The University of Michigan’s survey of consumer sentiment tumbled in March amid the uncertainty generated by events in Libya, surging gasoline prices and the earthquake in Japan.

But the closely-followed Consumer Sentiment Index managed a small rise this month, increasing from 67.5 in March to 69.8 in April, suggesting some stability in consumer confidence.

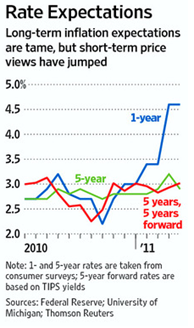

Inflation continues to be a concern but longer-term fears appear to be easing.

Reuters said the one-year inflation expectation was unchanged at 4.6%, the highest level since 2008. No doubt that gasoline prices are heavily influencing the short-term outlook.

But the 5-to-10-year inflation outlook fell to 2.9% from 3.2% the month before, which reveals that consumers and bond holders alike still believe the Fed has not lost its ability to keep price hikes under control (see chart from WSJ below).

That bodes well for the economy since consumers have been squeezed by the pain at the pump, and it has to come as a relief to policymakers at the Federal Reserve who have been wrestling with a sluggish economy, surging commodity prices and a modest bump in core inflation.

0 comments:

Post a Comment