment this time around was modest until the credit freeze in September severely jolted the economy, forcing firms to quickly slash payrolls amid falling demand for goods and services. The 1974 recession saw sharp losses after the first three month, followed by a recovery, while layoffs in 1982 were fairly steady until a bottom was reached.

It does appear, however, that the steepest losses may be behind us. A 500,000 reduction in nonfarm payrolls remains unacceptable, but April's losses were the lowest since October and Thursday's release of weekly initial jobless claims put the level at a three-month low. The unemployment rate seems destined to top 9% but expectations are rising that job declines will soon moderate.

0 comments:

Post a Comment