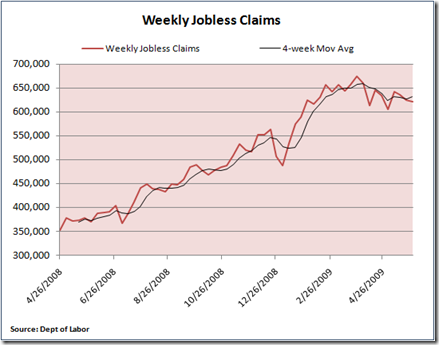

Most measures of the economy have been showing that the recession is easing, but today’s much smaller-than-expected 345,000 in nonfarm payrolls is the clearest sign yet that the economy is nearing a bottom.

Despite the relatively good news on payrolls, unemployment jumped from 8.9% to 9.4%. It seems like there is a disconnect between the two.

First, as I explained on my post on Examiner.com, Nonfarm payrolls drop 345,000, unemployment rate up to 9.4%, there are two separate surveys that measure nonfarm payrolls and the unemployment rate.

So let’s look at how the unemployment rate is calculated. Unlike the establishment survey, which focuses on companies and produces nonfarm payrolls, the household survey, as the name suggests, looks at households and generates the unemployment rate.

Unemployment per the household survey fell by 437,000 to a total of 140.6 million. Not too much of a discrepancy here. But unlike nonfarm payrolls, the unemployment rate looks at the total labor force, which increased by 350,000 to 155.1 million.

The difference, or 14.5 million, gives us the total number of unemployed. Divide 14.5 million into 155.1 million and you come up with 9.4%. So you can see how a rise in the labor force, the bottom number in the math equation, affects the jobless rate.

If the labor force had remained unchanged, the unemployment rate would have risen two ticks to 9.1%.

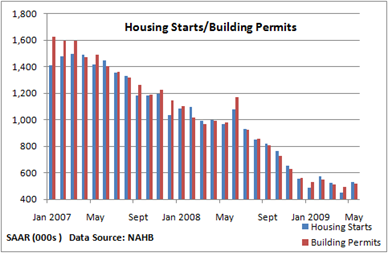

Employment trends

I don’t want to discount what’s happened in the labor market, and workers have felt the brunt of the recession. Companies have shed 6 million jobs, the worst on record, and when you look at it based on a percentage drop from the peak, job losses have easily exceeded what happened in the steep recessions of 1974-75 and 1981-82.

The severity of the current recession is only matched by the swift decline in payrolls in the short but nasty 1958 slump, but it’s not close to the 10% drop in payrolls that occurred just after World War II ended when the troops started coming home from overseas.

![[Deflating]](http://s.wsj.net/public/resources/images/NA-AY286_IRELAN_NS_20090611184917.gif)